May’s relative returns

We are focused value investors. The approach we have adopted, with a combined 80 years of Australian share market experience in our team, is working – and working well*.

The Mercer Survey of Australian ‘long only’ equity managers to May 31, 2013 was released recently (you can learn more about Mercer and purchase their full surveys here).

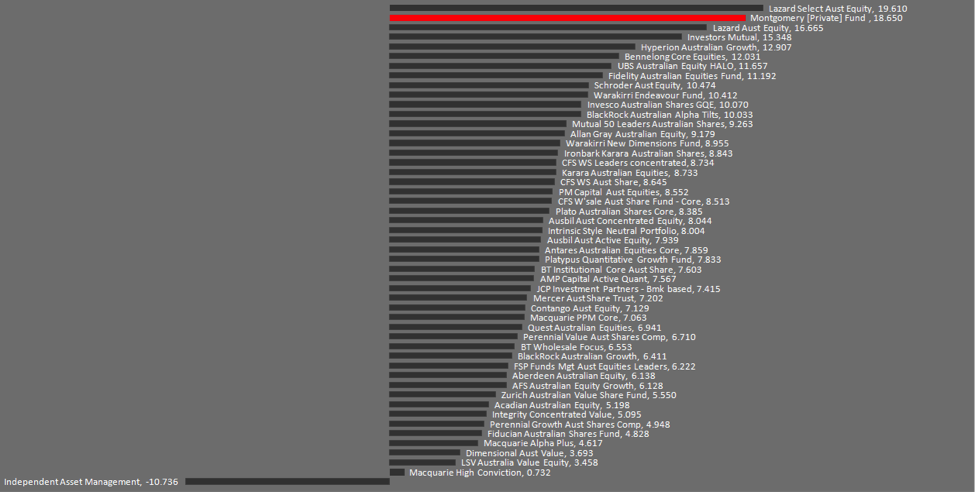

The survey reported on 88 funds and 62 managers. Had Montgomery been included in the survey, the returns for The Montgomery [Private] Fund would rank number no.2 over the 2 years to 31 May 2013 (see our interposition in the abbreviated chart below). Importantly, you should be aware that the survey reports returns before fees.

It is not our belief that we will always rank so well, and inevitably any investor in our funds must expect, and be willing, to endure periods of significant underperformance. For our team, however, the relative performance and a no.2 ranking is heartening and suggests our process is something to work on tirelessly to preserve, protect and repeat.

Please note Montgomery Investment Management is not included in the Mercer Surveys (but we would like to be in the future). To purchase or subscribe to Mercer’s information and in-depth research about Australian Fund Managers go to http://www.mercer.com.au.

Figure 1. Abbreviated survey. The full survey available only from Mercer includes 1, 3 and 8 month results as well as 1, 2, 3, 5 and 10 year results and all 90 managers.

Fig 1. Annual Compound Return for the two years to May 2013.

Fig 1. Annual Compound Return for the two years to May 2013.

*Important Information

The issuer of units in The Montgomery Fund (Retail Fund) is the Retail Fund’s responsible entity Fundhost Limited (ABN 69 092 517 087) (AFSL 233045). The Product Disclosure Statement for the Retail Fund contains all of the details of the offer. Copies of the Product Disclosure Statement are available from Montgomery Investment Management (02) 9692 5700 or at www.montinvest.com. An investment in the Retail Fund will only be available through a valid application form attached to the Product Disclosure Statement. Before making any decision to make or hold any investment in the Retail Fund you should consider the Product Disclosure Statement in full.

The issuer of units in The Montgomery [Private] Fund (Private Fund) is the Private Fund’s trustee Fundhost Limited (ABN 69 092 517 087) (AFSL 233045). The Information Memorandum for the Private Fund contains all of the details of the offer. Copies of the Information Memorandum are available from Montgomery Investment Management (02) 9692 5700 or at www.montinvest.com. An investment in the Private Fund will only be available through a valid application form attached to the Information Memorandum. Before making any decision to make or hold any investment in the Private Fund you should consider the Information Memorandum in full.

The information provided does not take into account the your investment objectives, financial situation or particular needs. You should consider your own investment objectives, financial situation and particular needs before acting upon any information provided and consider seeking advice from a financial advisor if necessary.

Future investment performance can vary from past performance. You should not base an investment decision simply on past performance. Past performance is not an indicator of future performance. The investment returns of the Retail Fund and the Private Fund are not guaranteed, the value of an investment may rise or fall.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Lloyd Evans

:

Hi All.

Congratulations on the results, given the results above are gross of fees and i assume yours are net, MIM should be top of the list!

One question , you noted:

Please note Montgomery Investment Management is not included in the Mercer Surveys (but we would like to be in the future). Why are you not included?

Roger Montgomery

:

Have to ‘pay to play’, so still saving up!

dietrich baumgartner

:

well done

Andrew Grant

:

As we all know the past couple of months in 2013 have been tough, and was well spotted (almost predicted) by the Montgomery team as a consequence of Macro economic indicators and lack of value opportunities lead to a larger cash position than normal as a response if my readings were correct. As an investor in the retail fund (unfortunately only since Jan-01) would be keen to understand if the cash position has shielded the fund to some degree in calendar year 2013. Appreciate your thoughts and feedback. Andrew.