Is Dick Smith’s float one to watch?

Last week’s Freelancer (FLN) IPO marked the 73rd ASX listing this calendar year. We have steadily grown more and more skeptical at the speed many businesses are being brought to market in the pre-Christmas rush.

Given a somewhat fully valued listed market, new IPOs have been labelled as the ‘only game left in town’ and we have witnessed incredible demand for what we would class as B or C grade businesses.

And with new valuation metrics such as EV/Sales (or anything else that can be quantified), not EV/Cash Flow or even EV/Earnings being marketed as reasons why companies should trade at lofty multiples, we certainly think that now is not the time investors should be throwing caution to the wind.

This goes for the upcoming float of Dick Smith Electronics (DSE), given:

• Anchorage Capital paid $94m for the business from Woolworths (WOW) just 12 months ago and is floating it for $520m.

• The well-published challenges WOW experienced with the business – and they are some of the best retailers in the country.

• After comparing some basic financial metrics to the number one Australian electronics retailer in JB Hi Fi and uncovering that it generates lower returns on capital, generates lower profit margins and materially lower revenues from a larger number of stores (smaller format).

This by itself is enough to put us off opening the prospectus and risk wasting our time undertaking hours of research. But not so fast.

Putting aside initial biases and instead digging further and talking with management, here are a few things to note:

• Whilst Anchorage capital is selling a meaningful portion of its stake, it will retain 20% with management and key staff, including the new CEO, also holding a further 5%. This provides comfort that they haven’t stripped the business completely bare for the IPO.

• Dick Smith’s new CEO spent 24 years at Myer and has built up a significant level of retailing and managerial experience. A history of long tenure and skin in the game generally results in corporate alignment, and hopefully, many years of sustainable growth.

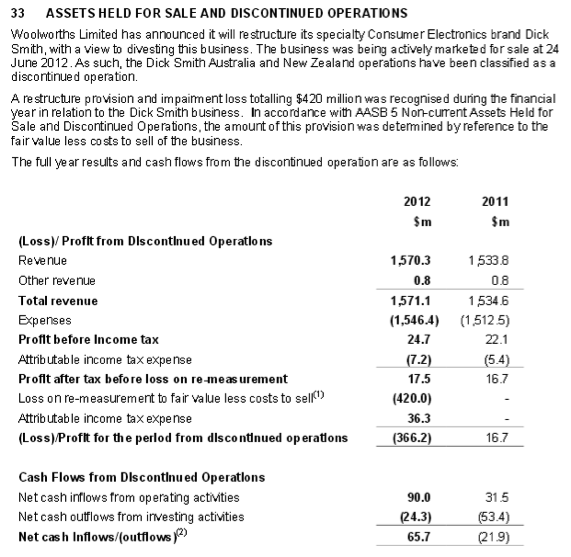

• After trawling through a number of Woolworths’ past annual reports, we discovered that it had written off the carrying value of Dick Smiths by $420m just prior to it being sold.

• This carrying value was justified by the firm’s auditors given it was earning ~$17m NPAT, as shown below:

• Under Anchorage Capital control, the business has boosted NPAT from $7m in 2013 (an abnormal year given heavy restructuring) to a forecast NPAT of $40m. This suggests to us that a proposed $520m market cap upon listing is not overly aggressive, and compares with the $420m valuation write-down.

• Under WOW control, ~17m NPAT on ~$1,550b sales translated into NPAT margins of 1.1%.

• Assuming the $40m forecast NPAT is achieved by current management, this would mean a margin of 3.2% which compares to JB Hi Fi’s (JBH) 2013 NPAT margin of 3.5%.

• Given this margin is in-line with industry best practice, it appears sustainable and not necessarily dressed up for sale. Indeed, these numbers are indicative of the remarkable and major turnaround that has been achieved since acquisition from WOW in November 2012.

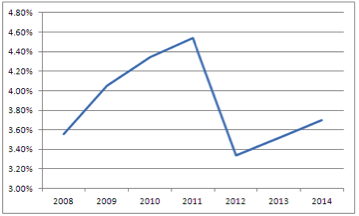

• In comparison, JBH margins since 2008 are as follows:

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

| Sales | 1830 | 2330 | 2730 | 2960 | 3130 | 3310 |

| NPAT | 65.1 | 94.4 | 118.7 | 134.4 | 104.6 | 116.4 |

| Margin | 3.56% | 4.05% | 4.35% | 4.54% | 3.34% | 3.52% |

• We note that in 2012, WOW management aggressively sold down Dick Smith stock and raised cash prior to its sale. This ‘fire sale’ caused intense market dislocation, putting JB Hi Fi’s margins under pressure. Since then, JBH margins are back on the rise as companies including Dick Smith have operated more rationally.

• In terms of future growth, whilst Dick Smith’s store rollout program is not as exciting as other retailers, the business’s turnaround is still in its early stages and a new concept store is being rolled out. This is coupled with positive like for like (LFL) sales in the retailing industry at present and positive tailwinds for the business’s top-line. Indeed management is expecting 2% sales growth.

• And whilst an aggressive sharpening of the cost base has taken place, new efficiency measures are still planned, and we expect costs savings to continue over the next two years.

• We would therefore anticipate that if Dick Smith can again begin to grow its sales line while improving its business efficiency, margins should improve further. Hence, profitability in future years will rise. As we know, in the longer term, shares prices follow earnings.

In Dick Smith, what appeared at first glance to be something of on an ugly duckling is actually a solid, well-established business with an invigorated management team and a clear strategy for the future.

Sure, it’s unlikely the business will be able generate the scale benefits and profitability of JBH, but given the pricing of the float at 13x forecast earnings vs JBH at 17x, we believe that discount is supportive.

We are more comfortable with the business, its earnings and hence its upcoming IPO post our review. And this was only reinforced when we also met with management. Despite these positives however, a lack of value has prevented us from participating.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hello I am the shift manager at dick Smith Townsville castle town. I am number 2 sales person in the region and worked with passion n drive through the Christmas period. We had enough staff and people were absolutely willing to wait in line considering the rush!! 99%… As a team we are efficient and yes less staff drives multitasking and with the right staff it was more than manageable.

I had a similar experience to ScottT when visiting Dick Smith’s at Brookvale. No staff member came near me in the 10min I was in the store. In fact the one staff member I could see was busy with another customer the whole time. I then went to Bing Lee and purchased the product I was after.

Telling.

Roger, I have also heard some mention that it is possible the Dick Smith business has been engaging in one of the older tricks in the retail book, by aggressively marking down inventory (on initial purchase of the business from WOW) and then when that inventory sells in the subsequent accounting period taking a profit. However, this still results in only selling inventory for 50c in the dollar – not a good long term recipe. Based on your review I am assuming this is not a risk / concern based on your meeting with management and investigation?

We aren’t participating in this float Paul.

Hi Roger, I understood from the other comments that you weren’t participating. What I was curious about was whether in your investigations did you come across anything suggesting the practice of writing off in one period and then taking a gain in a second period was occurring at Dick Smith? Obviously you might not want to comment on that as it relates to management / vendor integrity.

Thanks Paul.

Hi Russell, I was extremely dissapointed with my visit to Dick Smith today (22/11/13) I think they have improved their profitability by stripping staff out. Dick Smith Westfield Hornsby, 12noon. 9 Customers lined up to pay, one staff member, and he was on the phone. (Granted he was trying to multitask). People were giving up, it is easy to cut costs too far.

All the best

Scott T

Thats interesting Scott

On principle alone I hope your fund does not participate

Thanks Terry. We have decided the safety margin is marginal on this.