Persistently high and rising unemployment suggests to us ECB rescue this week or next

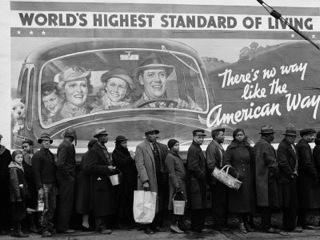

For all you budding economists: Unemployment rose in the Euro-zone in July. There was also a jump in inflation above expectations in August. Inflation rose for the first time in a year, from 2.4% to 2.6% and above consensus. The view now is that the downturn in household spending will worsen in the second half of this year. There were 88,000 additional people unemployed leaving the unemployment rate at an unchanged record high of 11.3%. June’s number was revised higher from 11.2% to 11.3%. Unemployment is worst in Spain where the proportion of people without a job is a staggering 25% or more. But French, Dutch and Belgian rates all rose too. It all suggests consumer spending will continue to fall over the next few months at least. Many now expect the ECB will adopt additional measures to support the economy either this week or in the next few.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.