No bundles of joy

You may recall that almost a year ago now we commented briefly on our decision regarding the Monash Group Limited (ASX: MVF) IPO in relation to odd trading behaviour we had seen at that time.

Back then, our findings on Monash’s prospects were that whilst it was a reasonably good company, it was losing market share in its primary field of IVF (In vitro fertilisation) treatments. With no turnaround in sight and sizable growth priced into the IPO valuation, it was an easy decision to pass on the offer. Further, we noted that the entry of Primary Health (ASX: PRY) into the market could erode shares further by providing ‘no-frills’ IVF services at discounted prices.

Competitor Virtus Health Limited (ASX: VRT) now seems to be dealing with market share issues of its own as noted in a trading update released today.

“Although market growth in NSW has improved in the three months to 30 April by 6% compared to prior year comparatives (Source: Medicare Statistics for item numbers 13200, 13201, 13202), Virtus has not achieved comparable cycle growth and believes the market growth is attributed to the bulk bill provider in NSW.”

Whilst not mentioned by name, the first link on a google search for “NSW Bulk Bill IVF” turns out to be Primary Health’s IVF division, so it appears that this is at least one of the reasons behind their troubles.

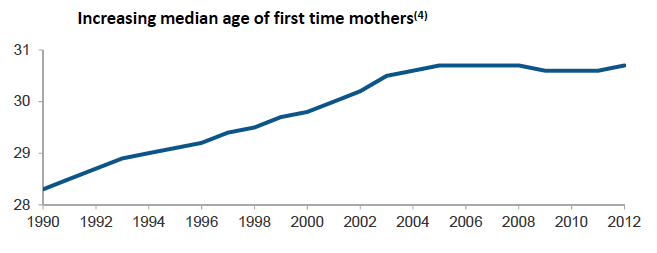

For a player who can grow market share consistently and achieve cooperation and loyalty from their specialists (whose knowledge and experience are the real drivers of value), the IVF sector can be a lucrative field. There are persistent demographic trends indicating that demand for IVF treatments will rise over time (for example, noted trend that women are deciding to have children later in life increasing the propensity of which IVF treatments are called upon).

In our current view, Monash and Virtus do not appear to have prospects on the horizon sufficient to change the performance of their businesses in a materially upward direction.

In our current view, Monash and Virtus do not appear to have prospects on the horizon sufficient to change the performance of their businesses in a materially upward direction.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY