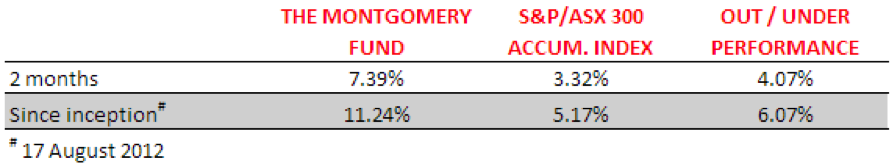

Montgomery Funds’ Performance to 30 November 2012

We are again delighted to provide an update on the results for The Montgomery Fund.

Whilst it is still early days and you must understand that past results are not a reliable guide to future returns, we continue to be encouraged by the combined performance of The Montgomery Fund’s 33 constituents.

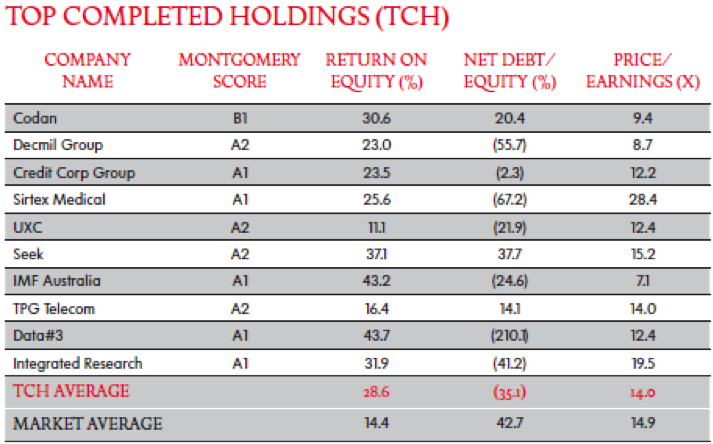

A number of weeks ago, investors received their first bi-monthly report. We presented the below table detailing the average return on equity for the Top Completed Holdings (TCH), which was 28.6 per cent, the average net cash/equity ratio of 35.1 per cent and the average prospective PE of 14.0 x. At that time, these fundamentals compared favourably with the market, which averaged a return on equity of 14.4 per cent, net debt/equity of 42.7 per cent and a prospective PE of 14.9 x.

We believe if we can put together a portfolio of businesses who’s economics improve over the years, so should the market value of the portfolio, as well as our chances of beating the broad indices we seek to outperform for our investors.

Please note that the table presented here is historical in nature. Today’s portfolio makeup is different to that of October, following both strong performance of some of the issues and a subsequent rebalancing. Those attempting to replicate our portfolio based on the infrequent blog posts or media discussions we participate in, would be well advised to seek personal professional advice that explains the risks of doing so.

We actively manage risk following a process summarised in Tim Kelley’s White Paper What’s Under the Bonnet? His paper provides an excellent overview of the Fund’s investment process sitting behind the stock selection and portfolio management aspects of The Fund. The paper is available here: download

At Montgomery we are passionate about investing and welcome you as a fellow investor. To invest $25,000 or more in The Montgomery Fund, you will need to click here, complete your details and a copy of the Product Disclosure Statement, which includes the Application Form will be automatically emailed to you.

I consider 13ish percent (as of today) to be an acceptable return over a fourish month period.

Carry on!