Is that Jim Rogers’ copy of Value.able?

I’ve been following and chatting to Jim Rogers for many, many years. And, if your pockets are deep enough to ride out the inevitable bumps (“nothing goes up in a straight line Roger”), his commodity calls have been on the money.

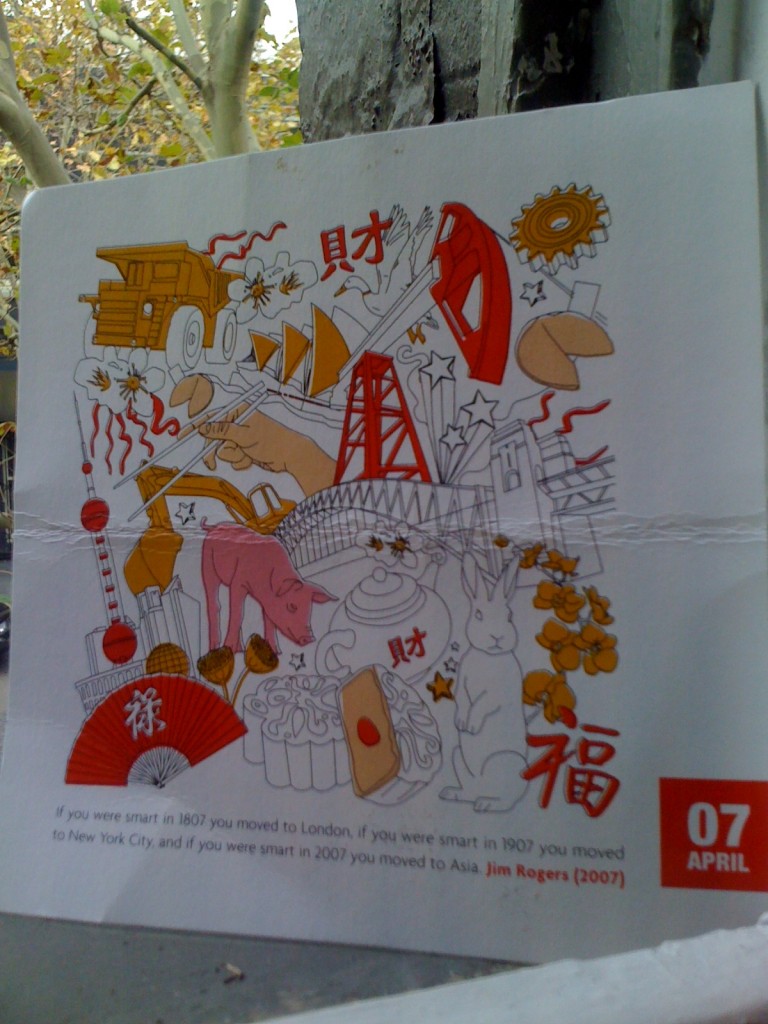

Last night I was delighted to catch up with him again, after being invited by CBA to celebrate the first birthday of their Institutional Equities business (the invitation (picture below) read “If you were smart in 1807 you moved to London, if you were smart in 1907 you moved to New York City, and if you were smart in 2007 you moved to Asia“, Jim Rogers 2007). I was impressed by how many of my friends in the funds management industry have employed the Institutional Equities desk of CBA. They are obviously not restricting their excellent service to me!

Jim arrived and I had the opportunity to catch up before he went on to speak to the audience. For those who missed it, he remains extremely bullish on commodities and in particular Cotton, Sugar, Oil and Gold. The audience were perhaps most in agreement with a bullish view on wheat and while this wasn’t discussed, I can tell you the expansion of deserts in China and the depletion of water reserves there will cause a fundamental step-change in the world’s agricultural markets and the price of food.

But if you really want to get a sense of how bullish Jim is try this on for size: Oil = $200/barrel or more (see my January 2011 Post), Gold $2000/ounce (January 2011 Post) sometime in the next decade and the Aussie dollar? Wait for it…..US$1.40!!!! Jim didin’t say it in so many words, but it was being whispered between the salt and pepper prawns, lime and coconut marshmallows, and for the late night revellers, a 2001 Noble One.

