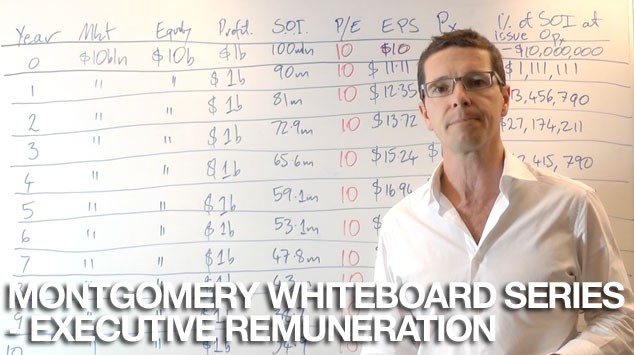

MONTGOMERY WHITEBOARD SERIES – EXECUTIVE REMUNERATION 4/12/2012

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Hi Dennis,

Could be on to something…. the other thing executives get/give themselves are share options, usually these share options have a period where they can’t be traded. If the share price remains flat they are not worth anything so there is an incentive to drive the share price up by buying back shares.

Also is something fishy going on down at Northern Star Resources? First a few months ago they waived the waiting period for option excise and then more recently they off loaded 40 million shares at a 17% discount to market value. Thanks guys, in two days the share price has dropped 22%.

Simon

I’ll be the first to admit I still have a lot to learn about this investing caper. In saying that, could you be referring to CSL? I read over their remuneration report a couple of months ago, saw the share buybacks and exercise of performance rights and thought it was all a bit fishy. Earnings per share have not been great the last few years and debt is on the way up. It seems like the directors are trying very hard to nail their short term and long term share price related bonuses. In my opinion, what the directors are doing is not in the interest of shareholders as the company seems overvalued to me. Buying back undervalued shares = good. Buying back overvalued shares = bad. Even based on a 20% profit upgrade the shares are overvalued in my opinion.

I guess my opinion hinges upon whether an investor thinks CSL is undervalued or overvalued. Plus, it seems CSL is a bit of a market darling at the moment which makes me fearful.