Dear Property Investor…Your Best Warning!

The Australian residential property market has had a spring in its step recently. Auction clearance rates have been healthy, and rising prices have prompted media commentary on the possibility of an emerging housing “bubble”.

I’m no property expert, and so it may be wise to avoid putting an oar in on this debate, but let’s put wisdom aside for a moment and think about whether the application of value investing principles can add anything to a discussion on house prices.

We’ll start by assuming that residential property – at least the investment kind – derives its value in the same way as other financial assets (by producing cashflows), and obeys the same fundamental financial laws. This may be too much to assume for owner-occupied property, but should be reasonable in the case of investment property.

Having made that assumption, and noting that property income is fairly predictable, the valuation exercise can be approached in a fairly straightforward way. We just need to come up with three critical numbers:

• The discount rate, or rate of return required by an investor

• The net rental income generated

• The long term rental growth rate

Having estimated these numbers, we can plug them into a simple formula that will calculate the present value of the cashflows into perpetuity – following the same principles one might use to value a business.

As an aside, I note that a lot of commentators assert that investment property is justified on the basis of capital growth rather than rental yield. For me, the issue with this line of thought is: how do you estimate capital growth? To a value investor, value needs to be anchored on future cashflows (rents), not extrapolated from past price growth. In the same way that share price growth in excess of profit growth is unsustainable long term, it seems that property price growth in excess of rental growth should also be unsustainable long term.

Moving on, let’s try to estimate our valuation assumptions, starting with the discount rate. You should feel free to substitute your own estimates here and reach your own conclusions. The thing I want to illustrate is how you can go about doing the calculation.

A discount rate reflects the rate of return an investor needs to compensate them for the risk of investing in a particular asset. A good way to estimate it might be to start with the ten year government bond rate (a proxy for the rate that applies when there is no risk – currently around 4% p.a.), and add a risk premium.

In the case of equities, the risk premium is commonly thought to be around 5-6%. I think a case can be made for a lower risk premium for property, given that it has a more stable profile, but at the same time we should consider that property is a much less liquid asset than equities, and investors should demand some compensation for this. For the sake of argument, let’s choose a risk premium of 4%. This gives us a required rate of return of around 8%. Again, feel free to adopt your own assumptions.

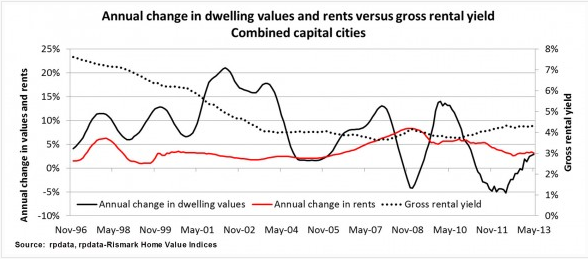

Net rental yield is the next piece of information we need. Here I’ll refer to some data published by rp-data, set out in the chart below.

The chart shows a gross rental yield for Australian capital cities of around 4.3% p.a. currently. Note that in times gone by this figure was significantly higher (as was the 10 year bond rate).

To get to a net rental yield we need to subtract all the expenses that an investor must incur in generating the gross rent, including property management fees, maintenance, insurance etc. I don’t have a good reference for this figure, but a reasonable estimate may be around 1.0%. For now let’s adopt that figure, which gets us to a net rental yield of 4.3% – 1.0% = 3.3%.

The final figure we need is the long term growth rate in rents. The rp-data chart above sets out the long term history of rental growth rates. Having regard to this history, it seems like a figure just above 3% p.a. might be a reasonable estimate. For now let’s assume 3.2%.

Combining these numbers into a valuation can be done as follows: we divide the annual rent earned on a property by a divisor, which is calculated by subtracting the long term growth rate from the discount rate, as set out below.

Value = Net Rent p.a. /(Discount rate – Growth rate)

For the financially minded, this is the formula for calculating the present value of a stream of cash flow that grows at a fixed rate in perpetuity.

If a property generates say $10,000 per year of net rent, we would calculate its value as $10,000/(8% – 3.2%) or $10,000/4.8%, which is equal to around $208,333.

If that property can be bought today at a net yield of 3.3%, then that would imply that the market price of the property today is $10,000/3.3% = $303,030. This is clearly a significantly higher number than the valuation of $208,333 that we just calculated. On the basis of the discount rate and long term growth rate we assumed, buying property on a net rental yield of 3.3% appears hard to justify.

This analysis may indicate that the last few decades of growth in property prices is not sustainable (recall the declining yield from the chart above) and some mean reversion is likely going forward. If this is correct, it may pay to be cautious about buying on the basis of a continuation of assumed capital growth.

