How diverse is your super or SMSF investment portfolio?

Here at Montgomery, investors often ask us if it is a wise idea for them to invest all their superannuation savings into our funds. Unfortunately, we cannot provide personal advice however, we thought it may be useful to outline some of the basic principles of investment diversification – and how it might be applied to your superannuation investment portfolio.

We have all heard the old adage – “don’t put all your eggs in one basket”. Well, investing with your superannuation money is no different.

There are steps investors can take to minimise their exposure to volatility and market setbacks. One of the most important considerations is to apply the principles of diversification, or spreading your money across a range of assets rather than sticking with one type of investment.

By not putting all your eggs in one basket, you reduce the impact of losses on your overall portfolio. However, investors should bear in mind that a diversified approach will also limit the potential for gains from the rise in a single investment’s value.

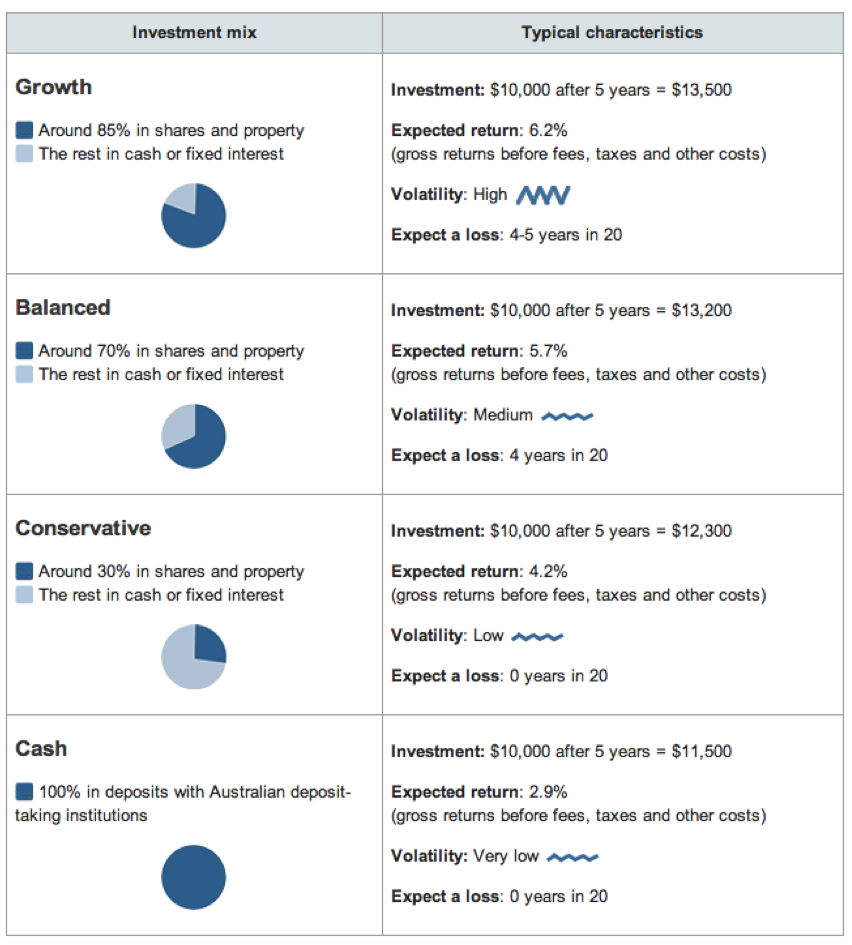

The goal of diversification is not to boost performance—it won’t ensure gains or guarantee against losses. But once you choose to target a level of risk based on your goals, time horizon, and tolerance for volatility, diversification may provide the potential to improve returns for that level of risk. ASIC’s Smart Money website provides a simple guide to what basic asset allocation exposures are expected to deliver over the next 5 years, as illustrated in Table 1.

To build a diversified portfolio, you should look for assets—stocks, bonds, cash, or others—whose returns haven’t historically moved in the same direction, and, ideally, assets whose returns typically move in opposite directions. This way, even if a portion of your portfolio is declining, the rest of your portfolio, hopefully, is growing. Thus, you can potentially offset some of the impact of poor performance on your overall portfolio.

Another important aspect of building a well-diversified portfolio is that you try to stay diversified within each type of investment or asset class.

Within your individual stock holdings, beware of overconcentration in a single stock. For example, you may not want one stock to make up more than 5 per cent of your stock portfolio. It can also make sense to diversify across stocks by market capitalization (small, mid, and large caps), sectors, and geography (Australia & Global).

Once you have a target mix, you need to keep it on track with periodic checkups and rebalancing. If you don’t rebalance, a good run in stocks could leave your portfolio with a risk level that is inconsistent with your goal and strategy.

