Is a tsunami about to hit Aussie retailers?

In April, Amazon sent a wave of fear through retailers when it confirmed its intention to launch in Australia. Leading retailer, Gerry Harvey, described Amazon as the “Attila the Hun” of the retail world. To be sure, Amazon’s arrival will pose a massive threat. But there are other challenges on the horizon for retailers – and investors.

As readers know well by now, at Montgomery we are very cautious on the retail sector. And it’s not just because of Amazon. We see four big reasons to be wary:

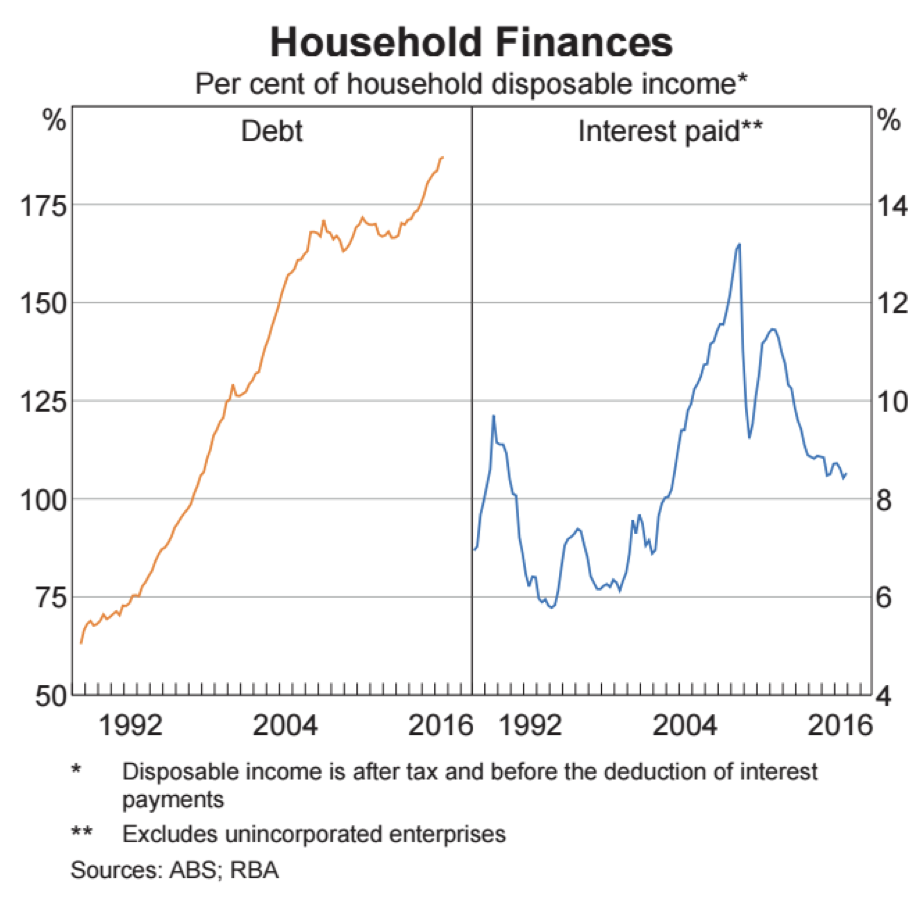

1. The Australian consumer is currently very leveraged on the back of the steep run-up in property prices. And as our readers will know, we are very pessimistic on the domestic property market and if we were to see a correction in the housing market, we believe that this could have a significant impact on consumers’ willingness (and ability) to spend money. As can be seen from the chart below from RBA, the Australian households have gone on a debt binge driven by falling interest rates. Although the low interest rates have meant that the running cost of this borrowing (the interest paid annually) has not increased, the recently announced bank levy on the 5 major banks will, as we wrote on the 25th of May, together with the recently announced credit downgrade by S&P for 23 smaller Australian banks, probably lead to higher interest costs for households.

2. There are signs of inflation picking up, particularly from higher energy prices. Wholesale electricity prices are up significantly over the last year on the back of the well-publicised gas shortages on the east coast, and this is starting to filter through to retail prices (Recently, I got a notice from my electricity retailer that they are going to raise prices by 14% – tip: it pays off to shop around and move to another retailer if this happens to you!) and the recent decision from the Federal Court to uphold the ACCC’s decision on network tariffs will lead to an increase of about $100 per year for NSW and ACT energy users (the increase will be phased over a number of years). Higher costs for necessities like electricity mean that consumers will have less to spend on other goods.