Of course, the conclusions you reach with this approach are sensitive to the assumptions you put into it, and the purpose here is not to argue that property is overpriced – rather, it is to set out a framework that allows some basic assumptions to be converted into a fundamental value. By doing this, you can focus attention on the things you need to believe in order to conclude that there is long term fundamental value underpinning a decision to invest.

Editor’s Note:

Tim’s proposed framework may help explain the reason why the world’s longest study of house price changes reveals that houses prices largely track inflation.

It’s my favourite academic study of house prices. The Herengracht canal in Amsterdam has been a favoured strip of real estate in the city since the 1620s when wealthy spice and slave merchants showed a penchant for canal-side living. Finance professor Piet Eichholz of Maastricht University data-mined extremely long term Dutch record keeping to construct the Herengracht house index. It covers inflation adjusted real estate prices from the construction of the Herengracht in the 1620s up to 1975, after which it was extended to 2008.

Over a 380 year period – commencing with the Dutch ‘Golden Age’ – real (i.e. inflation adjusted) house prices have only doubled, which corresponds to an annual average price increase of something like 0.1%. The conclusion then is that despite short-term rises and falls, prices roughly follow inflation.

What are the implications of both Tim’s and Eichholz’s work? Well, for starters, if you buy a property and subsequently enjoy the benefits of house prices that rise much faster than inflation over a decade or two, you should consider reducing your exposure ahead of a reversion. Alternatively, if you haven’t bought, then rather than relying on an already established area to increase with a rising tide, the general areas to invest in are those where gentrification and transformation are possible within the next five to ten years. Roger M.

Hi Sergey,

That $500k profit you are talking about is worth less 10 years later so it isn’t a $500k profit in real terms 10 years later. It is really worth about $250k 10 years later.

Also, if you have someone paying rent, you pay capital gains tax on that so that $500k figure is before tax.

Your statement of an initial $50k investment worth $1m now, well you need to include loan repayments as well even if you have renters, you make it sound like you are getting something for nothing.

And actually a lot of families can handle the debt. That is why there are so many home loans out there.

Many many people say that “paying rent is dead money”, this is a very misguided statement and only half the truth.

I don’t know anyone who buys property and never has to spend money on their property.

If you are making the biggest investment in your life, you need to think about these things otherwise you are being silly with your money and can make your life more difficult.

Hi all,

The way I see it is relatively uncomplicated really –

1. We all heard that for property to double up in value every 10 years it needs to grow at about 7.17% every year. If we agree that property value tracks (follow) the inflation than inflation is at about 7% every year, regardless of what they say on TV.

2. Say if property cost $500K to buy and you paid deposit of $50K (10%) and borrowed $450K (90%), 10 years later that property would double up and be about $1Mil in value. So with $50K invested 10 years ago you ended up with $500K profit, and that translates into 25.89% annual growth. Than as Sophie said earlier you can take some of it and invest into business and shares. What about repayments I hear they ask, well this is where tenant coming in to help you with bank repayments. The only catch is that not that many people can stomach to much debt I think.

When people buy an investment property, they seem to be influenced by low interest rates. That is a really stupid short term view. Also, they know nothing about margin of safety. I know property prices are less volatile than share prices so margin of safety should be less important, but still they should know about it. If you make the biggest investment decision in your life, you should know about this. I’m glad I studied Buffett.

Buying a house to live in is more a lifestyle decision and very different to investing in equities.

Exactly.

Great article Tim, as always property invokes a lot of passion and opinion as seen by the number of comments. Unfortunately it’s an industry driven by investor emotions, perceived tax advantages, banks greed and government meddling. There have been so many factors pumping property prices over the last 12 years, but as any seasoned investor knows no market ever heads in one direction all the time. What worries me is the amount of risk/debt that investors are encouraged to, and willing to take to invest into a single asset. They are encouraged by their accountant because apparently negative gearing is the only cash flow outcome that’s worth talking about, the developer/properly adviser are happy to sell you anything as long as they get paid, the banks as always are happy to lend as much as they think you can handle, then if your a first home builder in a country area you could have received up $37,000 from the government to build your first home. Most successful business people I’ve met in the property sector have made their money by building, selling or advising on property as opposed to owning it as a long-term investment. I don’t dispute that many people have made money on property investment over the last 10 years, but the amount of risk taken to do it is a worry. With one of the highest household debt levels in the world, lets hope our employment levels remain stable?

Thanks Rob. I agree that investors need to remember that negative gearing is an outcome (and a loss at that) not an investment strategy.

