National Australia Bank – ongoing challenges

National Australia Bank continued to suffer ongoing challenges from their Clydesdale and Yorkshire Banking subsidiaries, with reported net cash earnings for the year to 30 September 2012 declining by 0.5% to $5.443b. After contributing GBP183m in the previous year, NAB’s UK operations lost GBP139m. Charges for bad and doubtful debts soared by $793m to $2.6b. While average shareholders’ funds increased 7% to $43b, cash earnings on average shareholders’ funds declined by nearly 1.0% to 12.6%.

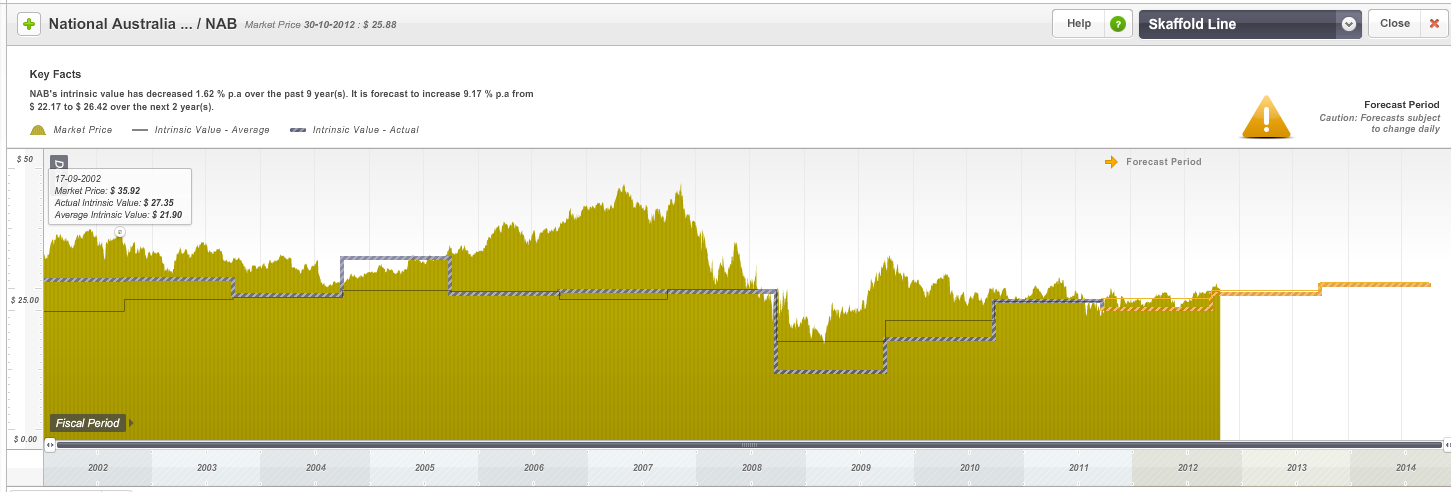

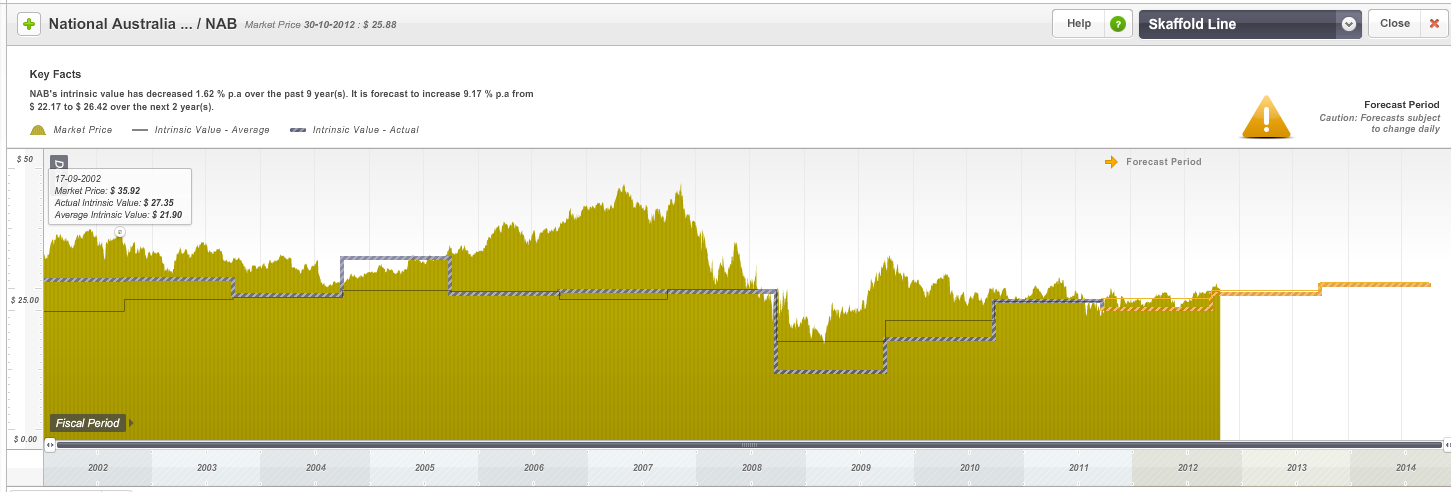

While the 7.0% dividend yield is attractive for retail investors, the National Australia Bank share price has been an enormous disappointment over the past decade and shareholders with long memories must be questioning the diversifications strategy which saw the purchase of Clydesdale Bank, Northern Bank (in Northern Ireland), National Irish Bank (in the Republic of Ireland), Yorkshire Bank and the US-based Home Side.

From Montgomery’s viewpoint, National Australia Bank received a B4 quality rating in 2004, and this was reaffirmed in 2007 and 2008. Its current quality rating is A4.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

The Irish saw them coming and took NAB to the cleaners.

Yes, glad I sold out. Banks certainly look over valued now.