Montgomery Global Fund Update

Members of the Montgomery Global team have just completed a roadshow to the financial planning community in several cities across Australia and New Zealand. This has coincided with the recently released ratings for the Montgomery Global Fund of “Recommended” from Zenith and “Investment Grade” from Lonsec.

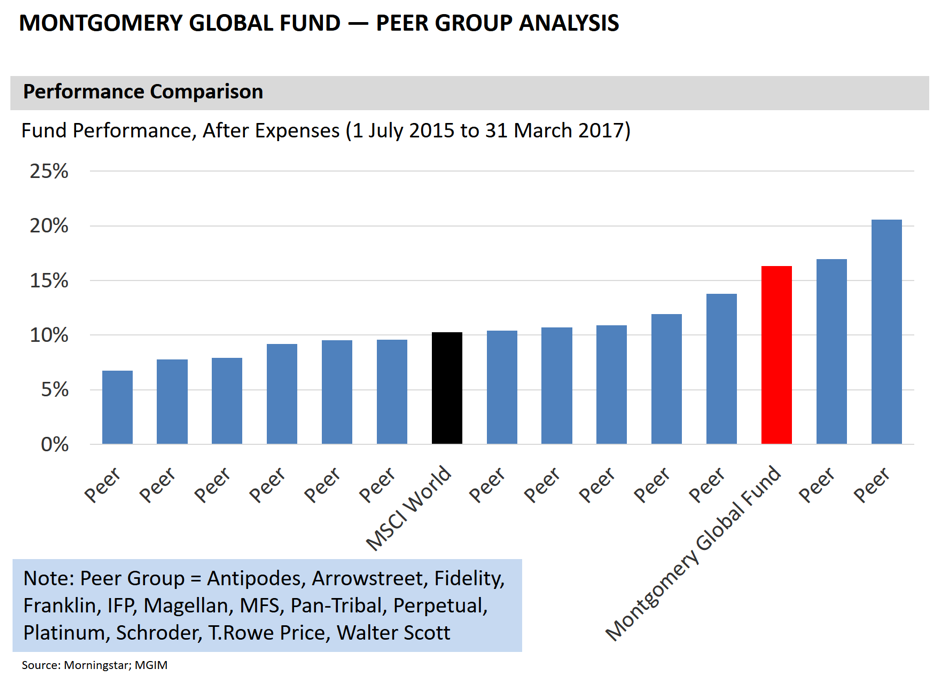

Pleasingly, the Montgomery Global Fund has since its launch on 1 July 2015 delivered our investors a return of 16.3 per cent, after expenses, while the MSCI World Net Total Return Index, in Australian Dollars, is up 10.3 per cent. The 6.0 per cent outperformance over 21 months equates to annual out-performance of 3.27 per cent. Importantly this result has been achieved with a typical cash weighting of 15 to 20 per cent.

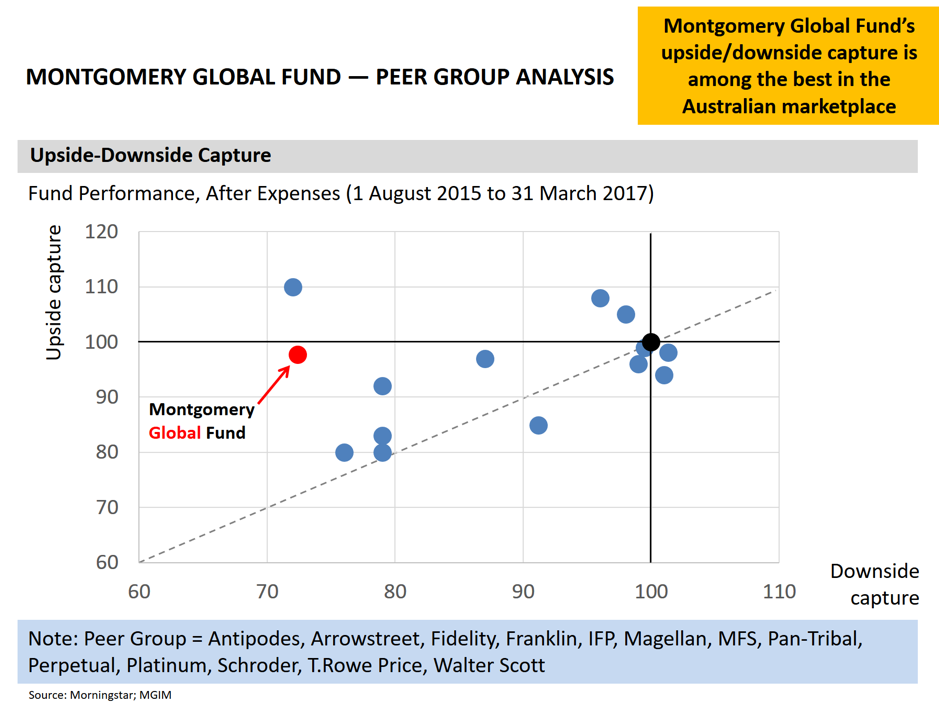

These results are illustrated in the graphs below, and while it is still early days, special mention should be made regarding the upside/ downside capture. While several of our peers go up and down with the market, the Montgomery Global Fund has captured 98 per cent of any upside in a rising market and 72 per cent of any downside in a falling market.

At the time of writing, the Montgomery Global Fund owns 21 high quality businesses of which 36 percent are domiciled in North America, 28 per cent in the Asia/ Pacific, 15 per cent in UK/ Europe and the balancing 21 per cent is largely in US Dollar Cash. To emphasise our “all-cap approach to investing”, the market capitalisation of the 21 stocks owned by the Montgomery Global Fund varies between US$754 b (Apple) and US$1.9 b (Insperity).

If you are interested in finding out more about the Montgomery strategies, please click here.

Hi David, here’s a short, recent interview with Jeremy Grantham, on the question of whether the US stock market is in a bubble. He thinks its not, but a 10-20% correction could happen anytime:

http://www.wsj.com/video/gmo-grantham-stocks-decently-different-this-time/D98E2C49-45CC-4F63-B304-7B6C5D26C7C8.html

Kelvin

Hi David, this is a recent interview with Ray Dalio in which he discusses where he thinks the markets are at the moment and also some of the investing lessons he’s learnt:

https://www.businessinsider.com.au/the-bottom-line-with-henry-blodget-episode-1-premiere-2017-4?r=US&IR=T

Kelvin

Hi David, that’s a wonderful job by the Global Team!

Kelvin