Listen Up

As you know we have long been short Iron Ore. That was clever! “…long been short…”?

Jokes aside, many investors are still buying mining and mining services companies. Their reasoning is that they have underperformed the financials and non resource cyclicals. The rationale is that because they have under performed it is time for them to catch up. Well as you know, I think that is a bit like entering a Formula 1 race with a billy kart and a couple of friends to give you a push. Just because the billy-kart has lost the last 1000 races doesn’t mean its time for it to win. An F1 car accelerates from zero to 150kmh in 1.4 seconds. No matter how hard your friends push, your billy cart simply isn’t going to match it.

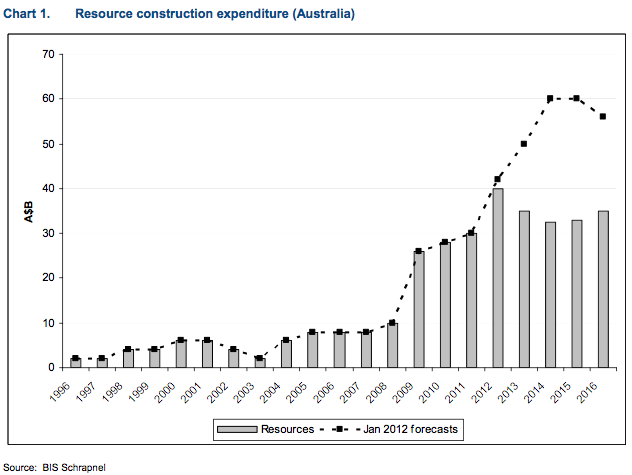

Mining construction was forecast to peak in 2015 at $60billion pa. According to BIS Schrapnel Current estimates now suggest mining infrastructure spending has already peaked at $40billion in 2012. Its still fives times the levels achieved before 2008. Nevertheless there is a very high correlation between the chart we show here and the price of Iron Ore. Before 2004 iron ore prices had not traded above $20/mt for two decades. Then into 2011 prices rallied to $187/mt. The response? Massive mining capex.

But that’s over now and there are a bunch of mining services companies that will be fighting to tender for a smaller amount of projects (even less if the iron ore price keeps dropping). In turn, these mining services businesses will bid lower and lower prices to keep their staff employed. As a result they will suffer pressure on their margins and so even if they survive the profit growth and dividends may just not be there. For others survival will not be an option and all the mining services analysts that emerged to cover the sector in 2012 will disappear, relegated to covering Wesfarmers, Worley Parsons and Monadelphous.

I agree with the premise of shrinking margins for services companies in the iron ore space. If you wanted to invest short on that premise, the problem I see is that most of these companies already trade at less than half their peak values. So there is a lot of future deterioration already being built into the valuations?

Which specific services companies do you see as most vulnerable if your thesis plays out?

Hi Will, Those with exposure to Iron Ore, Those without long term contracts, those without a long track record and those that are highly capital intensive and/or have high operating leverage. Compare the revenue to the level of total property plant and equipment on the balance sheet.

Of course, occassionally the F1 car crashes or has a mechanical meltdown and like the tortoise and the hare, the billycart might just cruise on past without any trouble.

Rare but true.

Hi Steve,

I work in the coal sector and indeed know Mastermyne, this company is no exception to what Rodger is talking about. They are tendering currently, along with numerous other contractors tendering for the meager amount of work that is out there. To gain the contracts M/myne are also under pressure to slice there once juicy margins.

Tony

Typo in paragraph 2

fixed. thanks Guy

If the Services companies could crash and burn, why has Forge been able to be valued at $17 approx in recent times when it’s share price is $6.60 and still rated A1? Or is this just an exception to the rule?

Delighetd you asked Tony,

Take a look not only at the intrinsic value but the path of its future IV. You will see it is declining. Also a substantial decline in the price of iron ore is just my view, not the majority view. I could be very, very wrong. Thats why Skaffold isn’t me. Skaffold is fact based and its valuations are based on actual performance and analyst expectations.

It would seem to me that Mastermyne and NWH are well run companies that do much needed work in mining and other areas. They have a very good reputation and their services will likely remain in demand even though mining is decreasing.Granted, this demand may reduce but future projections for Mastermyne still look good although this would obviously need to be monitored closely. NWH projections aren’t so good but it would appear it is still substantially under value and offering a good dividend that appears to be sustainable. It also does a good deal of business in civil contracting which gives it diversification and would be my preferred stock of the two.

Obviously both if these stocks still concern you Roger?

Of the mining resources companies I have MIN which has been one of the best in this field. I purchased low at mid 7’s to mid 8’s. I see it as a good company which meets most filters and its only sin is it is in the mining services sector. To hold or not to hold, that is the question.

Is MIN only in minings services?

All true, but given the herd has no idea about this, wont they all still jump on board while ever the profits keep rising. Hence there may be 12 months of reasonable price increases available to investors ??

OK. Best of luck with getting the timing so fine-tuned.

So, do you still put the likes of Mastermyne and NWH in this category Roger?

Do you think they are each an exception?