Property is still seen favourably by Australian banks, for those who do not have the acumen to invest in shares its not such a bad investment. However its a more transparent purchase as many factors that effect growth can be easily researched by looking towards proposed council developments, and the possibility of a future resource boom eg the Darling Downes region which is resource rich but underdeveloped.

For me property has always been my leverage to buy a buisness (pharmacy) and my share portfolio unless converted to cash for most bankers at the moment will do well. Country areas don’t fluctuate as much as cities give greater rental returns, and if there are known resources there is a potential for short term explosive growth…but not right now. However super shares are a far better investment hands down simply because you can get a well invested fund like yours and let you do all the work, without the headache of tenants etc.

Property is still seen favourably by Australian banks, for those who do not have the acumen to invest in shares its not such a bad investment. However its a more transparent purchase as many factors that effect growth can be easily researched by looking towards proposed council developments, and the possibility of a future resource boom eg the Darling Downes region which is resource rich but underdeveloped.

For me property has always been my leverage to buy a buisness (pharmacy) and my share portfolio unless converted to cash for most bankers at the moment will do well. Country areas don’t fluctuate as much as cities give greater rental returns, and if there are known resources there is a potential for short term explosive growth…but not right now. However super shares are a far better investment hands down simply because you can get a well invested fund like yours and let you do all the work, without the headache of tenants etc.

Related articles on canal properties:

http://hotelivory.wordpress.com/2010/08/29/a-very-long-view-on-house-prices/

http://www.nytimes.com/2006/03/05/magazine/305tulips_shorto.1.html?pagewanted=all&_r=0

Perhaps following paragraph sums up why we buy properties:

“Most of us leave no lasting traces that recall our stay on the planet, but through accident and fate, Fransz left something that has endured the centuries. His house — an elegant redbrick step-gable, its facade ornamented with sandstone bands and wooden cross-framed windows, a building that has more of the Renaissance than the Baroque about it — still stands. Napoleon and Hitler conquered Amsterdam in their separate centuries; later, postmodern architects and the sex and soft-drug industries made their marks. Pieter Fransz’s house withstood all.”

Tim,

Agree with the premise of the argument, however unless you are buying the property with 100% cash, you are mixing concepts and it is not the same as your value.able analysis for shares.

The cash flows you use for shares are post debt already inherent within the business, whereas the analysis you’ve got above, you have used an “equity” type discount rate, but applied it to pre-debt cash flows.

Therefore you either need to adjust the cash flows to be post-debt or the discount rate is too high.

1. Adjusting the cash flows makes it difficult as most IP’s are negatively geared, and until you reach some level of “steady state” debt when cash flow positive, the value assessment doesn’t work.

2. The discount rate you’re using is too high and forgets that properties are significantly levered. Assuming 7% as the pre-tax cost of debt, 30% tax rate and that you maintain debt to 60% of the property value on average, the combined discount rate would be closer to ~6% which means the 10kp.a. is worth about $340k, i.e. more than calculated by the implied yield.

However, they key thing i think about is that the 3.3% yield is pre-tax, which is even uglier if you put it on a post-tax basis, and even worse on an post-debt basis. Going back to value.able, if this was a company that generated ~1-2% RoE, it wouldn’t even pass your filter of being investable, regardless of value.

Thanks for the article, I had always planned to do this analysis, but this finally prompted me.

Cheers

So what’s the value of a business that makes a loss after interest payments? Doesn’t seem that problematic to me.

Agreed.

What is your take on my final point I made re the RoE. Even assuming 100% cash purchase, simplistically it is a ~3-4% pre-tax net yield at the moment, as compared to your thresholds you look at for good businesses being in the 15-20% RoE range.

I take the point around stability of property income, but to me it is not that compelling at a threshold level? Even at higher yields, there is always the risk of vacancy which is binary.

At least with a company they usually have a range of revenue sources, which even if one reduces, should hopefully still be profitable albeit reduced.

On a similar note, how do you think about risk profile and diversification in ones portfolio as it relates to property, noting that for most people, it will be such a significant (levered) component, which in turns creates a greater risk.

Hi Brett, Its the gearing on the balance sheet typically added that boosts the return on equity. You then need to decide if it remains compelling given the higher risk of the balance sheet and keeping in mind that NPAT become negative (negative gearing) after interest expenses are factored in for many if not most properties. The earlier comments here about Chinese buyers buying in bulk and leaving the properties untenanted is worthy of note but of course, bubbles still form and no nation nor its constituents can remain immune from the aftershocks…

If you live in Sydney and put your property on the market you will find that 9 out of 10 open home viewers are Asian. The game has changed, in China there are hundreds of high rise apartment blocks all owned by investors and all empty.