As you can see Jim was delighted to receive a personally dedicated copy of Value.able to read on the flight back to Singapore. I hope that he gets as much out of it as I have from his.

Posted by Roger Montgomery, author and fund manager, 8 April 2011.

I had the opportunity to catch up before he went on to speak to the audience.

A lot of people are bullish on Aussie and Canadian Dollars, but recently the Canadian Dollar has not performed as well as the Aussie. Does anyone know if that trend will continue or is the Canadian ready to recover? They are keeping interest rates too low so that probably is making the Aussie more attractive.

I’d appreciate comment on advisability of participating in the Matrix Composite & Eng share purchase plan, priced at $8.50.

I don’t think anyone at this blog should be providing individual financial advice Debbie. No-one is qualified, nobody has any interest in your personal financial needs and circumstances and so no-body can do anything but make general observations or give opinions. However, I believe that Matrix is currently undervalued and the intrinsic value is rising over the next few years – but, you must ensure that any decisions you make should be appropriate for your portfolio and your current financial situation. Another consideration is that the current price is getting close to the offer price of $8.50 – therefore should you choose to increase your allocation, you may get an opportunity to buy it at a better price on the market.

..and Debbie, you MUST seek and take personal professional advice.

Hi Debbie,

No advice but,

U should consider the following:

1 how much exposure of ur portfolio u wish to allocate to this company?

2 would u buy shares at 8.50 if there was no SPP offer?

3 what is the likelihood of the price dropping below 8.50 in the short term?

Lots to think about GOOD LUCK!

Hi Bloggers

In Ron’s post, point 3 is critical if you believe the stock is at a discount to its IV. It could well be that before the closing date of the SPP, that MCE could drop further in price, meaning you could get the shares on market at a larger MOS than the SPP (including brokerage).

Hope this helps

how many Brads are there !

Brad I am “Brad J” not sure if there are any other Brad’s

Peter/Room

Have recently been looking at a company Peter mentioned about aweek ago IDL.I was interested if anyone has a rating on this company or anything on there history,they do appear to be at a discount and also in the service division of mine equipment rather then coal itself.

However going through the recent investor presentation i noticed that they are well down in mining equipment division.The four areas they cover are minig technology,mining equipment,gas management and mining services.Peter i noticed you used 10%RR and thats fine if you are comfortable with that,but i think 12% would be best for this company.

I have a greater interest in there MQR before further research and relatively new at this.Thanks to all on this blog for their continued help and inputs.

Off topic fellow bloggers, but have a couple of questions and a stock for the blog.

In the latest edition of ‘Money” magizine, there is a tech stock listed from the USA. We did the IV for it on the weekend and looks very promising.

” IDCC currently earns a royalty on 50% of all 3G phones sold. It has license agreements with tech companies that delivers a % of there sales from wireless devices.Companies include Samsung, LG,Apple, Blackberry, Nokia and HTC”

IDCC- Interdigital Inc and calcs are in US dollars

Eqty per share – $7.79

Return on Eqty – 43.50%

RR – 12%

IV – $75.87

Currently trading at $47.16

My thoughts on this company- barriers to entry as significant, even for a Tech company. They have the expertise and more importanly- the patents and are quite prepared to go to court to uphold there patents and they have won on most occassions. This would also cover competive advantage for the short to medium term.

Smartphone sales are were up by over 25% last year and is expected to rise again by that much at the minimum this year.. This will enable more revenue from patents.

4G smartphones require there patents and this will be the new wave of smartphones for all of us to buy and revenue for IDCC

Risks- Aussie to US dollar exchange rate will possibly go higher in the short to medium term and impact on the potential gain.

Other Tech/Phone companies may develop new ways of circumventing there patents.

They will coninually need to spend significant sums on R&D to stay ahead of the pack.

I have a commsec accout and tried to put a buy order in with them and didn’t realise that you have to setup a external account with “Perishing International Markets” provider they use. Tried, but when i tried to register, they ask for the first 3 characters of your account number. Didn’t do any good. Other Commsec account holders have any info on this please.

