Performance to 31 March 2015

The Montgomery funds recorded solid results in the twelve months to 31 March 2015.

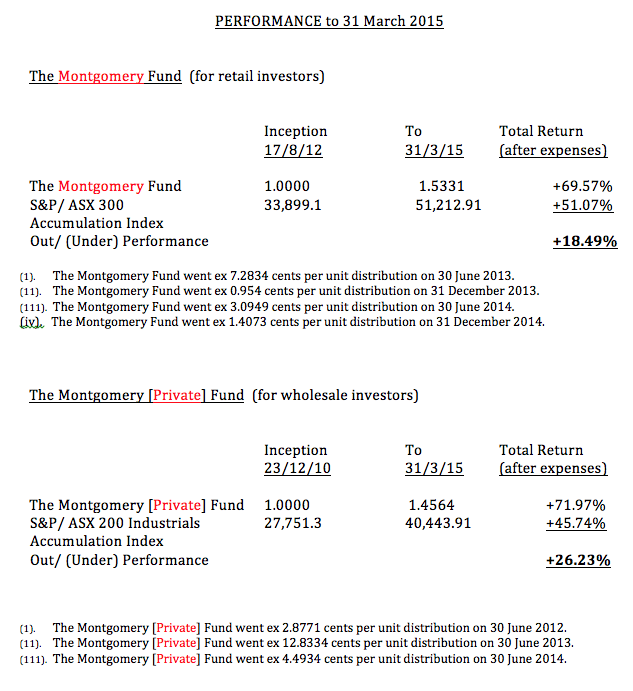

The Montgomery Fund was up by 18.87 per cent, outperforming its benchmark by 4.97 per cent. Over the period under review, the S&P/ ASX 300 Accumulation Index, which assumes reinvestment of dividends, was up 13.90 per cent.

The Montgomery [Private] Fund was up by 15.91 per cent, out-performing the broader market by 2.01 per cent.

In the period between inception (23 December 2010) and 31 March 2015, The Montgomery [Private] Fund has out-performed its benchmark by 4.31 per cent per annum, after expenses.

In the period between inception (17 August 2012) and 31 March 2015, The Montgomery Fund has out-performed its benchmark by 5.17 per cent per annum, after expenses.

Pleasingly, these results have been achieved when both Funds have generally maintained a significant cash weighting.

For those readers who may be having trouble understanding the difference between the total return and the unit price, can I please encourage you to read the following post, How Do We Calculate Returns?

Investors who either do not have the time or the inclination to follow the share market so closely, may want to consider outsourcing some of the management of their funds to Montgomery Investment Management.

Investors who either do not have the time or the inclination to follow the share market so closely, may want to consider outsourcing some of the management of their funds to Montgomery Investment Management.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Pity about the NZD/AUS exchange rate! Promised my daughter some years ago that if there wws currency parity I would consider coming to live in Sydney. Might yet have to eat my words.

I love hearing good news like this, thanks to the Montgomery team, keep up the good work.