Merry Christmas

As Christmas approaches and we gradually unplug from the frenzied activity of another year, I’d like to leave you with a brief summary of the year that was, provide some guidance on what 2025 might bring and offer you my prayers for a safe and peaceful Christmas.

‘Extremes’ is the word that best explains 2024. Several extreme trends and themes become more so during the year. The love affair for U.S. stocks intensified. U.S. markets are in the process of delivering a circa 25 per cent return for 2024, compared to a return of less than 10 per cent for non-U.S. equity markets (circa eight per cent for Australian stocks).

That’s double the outperformance U.S. stocks delivered above global counterparts since 2000, and it’s thanks to the Magnificent Seven, the relatively faster growth of the U.S. economy compared to the rest of the developed world, and U.S. dollar strength.

Bitcoin raced to US$107,000, with the rally prompting one conservative institution – AMP (ASX:AMP), to take a stake in the cryptocurrency.

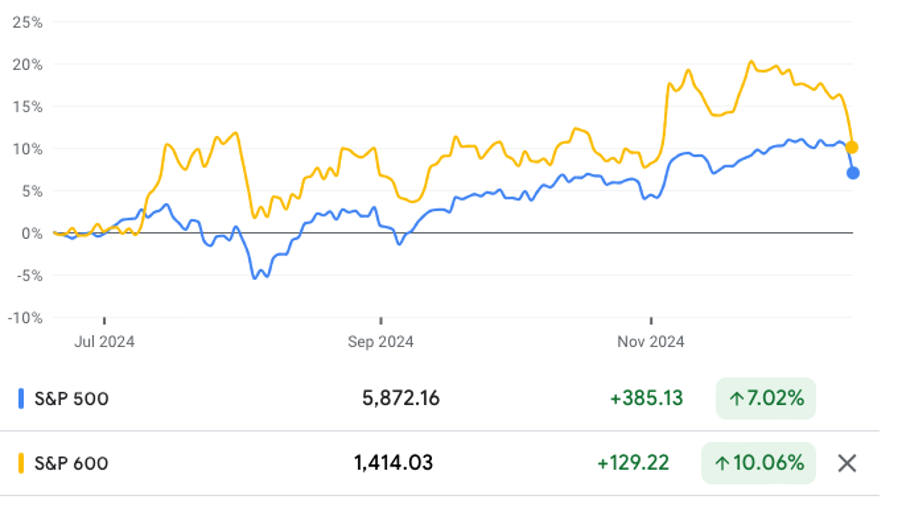

One extreme that began to moderate was the outperformance of large and mega-caps versus small caps. As Figure 1., reveals, small caps began outperforming their larger counterparts over the last six months.

Figure 1. S&P500 v S&P600 (small caps): 6 months to December 18 Source: Google

Source: Google

Meanwhile, our prediction that private credit funds, such as those we distribute to individuals, families and their family offices, would flourish is bearing fruit. Investors simply cannot ignore the attractive monthly cash returns delivered with none of the volatility of public markets such as equities.

Poor CEO behaviour ramped up over the year, with Coles (ASX:COL), Mineral Resources (ASX:MIN), Wisetech (ASX:WTC) and Qantas (ASX:QAN) in the headlines for all the wrong reasons.

Finally, the year also delivered more uncertainty than our world typically experiences, with political change and breakdown in the U.S., France and South Korea, not to mention Syria, Israel, Palestine and the ongoing fight for Ukraine against Russia’s Putin. It’s easy to feel overwhelmed amid the chaos, and that list doesn’t acknowledge the personal turmoil many of us have faced.

For 2025, despite the inevitable bumps along the way, I believe markets will continue to defy the naysayers. As long as positive economic growth is accompanied by disinflation, the share prices of innovative companies with pricing power and growth should do well. I believe small caps will continue their emerging trend of outperformance, and more investors and their advisers will realise the benefits of private credit, allocating to the asset class or adding to existing holdings.

Amid all the disorder and uncertainty, I was reminded today, by email, of the song of the angels, declaring “Glory to God in the highest heaven, and on earth peace to those on whom his favour rests”. Christmas reminds me of the gift of the historical Jesus, and his offer of unconditional love and promise for true, lasting, and certain peace, whatever the circumstances today.

I wish you a safe, peaceful and blessed Christmas, and I sincerely look forward to sharing our investing insights with you in 2025.

Merry Christmas from all of us at Montgomery.

Roger M.