Is there a easier way to buy US shares out there potentially via an online provider??. I checked Etrade, but this company is not on there supported list. I don’t want to use a full service broker, as it will cost me a fortune in time, paperwork and dollars to setup an acoount. Looking for suggestions???

Roger & grads

Re the MCE SPP how can we estimate the likelihood of a scale back ? MCE are seeking to raise $6M @ $8.50 per share with the SPP maximum of 1,764 per eligible shareholder. $6M /$8.50 =705,882 shares. 705,882 shares divided by 1,764 (max SPP) = 400 ! On my numbers 400 shareholders taking up the maximum SPP would generate the $6M required. This would suggest a significant scaleback is likely.Are my calculations right?

How can you estimate the number of retail shareholders?

Been casting my eye around for opportunities in light of what Jim Rogers had to say and I must say the pickings are rather slim in one of his key sectors: Food.

Having examined several stocks in the food sector it quickly becomes apparent that none are in value at this time (according to my calcs) and most produce very low ROE, barely getting past 10%.

GNC, TGR, GFF and MSF are often mentioned in the news but I can’t see any value in buying them and none crack much more than a 10% ROE. AAC, which his often held up as a buying opportunity, trades at 75% of book value but is on track for a 1% ROE this year if my broker forecasts are correct.

Short of buying a farm ourselves or actively trading futures, both of which are higher risk ventures than well researched common stock, it looks like we may have to leverage off Jim’s other suggestion: resources. Fortunately this is something we are not short of in Australia and there are several high quality companies actively trading on the exchange.

Alas, I will stick to eating (lots) of food rather than investing in it until a suitable opportunity presents itself.

Scotty,

I too have been wondering about the agricultural sector but have failed to find any suitable companies to invest in our market.

Agree Guys,

Nothing is investment quality and cheap.

I saw a piggery (unlisted obviously) recently that sparked some interest.

IPL is best of bread in the sector in my view but it is very expensive.

Hi Scotty.

I concur with your comments on the food industry.

Recently on Switzer, with the focus on increasing food prices over the next decade they had a segment on food stocks to watch.

The stocks were : MSF,GNC,IPL,NUF,WCB,RHL,RIC,AAC,PAG.

I did not find one of investment grade because of Low ROE’s (well below 10% generally),

erratic earings (not a surprise),high debt levels and trading above current IVs.

Looks like I will be getting off the tractor and getting the oil rig out!

Hi Everyone,

I echo a fellow poster sentiments recently about a blog on debt. One thing i would like to know is what is the nature of business debt?

Its so simple but as i have never been in business i don’t know. Is the debt a business will take out based on a variable interest rate, fixed etc. Is there anyway we can find this out? Would it be detailed in the notes to the balance sheet?

Sorry for such a probably obvious question. I just take the easy way out and try to find companys with none but wouldn’t mind knowing either way.

Hi Andrew,

There are no obvious question as such, and we are all happy to help.

It is important to understand the “nature of the business debt” as you have mentioned. When analysing companies, we need to understand what going into the companies (i.e. debt and equity) and what is coming out (i.e. profits).

Generally, the “Borrowings” item on the balance sheet can either be borrowings or finance leases. I think appreciating the difference is important especially when you are analysing companies such as VOC. Just to further ‘confuse’ you, there are off balance sheet financing as well (e.g. operating leases and specific off balance structures)

Regarding the disclosure of fixed or variable interest, there are no specific requirements for companies to make such disclosures. As such, it depends on the management’s willingness to make such disclosure. The starting point is the “Financial Risk Management” note in the annual report. It is a very confusing and complex information but I think you can get the big picture. If you dig deep enough, you may be able to piece some of the information together.

Having prepared the Financial Risk Management note myself in a large company, I can say that it’s probably one of the most difficult note to make sense of.

Bank bill swap rate (bbsw) plus risk factor.

Hey Mr Montgomery, Their is a human error in Your quote of Jim Rogers “If you were smart in 1807 you moved to London, if you were smart in 1709 you moved to New York City, and if you were smart in 2007 you moved to Asia”

The error is in the 1709. Should be 1907.

