Polen Capital expands its global emerging markets footprint

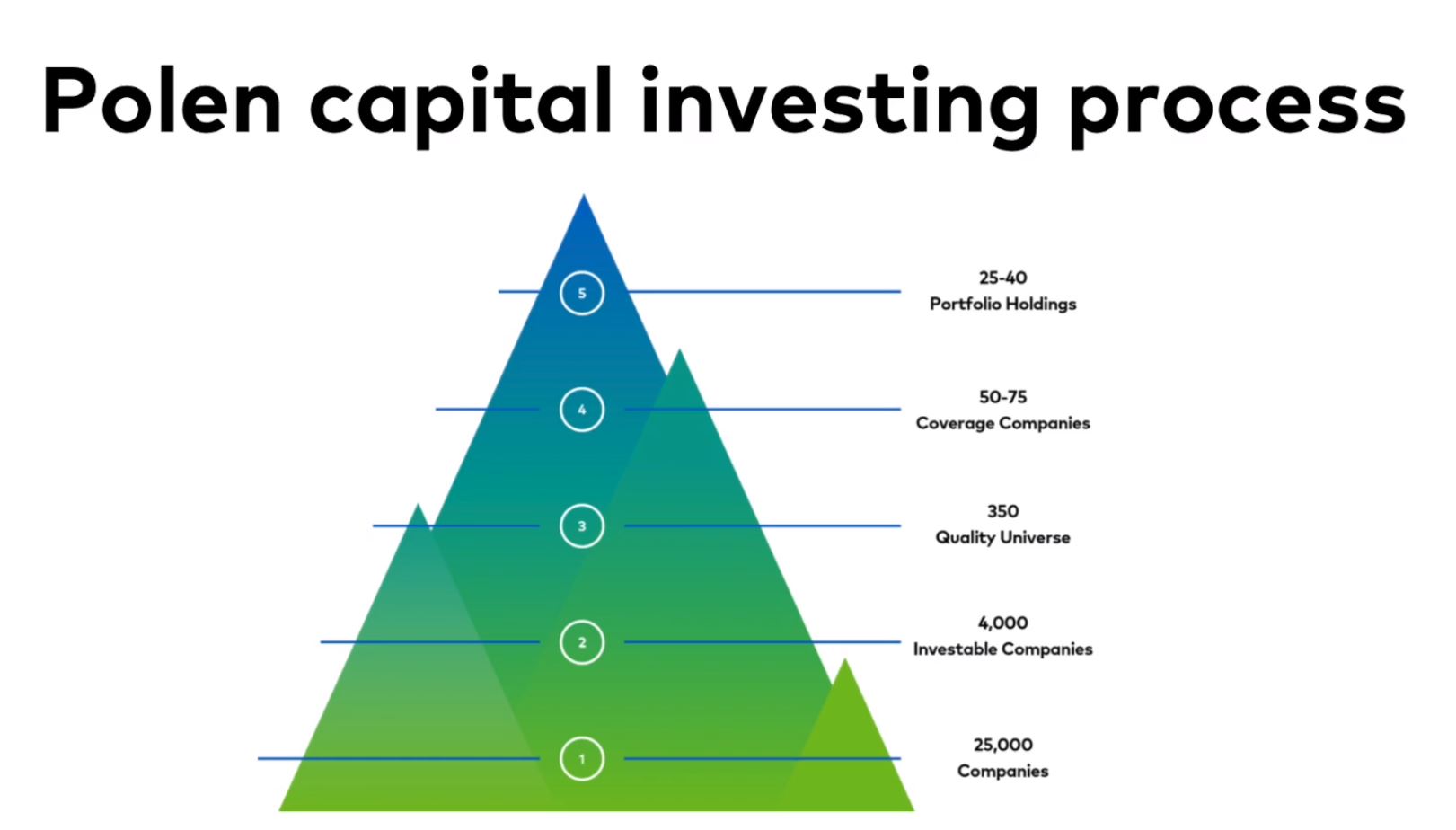

In this week’s video insight David provides an update on our global equity partner Polen Capital including how the Polen Capital Global Emerging Markets Growth Team selects what they believe are high quality 25-40 companies with difficult-to-replicate competitive advantages.

Transcript

David Buckland

Hello, my name is David Buckland and welcome to this week’s video insight. I thought I would take this opportunity to update you on our Global Equities partner, Polen Capital, a 40-year old staff-owned business with US$55 billion under management.

The Polen Capital Global Growth Fund, run out the Company head-office in Boca Raton, headed up by Damon Ficklin and Jeff Mueller, and nine other investment professionals, and was launched in Australia two years ago.

The second strategy, the Polen Capital Global Small and Mid Cap Fund, was launched in Australia unfortunately around the peak of the market in October 2021. The Portfolio Manager, Rob Forker, who is based in Polen Capital’s Boston office, is joined by seven other investment professionals.

The third global equities strategy is Polen Capital Global Emerging Markets, run by Damian Bird CFA out of Polen Capital’s London office. In a recently announced transaction, this strategy, via the acquisition of LGM’s business has expanded with Funds Under Management of US$1.3 billion, and now a team of ten, split between London (7) and Hong Kong (3). Prior to joining Polen Capital, Damian and his senior colleague, Dafydd Lewis, CFA, used to work with many members of the LGM team.

The Polen Capital Global Emerging Markets Growth Team selects what they believe are high quality 25-40 companies with difficult-to-replicate competitive advantages. They invest independent of benchmark allocations, based on key indicators for long-term growth, looking for companies that, in their opinion, can earn excess returns for many years in the future. Using a business-owner’s mindset, Polen Capital conduct deep on-the-ground due diligence to find and evaluate attractive opportunities around the themes of domestic consumption growth, economic catch-up, and digitalization in an effort to drive growth and long-term staying power.

The MSCI Emerging Markets Net Total Return Index (in Australian Dollars) benchmark has 1,373 constituent companies, with an average market capitalisation of US$4.6 billion. Major country weights are China at 32 per cent, Taiwan at 15 per cent, India at 13 per cent, South Korea at 12 per cent and Brazil at 5 per cent. Major sector weights are Financials (22 per cent), Information Technology (20 per cent), Consumer Discretionary (14 per cent), Communications (10 per cent), Materials (9 per cent), Consumer Staples (6 per cent) and Industrials (6 per cent).

Montgomery is investigating the most effective method of offering the Polen Capital Global Emerging Markets Growth Strategy to Australian investors, and we hope to have more news on this later in 2023.

You can register your interest in the Polen Capital Global Growth Emerging Markets Fund here.