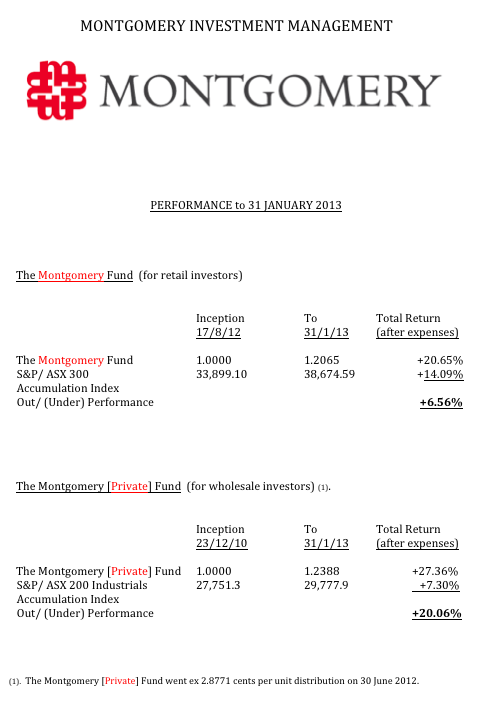

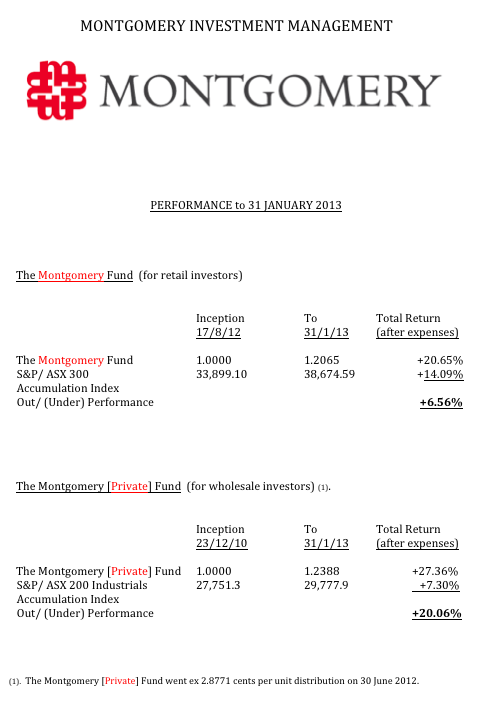

Performance to 31 January 2013

The Montgomery Fund was launched on 17 August 2012. In the five and a half month period to 31 January 2013, the Fund has recorded a return of 20.65%, after all expenses.

Over the period under review it has out-performed its benchmark, the S&P/ ASX 300 Accumulation Index, by 6.56%.

The Montgomery [Private] Fund was launched on 23 December 2010. In the twenty five month period to 31 December 2013, the Fund recorded a return of 27.36%, after all expenses.

Over the period under review it has out-performed its benchmark, the S&P/ ASX 200 Industrials Accumulation Index, by 20.06%.

Readers interested in investing in either Montgomery fund should click on the links below:-

Apply to Invest in The Montgomery Fund – Click here

Enquire about The Montgomery [Private] Fund – Click here

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

craig.cory.54

:

HI, you are comparing the asx 200 in one, and use the asx 300 in the other? why not use the overall? Cheers, C.

Daniel Falster

:

Hi Roger,

Congratulations to you and the team for these fantastic figures. During the last year I read your book and blog, and as a result have learned much about value investing. I was already convinced it was the right approach for me even before your fund launched, but these figures certainly confirm that. Unfortunately, I only recently had money become available to invest in shares (previously in property), so missed the recent jump in the market from under to over valued.

My question for you and the team is this: How do you handle new investments into your fund when the market is over-valued? I understand that we should not waste effort trying to time the market, and should think long-term. But you also advise us to buy at a discount. Your most recent post (http://rogermontgomery.com/where-to-next/) suggests nothing is trading at a discount right now, which by implication, suggests most of the stocks currently held by Montgomery Fund are also trading at fair value or above.

Given these considerations, which of the following two options makes best sense for a value investor looking to invest with you:

1. Immediately invest with the Montgomery fund

2. Wait for a correction, then invest with Montgomery fund.

By investing into the fund now, am I effectively buying a bunch of stocks that are over-valued, and thus at risk of a correction?

Thanks for the inspiring reading. I look forward to investing with you.

With best regards,

Daniel

Roger Montgomery

:

Hi Daniel,

The funds’ mandates have the fortunate benefit of being able to hold cash – and a relatively large proportion too. So unlike other funds there’s less timing required. Moreover what tends to happen to people who wait for a correction is 1) The correction may not come and instead valuations rise as companies report better earnings and performance, or 2) if a correction does occur, those that were waiting for it are now fearful it could fall further and hold off until a recovery emerges. Then, when the recovery emerges they curse themselves for having missed it and wait for another correction. Montgomery has already seen this with investors who elected not to invest at the launch of both funds, explaining to the company they were awaiting a correction that didn’t transpire.

Actually, over the last two years (the time that The Montgomery [Private] Fund has been operating, there have been a couple of small corrections in the market, but the unit price of The Fund didin’t dip by the same extent. You can see the chart here:![The Montgomery [Private] Fund performance since inception](http://www.montinvest.com/wp-content/uploads/2010/09/Screen-Shot-2013-02-06-at-6.08.57-PM.png)

Hope that helps. of course keep in mind that the risk of a sell off, or underperformance of the fund or even loss of capital is ever present when it comes to investing.

Daniel Falster

:

Hi Roger,

Thanks for the very prompt and informative reply.

Good to hear that you are able to hold a large amount of cash.

And you are right to question the psychology of beginner investors – I have experienced both of the risks you mention in the past (regret at not having acted, fear during a correction comes). Given that, I could certainly imagine that professional investors (at Montgomery at least) are more likely to deploy cash at opportune moments.

Many thanks,

Daniel

PS. Time for some regret: Since you posted your a week ago the ASX200 has risen another 1-2%….

Roger Montgomery

:

And today its down 2%. Don’t concern yourself with short term price changes. Instead focus on long term value changes.