Many thanks for the pick up Sam.

Hey Ash, whats your thoughts on Acrux (ACR)? Have them listed as a fantastic MQR A1 but not sure if its overvalued/undervalued. Cheers.

Hi Ryan

Beyond my cirle of competence I am afraid

(DCG) is probably one worth having a look at… also Ash have you yet had a chance to look at (NOE), rising debt is a concern

Hi Kevin (and everyone reading this…)

The above comment “(DCG) is probably one worth having a look at” is NOT the type of comment I can publish in future. You must explain your reasons for believing it to be “worth looking at”. Without justification, such comments will not be published.

Hi Kevin,

What Roger says is very important.

I have DCG at slightly expensive.

Re NOE yes you are right the balance sheet is less than prefect but I have decided to put it on watch

Hi Kevin,

Based on 2011 earnings I get DCG as a buy with a 20% MOS for a 10% return.

Ryan

i’ve pasted below a previous blog entry I made about ACR which didn’t gain traction blog-wise. Bear in mind I’m a novice, and not a value.able graduate. Also, I think this company’s profits are currently based on royalties from Lilly and not income per se.

While I believe that ACR is trading at a discount, and it’s IV may rise over the next couple of years, it’s prospects are only bright if doctors start prescribing its products (axiron for testosterone replacement). But as a general practitioner myself, I know how much inertia there is in doctors in changing their prescribing habits. If it ends up being a good quality product and well accepted with minimal side effects, it may go well, but it might take time. Axiron is the only product of ACRs that I am aware of. ACR does have a competitive advantage as axiron is now approved for use in the US/FDA, and will presumably be covered by patents for the first few years. Patients (us) will always prefer a topically applied medication (axiron) rather than a large needle in the bum (current testosterone replacement such as reandron).

Testosterone replacement in men for testosterone deficiency will be a bigger field in medicine in the future, but is still in its early stages of research.

Anyway, my original post…

Hi Everyone/Anyone

A good article Roger- thank you for that.

I guess Acrux would be a reasonable place to start for this blog. Any thoughts on its 2011 IV and current fundamentals?

Roger had it as an A1 in his 16 Dec blog, with a price at the time of $3.53 and a MOS of 12.5%.

My attempts at 2011 IV:

assumptions: RR14% NPAT 40M (I ignored the 2011 forecast NPAT of 70M as this seems to be an anomaly c/w 2012 & 2013 forecasts, and due to a one off payment from Lilly for Axiron). It is also due to pay a uniquely large dividend in 2011.

no. shares 165.5M average EQ- 67.65M EQ/Sh- $0.41 ROE- 59, use 57.5% (I dropped it down one level, although it is probably not sustainable long term at this level) POR- 0.25

IV $4.32, so currently at a reasonable discount to IV

forecast IV for 2012 and 2013 is $4.36 and $5.84 using average EQ (73.2M & 116.5M respectively), RR14, POR .25 and NPAT of 40.8M and 60.8M respectively (see link below for analysts forecasts/figures

So, IV not rising at a rapid clip, but has good growth prospects over the next 5 years, and the analyst stated these figures are conservative.

(LINK REMOVED. RESOURCE NOT FOUND)

Anyone else care to comment?

Matt

Dear Roger,

as an aesthete, a man of culture, and a lover of fine arts I must apologise to your photographer for the unnecessary criticism they have received from the acultural majority on this blog. I think your photographer is a hitherto unearthed genius of the photographic world. The sheer emotion and impact they have captured is truly extraordinary. The dim lighting conditions perfectly capture the grim and uncertain outlook of our economic futures. Having the two subjects, Jim and Roger, staring in different directions perfectly emphasises the crushing reality that in modern investing, even two like minded individuals, with similar outlooks, can still differ in the direction they see the world heading. And the coup de grace, the final cherry on top of an already exquisite composition is the not so subtle but ultimately satisfying addition of a degree of motion blur to the frame. It highlights to us that no matter how hard we squint, or how hard we try, sometimes in life things just aren’t clear. And never will be. Investing is not always sharp and hard edged, with perfectly uniform spreadsheets and figures and bottom lines that will tell us exactly what we need to do. There is always a degree of uncertainty, and ultimately, once we embrace this fact we will be better off in the long run.