China has never had a real estate crash, to them property ALWAYS goes up, so you don’t worry about rental yields, just keep buying.

Recent controls on purchasing investment property in China has resulted in many people looking further abroad.

Access to cheap finance and Asia’s appetite for property will continue to fuel the boom/bubble in Australia and concepts such as yield are irrelevant to them, In Brisbane groups of people fly in from overseas are taken around by bus to new developments, they pick the ones out they want and hop back on the plane back to China the next day. The same is happening in Auckland, I sold a property there, it was bought by a Chinese investors who has just left the property empty, almost 12 months now.

Thanks for the insights! I attended an open for inspection at the weekend held by Belle property. I noted five Chinese families inspecting the property out of seven in total.

B Wood is absolutely right in every aspect of what he just said. HKG has become massively overpriced due to the influx of mainland Chinese buying up property in “the right areas” to send their kids to “the right school”.

Part of it is that if they invest elsewhere (or buy a house here so that they can send their children overseas to study), they may obtain Citizenship in another country, hence, they can get a passport…which is insurance against if things go wrong in China. Match this with the Confucian value of “looking after family” and you can see what it spells.

When I say “buy a house”, I mean that – and not just any house. Houses in Burnside (SA) and other ‘nice’ areas are the ones being bought up, not ‘mum and dad’ properties.

The mainland Chinese are throwing a LOT of money around, very obviously – buying property in Singapore, New York, London etc. as two things – 1) an insurance policy and diversifying their wealth in case China collapses (which it will…history has a bad habit of repeating itself, and if you look at the drivers for the Soviet Union, they are very much the same, e.g. the Uyghurs / Tibetan “minorities” and the territorial arguments) and 2) because their existing Chinese and HKG markets are very, very overheated, as said before.

Terrific thoughts Chris. Thanks for sharing.

Roger,

A great article. Many years ago a US financial planner I new use to know always said that a home is not an investment it’s a place to live to bring up your family, he eventually had 8 kids and he stressed that it should always be unencumbered.

Mortgage money was then at around 12%. I wonder what the property market would look like under those conditions. Cheers

Do you think population growth should have been factored into one of the calculations ?

No. property hasn’t been an attractive investment for over a decade. There are other places to put money that provide much better returns, particularly for leveraged investment (leveraged property returns are pretty much universally negative at present).

It’s worth remembering as well that property prices are driven by lots of factors, none of which it seems have anything at all to do with value or return. The government meddling with grants, taxes and the like in order to boost the building industry by stimulating demand (a severely wrong-headed idea in my opinion) has probably been the most significant influence over the past 8-10 years.

Don’t get me wrong, there is money to be made in property – you have to be a developer to see any of it though.

Correct! Imagine how the sharemarket might perform if everyone was given a ‘first share portfolio buyers grant’ !!!

A couple of thoughts on property. The first is, we all have to live somewhere. So do you pay rent at 4.3% or a mortgage at 5.5%? Well given property grows by inflation, 4.3% rental yield plus 2% inflation makes a mortgage look attractive. Throw in the fact that owner occupiers pay no CGT and it is doubly attractive. But, capital should go to the higest ROI investment, I hear you say. So why put capital into a house instead of a higher returning asset? Well, because once the capital invested in a home is repaid, it can be redrawn at favourable rates and reinvested profitably, with the added advantage of living rent free for the rest of your life. It is that benefit of cheaper loans against bricks and mortar that is a considerable advantage to property ownership

Solid economic arguments. Go for the gentrification option then.

House prices do normally run with inflation but over and under shoot. ATM, they have overshot to an extreme. Prices resemble no value at all. The sums have not taken this into account.

I love any analysis that begins with “Let’s put wisdom aside for a moment.” Don’t forget that the transaction costs for property in Australia are ridiculously high (stamp duty on purchasing, agents commission on selling).

The concept of valuation and property is a funny one. What you did is valuation but what the people in the industry do tends to be more pricing.

Property to me, just doesn’t appear an attractive investment and believe that in most cases participants do it for the wrong or distorted reason. I have always thought it might be interesting for a study to look into peoples thoughts on different asset classes over a bunch of different socio-econmic cateogries.

i think it is more a show of wealth now than any logically decided investment criteria (hence negative gearing exists). Many stories exist of people who people thought were really successful as they owned multiple investment properties but didn’t enjoy life as they spent every day working hard to make sure they stayed afloat. I can see how this can happen with property but i have never had any impact in quality of life in shares (bull, stable or bear market).

The cons of property far outweigh any benefits to me but good and interesting post Tim.