Montgomery Small Companies Fund 2024 update

In this week’s video insight, I discuss the Montgomery Small Companies Fund (the Fund), managed by Gary Rollo and Dominic Rose. The Fund achieved a remarkable return of 21.4 per cent in fiscal 2024, outperforming its index by 12 per cent on an after-expense basis. Over the nearly five-year period from September 2019 to June 2024, it has consistently beaten the benchmark by over 5.5 per cent per annum. Notable performers in the portfolio include Life360 (ASX:360), Hub24 (ASX:HUB), and Megaport (ASX:MP1). Additionally, I explore the current returns of small caps versus large caps.

Transcript:

Hello, I’m David Buckland, and welcome to this week’s video insight. Today, I’m going to talk to you about the Montgomery Small Companies Fund, run by Gary Rollo and Dominic Rose. In fiscal 2024, the Montgomery Small Companies Fund delivered a return to its unitholders of 21.4 percentage points, 12 per cent ahead of its index, on an after-expense basis.

Over the four and three-quarter years from September 2019 to June 2024, it has beaten the benchmark by over 5.5 per cent per annum, again, on an after-expense basis. In fiscal 2024, there were three stocks that really stood out: Life360, Hub24, and Megaport, and these really did some heavy lifting.

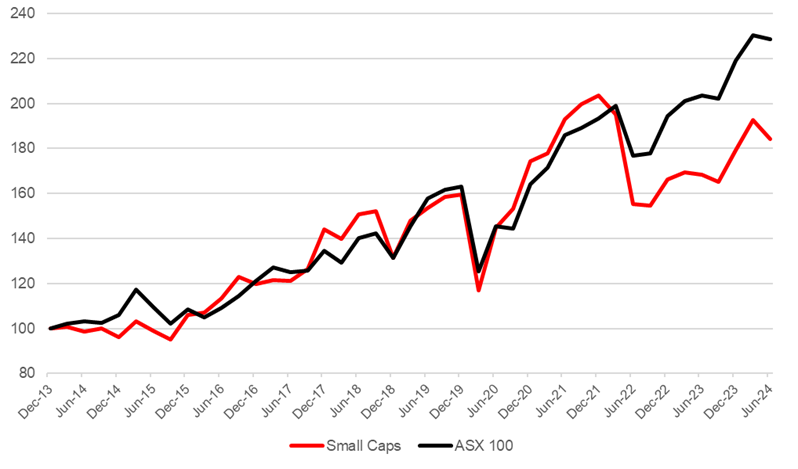

Benchmark returns profile: small caps versus large caps

Source: IRESS, ASX 100 Accumulation Index, ASX Small Ordinaries Accumulation Index. Data from December 2013-June 2024.

Source: IRESS, ASX 100 Accumulation Index, ASX Small Ordinaries Accumulation Index. Data from December 2013-June 2024.

If you look at the current graph, which is well over a decade old, and you compare the return of the big cap accumulation index with the small cap accumulation index, it’s interesting. The S&P/ASX Small Ordinaries Index has underperformed in recent times by at least 25 and possibly closer to 30 per cent, and we think there’s a good opportunity for a bit of catch-up football to be played. Why is that? Firstly, it’s a global phenomenon. The smalls have underperformed bigs by quite some margin in recent several months.

The second point is that we’re now starting to see some really good interest rate declines, particularly in places like Europe, Sweden, and Canada, and it now looks odds-on that we’ll be seeing a quarter percentage rate cut in the U.S. So that actually is inspiring us to see that gap come in. The other point to make, of course, is that small caps are a bit like speed boats; when economies are doing well, they tend to do at least as well as bigs and possibly even outperform.

Gary and Dominic have tilted the portfolio for fiscal 2025 accordingly.

That’s all I have time for this week, please continue to follow us on Facebook and Twitter.

Disclaimer

The Montgomery Small Companies Fund owns shares in Life360, Hub24, and Megaport. This article was prepared 08 August 2024 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Life360, Hub24, or Megaport, you should seek financial advice.

Important Information

You should read the Product Disclosure Statement (PDS) before deciding to acquire the product.

The issuer of units in Montgomery Small Companies Fund (ARSN 635 229 533) (Fund) is the Fund’s responsible entity Fundhost Limited (ABN 69 092 517 087) (AFSL 233045). The Fund’s investment manager is Montgomery Lucent Investment Management Pty Limited (ABN 58 635 052 176, Authorised Representative No. 001277163). Copies of the PDS and Target Market Definition (TMD) are available to download from this page and at https://fundhost.com.au/

An investment in the Fund must be through a valid paper or online application form accompanying the PDS. Before making any decision to make or hold any investment in the Fund you should consider the PDS and TMD in full.

The information provided does not take into account your investment objectives, financial situation or particular needs. You should consider your own investment objectives, financial situation and particular needs before acting upon any information provided and consider seeking advice from a financial advisor if necessary.

You should not base an investment decision simply on past performance. Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.