BUT, instead of hailing your talented lensman as the new Annie Leibovitz the bloggers on this site are carrying on as if the piccie was taken on a cheap camera phone at the end of the night by a merry fellow reveller who’d had a few too many Noble Ones.

I mean honestly! :)

Hasselblad will never recover! Delightful

I think it was too much Cab, Sav!

Rob

Cab Sav…LOL

Ha Ha, that is fantastic, made me laugh out loud. Very very good

Ah, but then miracles can be achieved with Adobe Photoshop – all images can be rendered lucidly clear and when it comes to investing our matrix of intrinsic valuations ensures that our vocus (sic focus) portfolio forges ahead in-value and becomes in-value.able.

Hi everyone,

I have a question about required return. Alot of discussion is around 12% for a certain company or 14% for another. I assume the RR includes a few parts; a risk free component plus a premium for risk of a particular equity (or as Roger’s book mentions growth plus real return plus equity premium).

So when applying say 14% RR to particular companies under current conditions, if interest rates suddenly went up 2% tomorrow how do you factor this in? 16% RR?

thanks, Matt

Hi Matt,

“That gets to the first of the economic variables that affect stock prices –interest rates. In economics, interest rates act as gravity behaves in the physical world. At all times, in all markets, in all parts of the world, the tiniest change in rates changes the value of every financial asset. You see that clearly with the fluctuating prices of bonds. But the rule applies as well to farmland, oil reserves, stocks, and every other financial asset. And the effects can be huge on values. If interest rates are, say, 13%, the present value of a dollar that you’re going to receive in the future from an investment is not nearly as high as the present value of a dollar if rates are 4%.”

Hi Matt & Roger,

Well said Roger.

Personally I did not get this theme until I read Warren Buffets 1999 Fortune Magazine article. I have posted this before but for the New Grads and undergrads here it is again

http://money.cnn.com/magazines/fortune/fortune_archive/1999/11/22/269071/index.htm

Thanks Ash,

If we project the themes of that article what do we get currently? The interest rate cycle is up, corporate profits are mixed but must go down if interest rates go up? How confusing. And cash in the bank is a burden! Its harder doing nothing than something for me now. Thanks for the posting. I like Buffets quote; ” The Tinker Bell approach–clap if you believe–just won’t cut it.”

Hi Punchy,

I think we are going to look alot like the 1970’s and if you can’t pick stocks you should be somewhere else.

Just my view

Thanks for the comments and article.

Hi All

What is a good book to read regarding commodities, and where to invest in order to take advantage of the rising AUD?

I think Jim Rogers has a book called “Hot Commodities”. Is that correct?

Thanks

great book – a must read!!

Hot commodities is a great read. However you should also look into the reasons why the aud is currently strong. Both the aud and commodities are rising for for similar reasons and there is a some overlap.

Hi Steve,

The $A has an extremely high corelation to commodity prices. If you think commodity prices will continue to rise then the $A will continue to rise.

To pharaphrase Jim himself

If you think the world economies will recover then you should own commodities because there is a shortage. I you don’t think world ecenomies will recover the commodities are the place to be because they will just print more money.

As both Roger and Jim frequently say. It won’t go up in a straight line and there will be setbacks along the way

Ash,

You said it very nicely. Commodities if its good and commodities if its bad.

Hi Steve

I stumpled on the article today. I thought you might like it. Written the Englands telegraph

Aussie dollar boosted by its own ‘gold standard’

“The Australian dollar is one of the strongest currencies in the world because it is a commodity-backed currency. That’s why it hit a 29-year high against the US dollar today – and it’s all related to the gold price.

The gold in Australia’s ground acts as ‘gold standard’. By Garry White 10:44AM BST 08 Apr 2011

The gold price is hitting new all-time highs on a daily basis because many investors have lost faith in paper money. They believe that central bank printing presses are devaluing currencies on a daily basis.

