Retail trends

The Australian Bureau of Statistics (ABS) has released retail trade data for August 2014. A single data point is not very meaningful, so instead we thought we’d draw on the deep pool of data available to explore long-term trends.

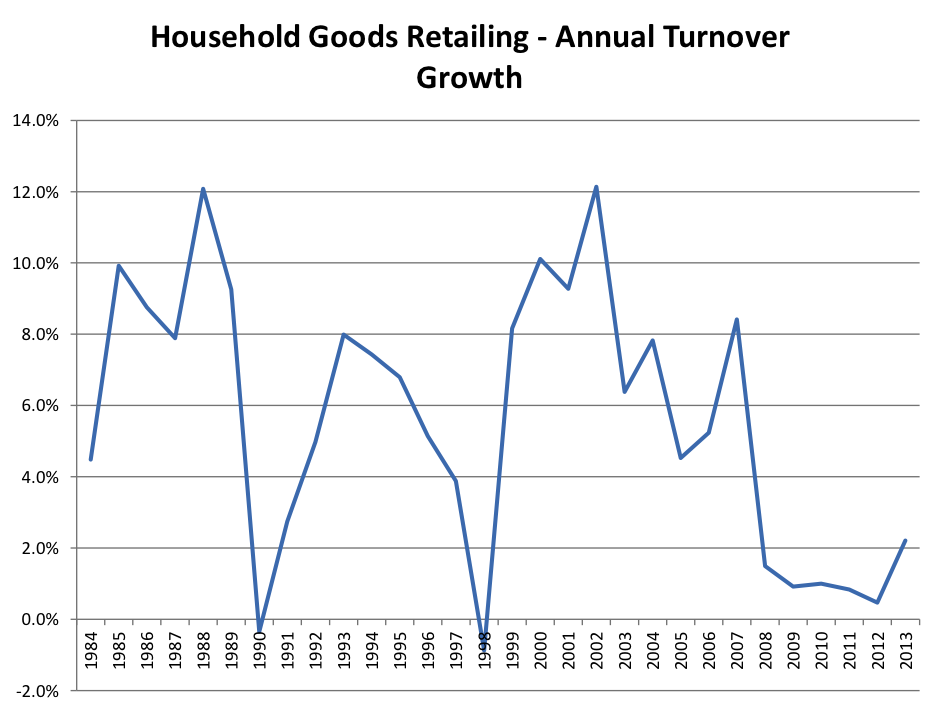

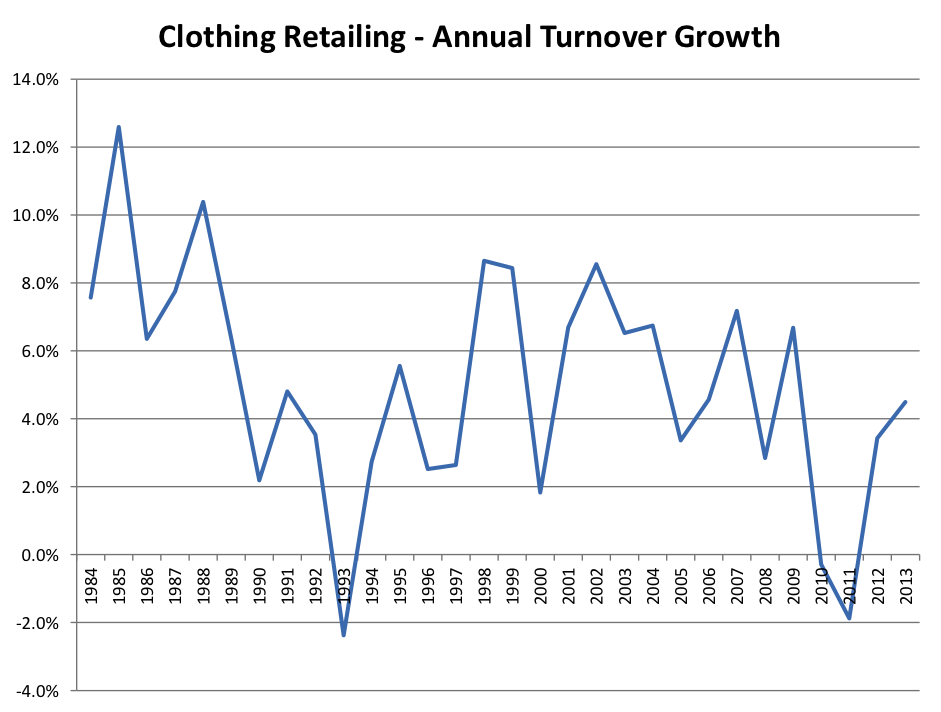

The following charts display the annual turnover of retail sectors, collected by the Australian Bureau of Statistics over the past 30 years. The sectors include; clothing, food, household goods, department stores; as well as cafes, restaurant and takeaway food services.

Food retailing has demonstrated consistent growth, with a compound annual growth rate of 6.6 per cent since 1983. This is relatively unsurprising, as groceries are a critical purchase for households in any part of the economic cycle.

What is more interesting is how much Australians seem to love dining out. Cafes, restaurants and takeaway outlets have experienced particularly strong growth over the past decade.

Growth in household goods appears leveraged to the economic cycle.

Growth in household goods appears leveraged to the economic cycle.

Clothing retailers also appear to be influenced by the economic cycle, but the growth is relatively more consistent.

We have discussed at length the deteriorating prospects of the department stores, and this graph clearly demonstrates why Myer (ASX: MYR) and David Jones (ASX: DJS) are in for some challenging times ahead. It seems that turnover in the department store category has reached a ceiling, and may even continue to decline.

Against this backdrop (that of a shrinking market), it will be difficult for Myer and David Jones, which respectively generate $2.7 billion and $1.8 billion in sales annually, to grow their top line without taking market share.

When viewed over a long-term perspective, it becomes difficult to empathise with management that point to short-term events, such as weak consumer sentiment or unseasonable weather, to justify disappointing sales. The structural trend is clearly evident.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

This trend for dept stores I believe is being exacerbated by increasing competition who are arguably better and more innovative retailers. I have been a critic of the dept stores for a while and believe they appear to have very little grasp as to what is happening in the marketplace. For a business that is effectively about exploiting current and future trends this is a serious indictment.