Performance to 28 February 2015

The Montgomery funds recorded solid results in the twelve months to 28 February 2015.

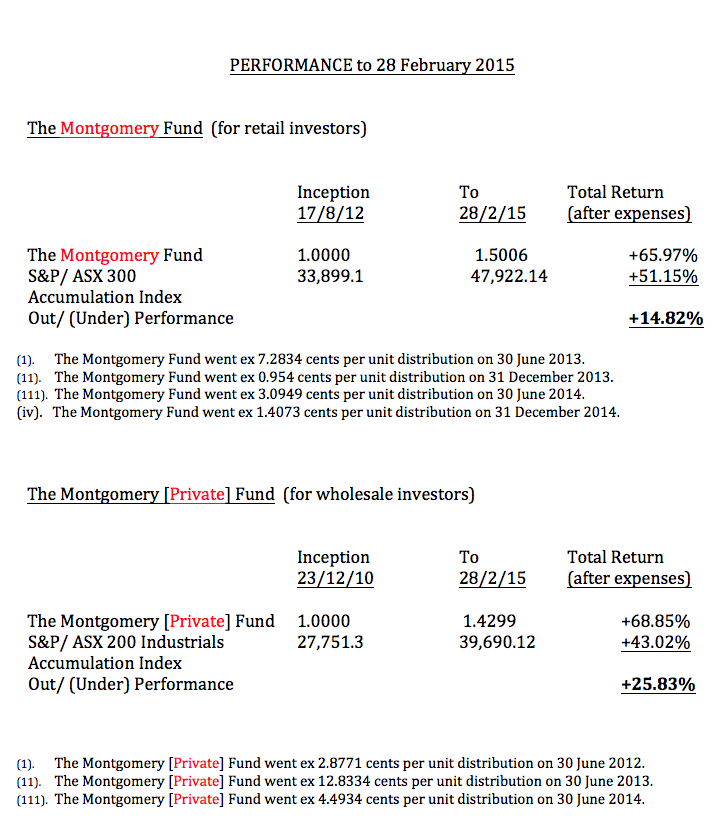

The Montgomery Fund was up by 18.14 per cent, outperforming its benchmark by 3.95 per cent. Over the period under review, the S&P/ ASX 300 Accumulation Index, which assumes reinvestment of dividends, was up 14.19 per cent.

The Montgomery [Private] Fund was up by 16.55 per cent, out-performing the broader market by 2.36 per cent.

In the period between inception (23 December 2010) and 28 February 2015, The Montgomery [Private] Fund has out-performed its benchmark by 4.40 per cent per annum, after expenses.

In the period between inception (17 August 2012) and 28 February 2015, The Montgomery Fund has out-performed its benchmark by 4.33 per cent per annum, after expenses.

Pleasingly, these results have been achieved when both Funds have generally maintained a significant cash weighting.

For those readers who may be having trouble understanding the difference between the total return and the unit price, can I please encourage you to read the following post, How Do We Calculate Returns?

Investors who either do not have the time or the inclination to follow the share market so closely, may want to consider outsourcing some of the management of their funds to Montgomery Investment Management.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Dear Roger,

I follow your blog / Skaffold / Montgomery Fund reports closely. Always interested in your approach to purchasing shares that will hopefully increase in intrinsic value as well as what you divest and when. I note that Mont Fund holds shares where the safety margin is now over -50% .CSL at -52%, Sirtex at -69% still have high scaffold scores but Ramsay (-52%) and iiNet (-24%) are starting to slip off your investment grade. How do you manage these changes ??

Thanks for the ongoing education.

David

Hi David have a read of Value.able. You can buy a copy here In the meantime, keep in mind that we use a variety of models to determine valuation and we establish our own earnings forecasts.

So if everyone invested in one of these two funds early enough in their lives there would be no need to have a government contributing aged pension fund.

Wake up government and get into it!

Well done Roger and crew.

Thanks Michael. One suspects that with the volume of dollars you’d be talking about (trillions) we might have a tougher time repeating the performance. I think we can do an admirable job up to several billion.