It is the same lack of belief in paper money that has been boosting the Aussie dollar. Paper money used to be backed by gold held in a central bank, but this was abandoned all over the world, allowing central banks to print money via processes such as quantitative easing.

Today, no currency in the world is on the gold standard – all money is “fiat” money.

However, Australia has significant resources of gold, uranium, iron ore, coal and many other important and valuable commodities. They are in the ground, not in a central bank, but this is the nearest thing the world has to the old gold standard. That’s why the Australian currency is so strong.

The same is also true of currencies in Canada, South Africa and Russia. They are effectively backed by commodities in the ground.

We are in the middle of a commodities supercycle, fuelled by an awakening China. However, the mining industry is cyclical – and commodity prices will eventually fall.

When this happens the Aussie dollar is likely to fall. In 1986, when the oil price tumbled to $10 a barrel, the shock for Saudi Arabia was significant. But Australia’s strength s the diversity of raw materials it possesses.

Commodity prices will fall – and the Aussie dollar along with it. But it won’t be for some time yet”

Thanks Ash for that article. Sums up the AU$/commodity situation very elegantly.

After the death of the gold standard and before the birth of the IMF, John Maynard Keynes and Ben Graham enjoyed a lively correspondence in which they agreed that a “multiple commodity currency” might work as the currency standard for the new system. That was before they had to plumb for the (then gold-backed) US dollar reserve currency. Jim Grant observes that currency systems last about 40-50 years. Time for a change, and I reckon JMK & BG’s idea is the one whose time might have come. Hence, I think I’ll stick with BHP, which just might become the world’s reserve currency. (For this reason, I didn’t even mind when they had a go at buying Potash.)

Brian,

Although this concept sounds good in theory, history shows that all fiat currency systems fail as governments take advantages of monetary inflation.

Let’s say BHP was an alternative. Eventually they would have management that would be irresponsible and they would issue excessive shares to pay for their overspending.

Precious metals are the alternative currency that cannot be printed and have true store of value for long term stabililty. Replacing one fiat currency for a basket of other fiat currencies only repeats past mistakes. However it is probably something that is on the agenda right now.

Ash,

Thanks for the reference. I agree 100%.

The only rock in the road will be our private debt (mortgage) and how this plays out. If it breaks and the RBA steps in and decides to print like US and UK then our currency falls. If it doesn’t play out then it’s strong through this cycle. I guess it’s exactly the same situation as Canada – very similar.

Hi Steve,

The problem I see coming is that the inflation that is building around the world can’t be stoped by central banks. The RBA will just keep raising rates and as you say this may bust the mortgage debt bubble.

As you hint out central banks around the world have a much harder task ahead than they had for the previous 10 or 20 years

Ash,

You are spot on. I can’t see high inflation without high interest rates somewhere.

If the RBA keeps rates too low then it will make it worse. However if they keep on raising rates there is bound to be public backlash. I wouldn’t want that job.

Thank that was a camera phone shot!!

Is there a decent Jim Rogers website? I’ve searched but only found sites that have one or two line “sound bites” or headlines.

Dave

Haven’t found one that beats talking to him.

I would love to give him a call. Can you email me his phone number? :)

John your humour balances the distaste of the gloat. Well done.

Roger It’s your blog and you’re obviously free to do as you choose, but my opinion if you choose to consider it, is that the content is slipping to an extent that there’s too much gravel to justify sifting for the gems anymore. I’m about ready to vote with my feet (eyeballs)

The balance between your brand image and education on the blog feels like it has swung too far away from education. The pack of seagulls around the back of the boat is a symptom that the emphasis seems to have changed from discussing how to fish to throwing fish scraps.

Hi Gavin,

Agree in many respects. I am onto it. Thank you for the feedback. I have already submitted the next Eureka column for tonight and the heading sent to the subeditor was “Back to the Classroom”. It is really good of you to take the time to let me know. I have been very concerned that there was little research going on. That of course is not true of everyone. I am delighted to see so much discussion about industry prospects (retail), required return establishment and quality assessment going on here at the blog.

Nice one John!

Ahlough I think be is pretty open with his views in his interviews. Go long rice!

Dave, you can go to Google video and search all his interviews in the past couple of years.