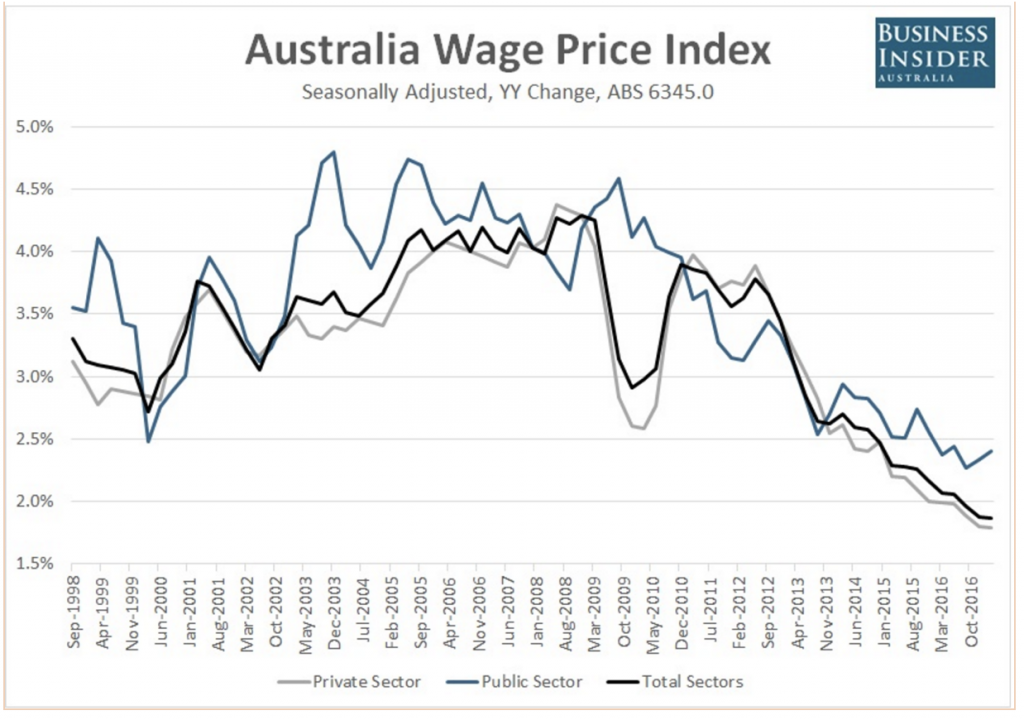

3. Real wage growth is showing no signs of picking up to compensate for increased costs as the following chart (published by Business Insider with data from RBA) shows.

4. Amazon’s upcoming entry into the Australian market place will, we think, have a significant impact on retailer margins and growth prospects. We have written extensively about this before (see for example here, here, here and here.)

4. Amazon’s upcoming entry into the Australian market place will, we think, have a significant impact on retailer margins and growth prospects. We have written extensively about this before (see for example here, here, here and here.)

We note with interest that several investment banks analysts are agreeing with us. In the last couple of weeks, we have seen significant downgrades to forecasted earnings and to recommendations. For example:

- On the 25th of May, JP Morgan downgraded their 2019 forecast for Harvey Norman, JB HiFi, Myer and Super Retail Group by between 12-30%, and moved their recommendation to Underweight on all these stocks based on the risk to consumer spending combined with Amazon’s entry.

- On the 10th of May, Citigroup downgraded their long term earnings forecast for JB HiFi and Harvey Norman by around 30-40% per year after having had a good look at what happened in other countries after Amazon entered.

These downgrades followed a note on the 17th of March by Credit Suisse analysing the potential impact of Amazon entering the Australian market. The note highlighted that it could impact profitability for JB HiFi, Harvey Norman, Super Retail Group, Myers and Premier Investments by up to 55% in 2022 in the worst case scenario but likely somewhere around 20-30%. Credit Suisse has not formally put out these numbers in their published forecasts but we suspect this will soon eventuate.

Share prices have started to come down (JB HiFi is down 27% since its peak in September 2016 and Harvey Norman is down 32% in the same period) and the headline valuations on near term forecasts are starting to look cheap compared to history but both a consumer slowdown and the Amazon threat will play out over quite a few years to come and hence we believe that current earnings are not sustainable and longer term valuation is much less attractive.

At Montgomery, we retain our view that Australian retail companies and, in particular, electronic and apparel retailers, are not companies we want to put our money into and hence we plan to stay well clear of this space.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

What is your opinion on the position of Harvey Norman and the benefit of their property portfolio.

The property adjusted valuation of HVN is currently 6-7x P/E. Do believe the headwinds to retail are will be so catastrophic that at 6-7x P/E still do not present an attractive valuation and sufficient margin of error?

Hi Andre,

It is correct that some brands control their prices globally but others do not (if you see the blog post I wrote on the 15th of May, you will see a good example of some products where this is clearly the case and Apple and Microsoft for example has mandated a global price so Australian prices and US prices are more or less the same).

What I think will happen is that some brands will not mandate the selling prices and hence Amazon can sell these products for a much more attractive price than the ones who do mandate selling prices. The “cheap” products will gain market share and the “expensive” will have to follow down or focus on being a premium priced product with lower volume. This is to some extent already happening in the existing retailers in Australia but what Amazon adds is a more sofisticated pricing engine that is fully optimised to deliver maximum market share to Amazon rather than to give maximum margins overall.

My feeling is that some other brands that control selling proice will have to give in due to Amazon and that some will be able to continue the country pricing strategy but that the ones who will be able to do so are the ones that offer a clearly premium product compared to competition (and with enough consumer being prepared to pay the premium). Think Bang & Olufsen and similar products.

Andreas, Do you have any indication how Amazon will manage the issues of country pricing strategy from market leading manufacturers? For example I am a regular buyer of running shoes but they are more than twice the price of the same shoes in the US. A similar story is repeated with electronic items. I would be surprised if these manufacturers are willing to kill the golden goose when it comes to the increased margins that they enjoy in Australia