Is this the fate that awaits Australian Iron Ore Producers?

Could it get any worse for Iron Ore? It Just did!

Could it get any worse for Iron Ore? It Just did!

News Flash! Shipping more iron ore volumes at lower prices is the same as JBH and HVN selling more TV’s a lower prices. Margins compress and profits don’t meet expectations.

Back in April, when we began more urgently warning investors to look carefully at profit assumptions for the big material stocks, our theory was that iron ore prices would decline because of a massive supply response. It really was basic supply and demand. Economics 101. You can read our warning here: http://rogermontgomery.com/is-the-bubble-bursting/

Back on December 8 2011, with BHP trading at more than $37.00 we again warned:

“I now wonder whether we are seeing the bubble slip over the precipice? Falling property prices (10 per cent of the Chinese economy) leads to lower construction activity, leads to declining demand for Australian commodities, leads to falling commodity prices, leads to big drops in margins for a sizeable portion of the [Australian stock] market index…”

The doubters and many analysts that cover the sector however told us that lower prices would just mean that BHP, RIO and FMG would simply ship more volume. Remember share price performance over the long run follows profitability not profit.

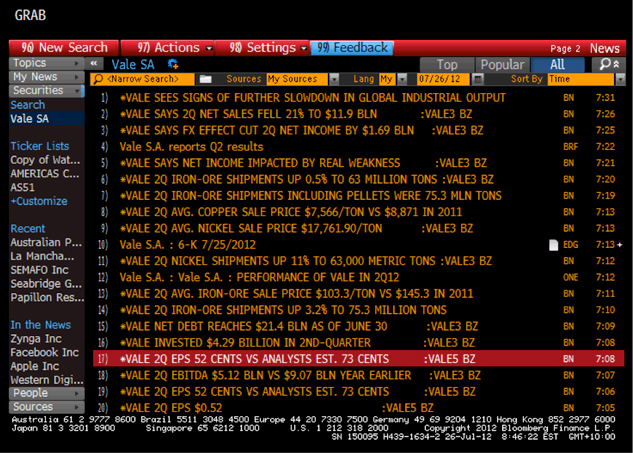

And here’s the latest…

According to a news article that landed in the Bloomberg terminal this morning (see screenshot), Rio de Janeiro-based Vale, the world’s largest iron- ore producer, said second-quarter profit plummeted 59 per cent after prices for iron ore, nickel and copper declined.

Net income dropped to $2.66 billion, or 52 cents per share, from $6.45 billion, or $1.22 per share a year earlier. Vale was expected to post per-share earnings of 73 cents. The selling price of iron ore and most of Vale’s main products is lower than in 2011. This explains the decline in earnings.

Net sales fell 21 percent to $11.9 billion despite an increase in supply / production at Carajas, its biggest mine. Vale reportedly sold its iron ore at an average $103.29 per metric ton, down from $145.30 last year – something we have been warning for 6 months may happen. Nickel’s average sales price dropped 31 percent and copper declined 15 percent.

The stock has fallen 24 percent in the past 12 months, twice the 12 percent decrease in Brazil’s benchmark Bovespa Index. Management has put the focus of the fall squarely on slowing economic growth in China, the world’s biggest steel producer.

Returning to BHP, just 12 months ago, analysts had forecast 2012 net profits of almost $22b rising to $23b in 2013.

Those forecasts now stand at $17b and $18b respectively, representing a massive 22%-23% downgrade. And like Vale, BHP has also materially underperformed the ASX 200 index.

And given the significant miss by Vale analysts this morning, we reckon forecast earnings for BHP, RIO, FMG, MIN, AGO, BCI might disappoint again in the near future.

The answer in future periods may in fact lie in the Shanghai Re-bar prices and we have been watching this closely. Why? Because this is the most-traded steel futures contract and last week it hit a 2012 low.

Are iron ore prices, currently trading around China’s cost of production of $120/t, about to follow Re-bar prices despite most predicting the price simply cannot fall past this point?

The last time Re-bar prices were at this level, iron ore prices were also significantly lower.

When I was last on the ABC’s Inside Business program (watch it here: http://rogermontgomery.com/an-important-announcement/), we discussed Fortescue Metals CFO stating that their long-term iron ore price target is $100/t. I wonder how long we will have to wait until that forecast is also revised lower? As always, time will tell. Vale’s news is not a good omen.