Montaka Global Investments wins Award

As an investment manager our number one goal is to compound the wealth of our investors in a prudent manner while trying to protect against the permanent loss of capital. If we can achieve this then we as investors alongside our clients will be not only successful but should also be happy.

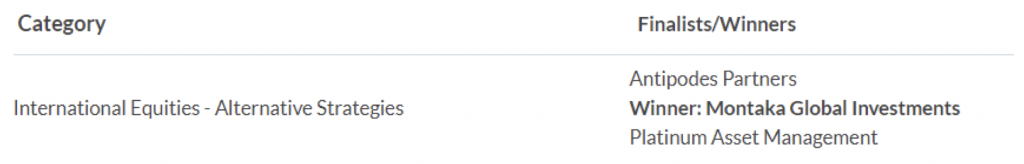

Coupled with a dose of modesty we are pleased to share with you the news that our global equity partner – Montaka Global investments has last month been recognised by a leading independent research house called Zenith Investment Partners where we won fund manager of the year in the category for International Equities – Alternative Strategies. We were up against some distinguished investing firms in Platinum and Antipodes for the award which made it rather special to be recognised and win the category.

If you’re interested in how the awards were judged, then I have included the explanation below.

Zenith’s Methodology and Judging criteria from their website:

Fund Awards based on long-term criteria

As a fund rating house, we operate to provide impartial and unbiased opinion on the capabilities of fund managers, which is then used to construct portfolios for investors. Our aim to provide information that will improve the financial outcomes of Australian investors.

Each of our awards is based on long-term factors derived from our extensive research and due diligence of fund managers including:

- organisational and investment team strength,

- investment philosophy,

- security valuation and selection,

- portfolio construction,

- risk management, and

- fees.

We also look at quantitative aspects of the funds longer-term returns to investors.

There’s no short-termism determining any award – the winning fund managers have to demonstrate they have what it takes to deliver for investors over the long term.

So congratulations to Andrew Macken, Chris Demasi and their team for being recognised in this way, but rest assured they are focused each and every day on compounding the wealth for their investors in a prudent manner, which is when the rubber hits the road!

DISCLAIMER

The Zenith Fund Awards were issued 11 October 2019 by Zenith Investment Partners (ABN 27 130 132 672, AFSL 226872) and are determined using proprietary methodologies. The Fund Awards are solely statements of opinion and do not represent recommendations to purchase, hold or sell any securities or make any other investment decisions. To the extent that the Fund Awards constitutes advice, it is General Advice for Wholesale clients only without taking into consideration the objectives, financial situation or needs of any specific person. Investors should seek their own independent financial advice before making any investment decision and should consider the appropriateness of any advice. Investors should obtain a copy of and consider any relevant PDS or offer document before making any investment decisions. Past performance is not an indication of future performance. Fund Awards are current for 12 months from the date awarded and are subject to change at any time. Fund Awards for previous years are referenced for historical purposes only.

Excellent achievement.