Mining Closures Gather Pace

As we have been warning for a while now, the mining services sector is, we think, largely uninvestible given the strong headwinds being faced. Particularly in light of mining companies continuing en-masse to scale back their investment activities. These headwinds don’t look like easing anytime soon.

For the year ending June 2014, mining firms plan to spend a commendable enough $167 billion, still a high level of investment by historical standards. But reality quickly sets in when you consider those same mining firms in the fiscal year ending June 2015 plan to spend 25 per cent less, or just $124.9 billion.

And remember, whilst there are 70-80 listed business on the Australian Stock Exchange that can either be directly or loosely defined as mining service-related, there are another circa 1,000 unlisted businesses. You can bet they are all bidding for work, and with increasing tension, in an ever-shrinking pie.

On this basis, we would argue that despite the already poor performances of the businesses that make up the sector, there is still lots of pain to come.

Take today’s article on Businessnews.com.au that reports mine site water infrastructure group GFR has become the sixth Perth-based company to call in administrators in as many weeks, citing deteriorating trading conditions and significant contract delays.

With new work likely to be intensely bid for on wafer-thin margins, until the over-capacity in the industry is shaken out and only the strongest and best-placed service firms are left standing, we suspect that firm failure rates will only continue to gather pace over the next 12 to 18 months.

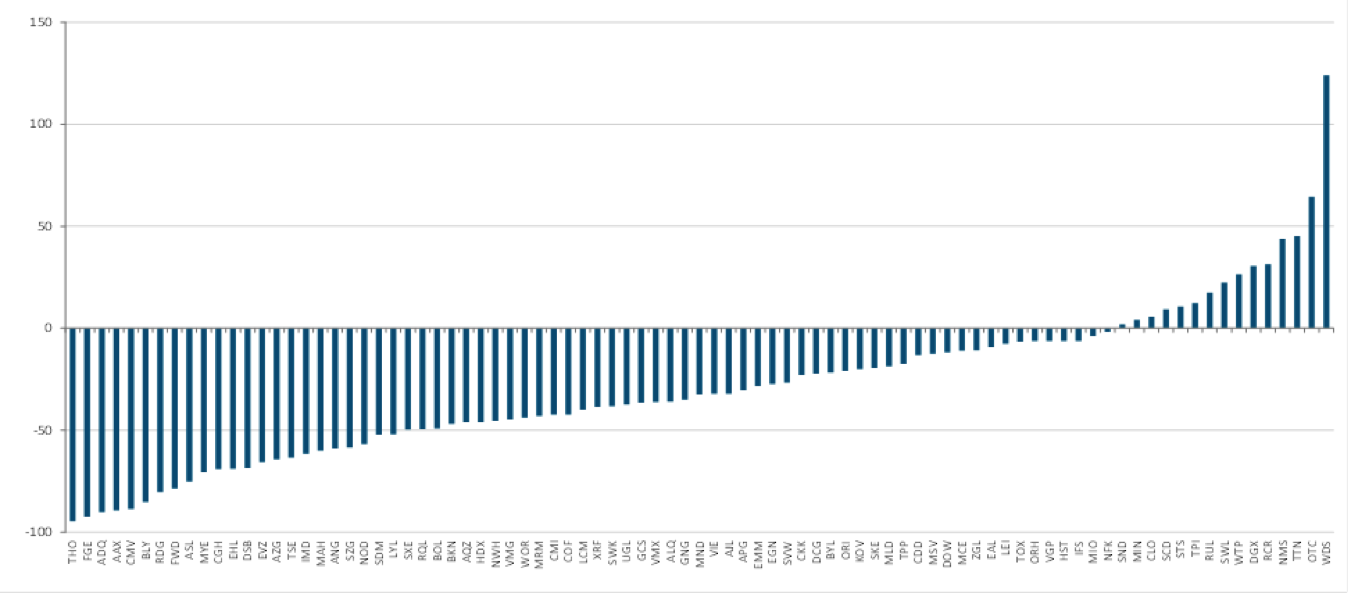

And certainly looking at the rolling 12 month returns for many listed mining services, given the large negative skew to the left, it confirms to us that trying to pick a winner at the moment is akin to walking through a minefield.

Mining Services/Contractors & Engineering Rolling 12 Month Returns vs. ASX200 (%)

On this basis, we will continue to largely avoid any investment and prefer holding cash as an alternative, being certain of a positive outcome rather than hopeful of one.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

I own mnd shares & still think they are one of the best, what are your thoughts?