Is this a FOMO rally?

A lot has been written about the COVID-19 crisis and undoubtedly it will go down in history as a monumental market crash, and so far it has been one of the quickest technical “bear” markets on record, with the S&P 500 hitting its high on 19 February 2020 and into a bear market just 16 days later.

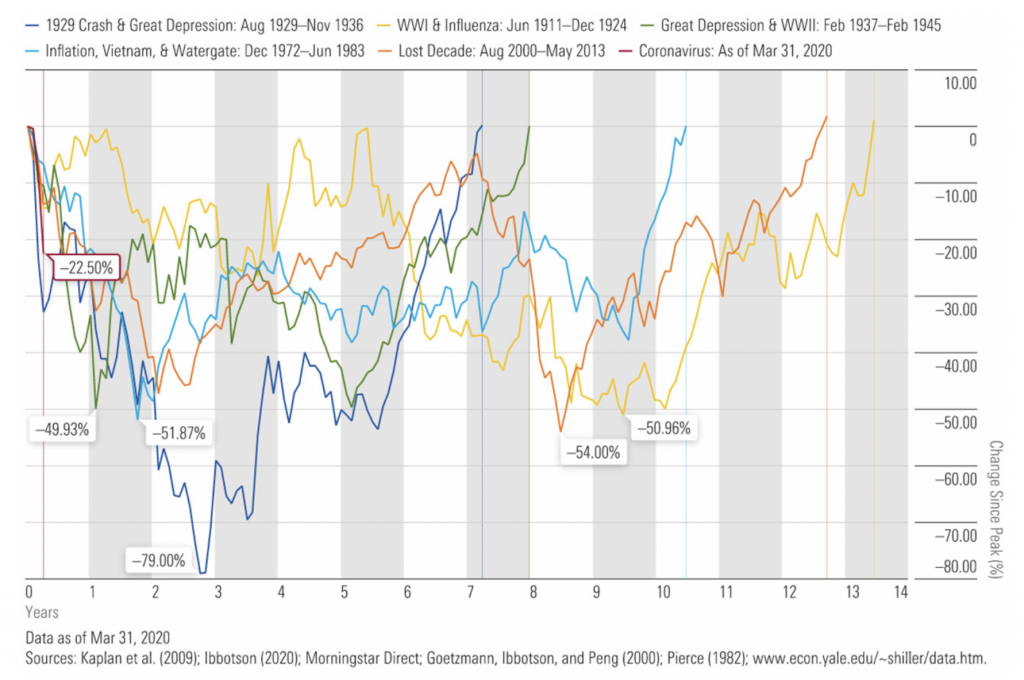

To achieve this, it needed to fall 20 per cent and as we know today the current low was reached on 23 March 2020. The graph below reproduced from Morningstar shows the decline as at the end March in comparison to some of the other great bear markets in history.

Source: Morningstar

Since those lows, the S&P 500 has rallied back 27 per cent, and is only 16 per cent off its all-time highs.

The S&P/ASX 200 fell 36 per cent and has rallied back 18 per cent off its lows, but still 24 per cent off its highs. The question everyone wonders is whether the strong rally back is justified.

Over the last 80 years, the market has bottomed on average 107 days before the end of a recession. While we hear various estimates of time until the market bottoms, days until virus outbreaks peak and the length of the impending recession, there will not be an ‘all-clear’ sign for when the market starts to recover and it’s ‘okay’ for investors to jump back in.

What we do understand is that markets are forward looking, and they are constantly weighing up the probability of different sets of scenarios and their outcomes. Two known unknowns are the pace of the economic recovery and the path of post-recession earnings. Over the past few weeks, investors have increasingly assigned a higher probability to a shorter-than-anticipated recession and a stronger acceleration in profits.

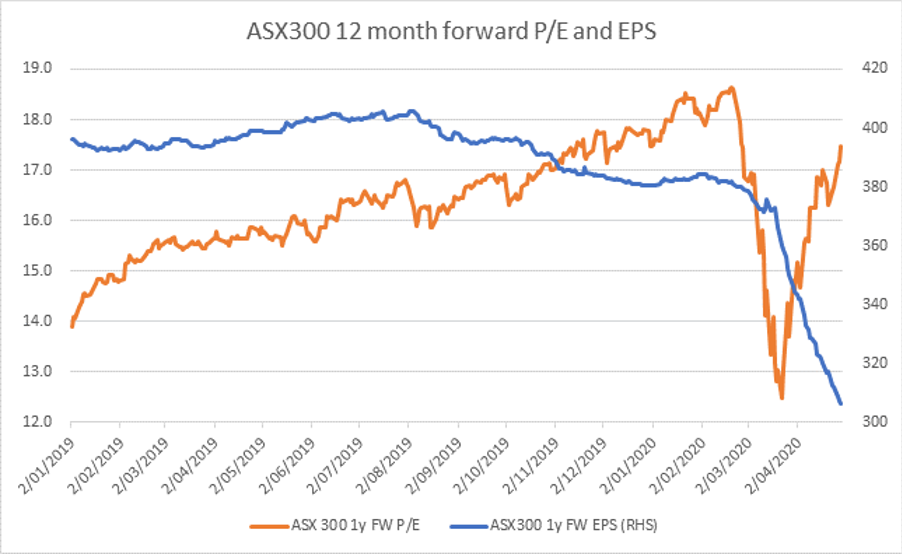

What seems inconsistent is that broker consensus earnings for the S&P/ASX 300 companies on a one year forward estimates basis (figure 2.) have been revised downwards by about 25 per cent since mid last year. But as we know the “fog” clouding so many businesses when trying to guide for earnings outlooks means that the picture is even more uncertain than what might be portrayed here. What is potentially alarming is the resulting forward PE of the market when current prices are taken into account and this reduction in earnings. Are we really happy to pay 17.5x forward earnings in such an environment? Further to this is the likely earnings dilution resulting from future equity capital having to be raised. It seems as if a FOMO rally is being played out.

These days most investors have been well versed on the notion that they should buy the dips, but it occurs to me what else can you buy when cash yields you practically nothing and most people need to generate an income.

Maybe the sharp rebound is a result of the old adage of “don’t fight the Fed” and if the Fed is wanting to inflate asset prices then maybe it’s safe to go swimming again. At this point in time however, we believe that caution is still warranted. Valuations in aggregate do not seem compelling for the uncertainty of the unknowns.

While individual opportunities are being selectively invested in, we require very strong balance sheets, growing competitive positions in their industry and a wider margin of safety from a valuation point. We think this crisis and the resulting equity market volatility has further to play out.