Just fantastic Roger, his predictions have been right on the mark and what a great picture. I have always struggled with the idea of futures to take advantage of these commodity movements, so I will be looking for great companies at discounts to intrinsic value in the right areas. If we combine your valuable approach with Jim’s foresight on the commodity boom our odds of doing well will be increased greatly. We really are in the lucky country.

Brad, i have a prediction also:

sometime in the next decade, the ASX200 will be a lot higher than it is today! and so will everything else that is being valued by paper money (cotton in the US) while that paper (cotton) is being printed endlessly!

the real art in my opinion, is to find companies that leverage off that, and thats why i admire roger Montgomery and his insights into these companies. Jim Rogers has proven himself and made a lot of money, but if im not mistaken, he did that with George soros by betting against currencies big time!

think about it – oil going to $200 in 10 years from now is about 6% return pa compounded from today. thats not a great investment at all. but investing in matrix for example, can leverage you substantially to this trend.

but maybe if you leverage oil futures with some CFD or whatever (high risk) you can earn a better return….

Hi Ron,

Looks like we have exactly the same strategy.

Also want to thank you for your excellent insights and company recommendations. If I am not mistaken you were one of the first (if not the first) to mention VOC, which I believe is the best opportunity since MCE. Hopefully there is some profit taking soon so I can get in and buy more.

In the last three months I have made up a large loss from a portfolio managed by my ex broker over two years and gained substantially after making up for this loss. The broker portfolio was in the big name blue chips which are mean’t to be safe. I have a long way to go as I have lost valuable opportunities but I will continue to put the time in and use this approach.

Just on another note, I put most of my money into the companies I like best. I don’t believe in being overly diversified however some diversification is good as Roger has mentioned previously. Go value investing. Thanks Ron, Ash, Steve, Scott and all the other valuable grads and of course especially Roger.

Hi Brad,

I agree

I now own 6 stocks

Mae west says too much of a good thing is wonderful

Ash,

I have 6 stocks too! I have no need for more at this point in time.

Hi Ash and Steve,

Yep I think 6 is about right. Mind you I have to admit that I am heavily weighted to my top three companies.

Yep

MCE FGE & VOV that my biggest holding

I got two of those Ash. I only hold 4 stocks. I’m on the sidelines waiting for a business to put some of my cash reserve into. I didn’t swing on VOC and RMS. I have not found anything worth buying in recent weeks. Work has been too busy to put the research into it and I won’t just follow Roger into a stock.

Hi Ash,

I have your problem too – i think you meant VOC and not VOV. My index finger often finds the cracks!!

David Martin

Hi brad, I don’t think I ever recommended specific companies, I just mentioned ones I think have potential. Also big difference between mentioning something and writing an in depth review about it, which is exactly what Roger did. Credit should go to Roger, his insights and most of all his amazing book!

(but thanx anyway)

Hi Ron,

Yep, Roger has an amazing ability of explaining and understanding opportunities. When I first looked at VOC I passed it by as I just didn’t understand it until I read Rogers article. Roger has trained us well and there is no doubt in my mind he is the best there is. The WB of Aust.

Except that oil could be $200 within 1 to 2 years.

Hi Steve, yes there is a good chance of this. I personally will just stick to companies like MCE as I understand them a lot better and they will benefit from higher oil prices, but will more than likely do well regardless. As WB has said, one of the most important things in investing is to stick to what you understand.

Who knows, I may in the future decide to trade specific commodities, but would need to do a lot more work on futures first. In fact if anyone knows of a good book I can read or a course I can do in this area, it would be greatly appreciated.

Also worth noting, if the oil price did go up to $200 and the AUD went up by 35% to around $1.40US we need to take this off our overall return assuming they both got to these levels within the same time period. Still a great return but not as good. Worth investing in directly but not for me at this stage until I get more knowledge under my belt.

I am also a big JR fan and have been watching him for a long time. I will use his insights to look for companies in the right space as I know you are doing from your previous posts.

Brad,

I agree that investing only in the areas that you understand and therefore have conviction in is the key. Any uncertainty and severely cloud sound investment principles.