It is pretty basic stuff, and most people have heard of it.

But, do all investors take the time to ensure that their super and investment portfolios are properly diversified?

The most recent ATO SMSF report on asset allocation reveals that an average SMSF has approximately 35 per cent of its assets invested in Australian direct listed securities, 25 per cent in cash, and only 9 per cent in overseas assets. Anecdotal evidence also suggests that many super funds are also heavily exposed to the traditional ‘blue chips’ that are familiar to most, and have historically given a solid, fully franked yield. Common examples include the big four banks, as well as companies like Telstra (TLS), CSL Limited (CSL), Woolworths (WOW), Wesfarmers (WES), Rio Tinto (RIO) and BHP Billiton (BHP).

Although this strategy had worked well in the past, it has definitely been a different story recently – especially in the face of falling bank profit margins, events like BHP’s recent woes, and the extremely competitive landscape in the supermarket space.

For most Australian investors, the path towards successful diversification lies in looking outside of the traditionally popular blue chip stocks – and in some instances the ASX entirely. There are many smaller companies who have bright prospects, and are not even in the top 50 ASX listed companies (but may be one day). However, it can be daunting to make a decision on any new investment. And considering that there are over 2,210 shares on the ASX, and 13,000 on the other major western stock markets… Where do you start?

One solution may be to outsource some of your portfolio management to a professional active fund manager. By outsourcing some of your investment management, you are effectively buying a small portion of a larger portfolio of individual stocks – thereby diversifying your wider holdings.

Investing with an active fund manager allows you to harness their knowledge and analytical resources, to potentially out-perform the relevant market while providing a level of diversification for part, or your entire investment portfolio. Ideally you will invest into a fund that covers an area of the market you don’t already have exposure to.

Table 1. Source: ASIC Money Smart

Source: ASIC Money Smart

For those investors who have their super in a large industry fund, we observe that while there is usually excellent asset class diversification, there is often over diversification in the underlying asset classes. It is common for five or more fund managers to be used in each asset class, which can result in an overall exposure of a couple of hundred or more underlying securities. Although the fund may be spread across different markets, the underlying stock portfolio usually closely resembles the broader index for that market – which leads to a pre-disposition to larger stocks. It’s similar to buying an index fund, the pitfalls of which have been mentioned previously on this blog.

Allocating a portion of your super account balance to an active fund manager is a simple way to diversify. However, before choosing a fund manager you should carefully consider their investment philosophy and their investment universe (i.e. the sectors/markets they will focus on) to make sure you are comfortable with the way they will manage your money, and whether it is a good fit for your overall super strategy.

We offer multiple funds here at Montgomery that may help you diversify your super investments.

You can invest your super into Montgomery funds with, or without an SMSF. No matter what your current superannuation structure is, we can help you to find a suitable option to diversify your super investment portfolio.

Scott Phillips is the Head of Distribution of Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

One element of diversification is to invest in local and international shares. What are Montgomery’s attitude to the proportions that a Growth Mix portfolio should hold. Where is the greater growth likely to come from?

Hi John,

We aren’t financial advisers so can’t really comment specifically. The right mix not only depends on an assessment of the alternative’s prospects but also on your personal circumstances and future needs. That’s the domain of a personal professional advisor.

Thanks Roger. I am invested in The Montgomery Fund, The Global Fund and The Montaka Fund. My question is: Which of these do you expect to perform the best in the 2016 calendar year.

Hi John,

I cannot possibly say. We do believe that there will be heightened volatility this year and that it will provide opportunities for all our funds either through being able to deploy relative high current levels of cash, or through shorting in Montaka and the Montaka Global Access funds.

Hi Scott,

Happy new year to you and the team at Montgomery.

How would an individual go about investing super in the Montgomery funds without an SMSF?

Hi Oscar,

Many people don’t realise that you can very easily access The Montgomery Fund via your personal super (so non-SMSF) if you go through a Super wrap platform. Some platforms have to be accessed by going through a financial adviser but some like netwealth allow you to invest directly. We actually have a link on our website which explores how you can do this. As always please make sure you consider any financial product for your own individual circumstances.

http://www.montinvest.com/tmf/personalsuper

Thanks for that information Scott. Can I invest in the Montgomery global and Montaka GAF through Netwealth?

Hi Peter – thanks for your question. Unfortunately, at the moment netwealth only makes The Montgomery Fund available for investors in their Super and Pension offering. Hopefully, over the the course of 2016 they will also add the Montgomery Global and Montaka Global Access Funds to their menu. Please feel free to contact netwealth directly to express your desire to see these strategies on their menu.