I don’t trade (only invest in companies at a discount to IV) but will probably do it for fun when I’ve made too much money from value investing and have some spare change to lose!

I think that we are living in very interesting times (seems we are a bit buffered living in aus atm) and this has massive implications on all forms of investment. Therefore I personally try to match this with the value principles from Roger (thanks Roger!) and, as you say, invest in the right sectors.

For example, why not invest in companies hat have leverage to the oil price but trade at a discount to IV even with lower prices. It’s a win win from my perspective and a pretty safe approach if done well.

Hi Steve,

Exactly and this is why this blog is so powerful. A group of like minded investors discussing opportunities based on the same value process.

I recommend to read the book “The prize – the epic quest for oil, money and power” by Daniel Yergin if you have time to read this 773+ page book. It may not sound relevant to value investment here, but this book gives a powerful story of the role oil played in the industrializaton of Europe, the US and Japan. Not to mention the games played by the large multinational corporations (andtheir governments) to secure oil concessions in Iraq, Saudi Arabia, Iran, etc… Linking this to Roger’s January 13 post, I have a feeling that oil will be a big theme in the next decade or so as China and India continue growing. Most of you have already started seeing the benefits of this through, for example, MCE, or if you were luck enough to get in on time ZGL, etc… There is probably much more to come.

Regards,

Yavuz

Yavuz,

Thanks for the mention. I haven’t read this book but have heard about it and follow the topic. I think that any who have the time spare should have a look.

The call of Aussie 1.40 is actually believable. Will be interesting to see how it goes. Jim Rogers is fantastic at seeing the bigger picture.

As well as seeing the big picture he’s also pretty good at seeing the camera taking his photo. Unlike Roger!

Sav,

I enjoyed reading your comment. Had a great chuckle.

Gee Roger…. in another blog you said you were awaiting photos from a professional photographer. Maybe you want to ask for a refund?

Still waiting Tony…

If the Aussie goes to $1.40 against the USD, MCE is in alot of trouble – it exports about 80% of its sales. It has some hedging in place that will cover for this short term. This though is a risk for MCE and other exporters or companies with significant overseas operations.

Nothing happens in a straight line. I am sure the implication isn’t a jump in the next year or even two.

Although it’s on it’s way there right now. $1.05 usd last night. Silver is on fire. Usd index breaking down. Interesting times!

several months ago i posted a link on rogers facebook page to a guy who sold his house put all his money into silver around $10-15. at the time of posting the link silver was $25. now its almost $40.

check out that link its really interesting read – it explains how the silver market works!

Michael,

You should also consider that in the long run, MCE can strategically respond to rising AUD. For example, increasing prices or change some expenses to USD to ‘naturally hedge’ it’s revenue.

I was previously working in a large corporate treasury and my view is that hedging via derivative is always meant to be a short term solution. In the long run, the business has to response strategically if they are concern over a long term trend in market risk.

Great insight Joab. Thank you for sharing.

Also,

The ultimate test of competitve advantage.

Can they raise prices?

Awesome roger, I’m so jealous!!!

I agree Ron,

JR is a champion.

Roger

Hmmm I might need glasses you look out of focus.

Has Jim established an ETF? If so where can I read about it?

Do you look at FCF yield when assessing businesses?

Thanks DC

Hi David,

Mr Rogers has two funds. The first fund is a pure commodity play with oil gold wheat etc in it. The second are 200(I think don’t quote me) businesses around the world that have or produce the real assets (commodities) in the first fund.

I have no clue how to invest in these funds as they are in us dollars and my personal belief is that the $A will continue to rise offsetting a fair portion of the potential gain.

Hope this helps

Congratulations Roger,

What a great opportunity.

Food, energy, precious metals… says it all

Congratulations Roger,

What a great opportunity.

Food, energy, precious metals… says it all

That would have been a wonderful experience Roger. Jim is one of my most revered investment gurus ever, up there with you and WB.

Thanks for passing on Jim’s thoughts. I must ask, how the the 2001 Noble One?

I must say, it will be hard to top the photo with Jim Rogers on the Value.Able’s photo hall of fame.