How China’s debt bubble could hurt Australia

Willem Buiter is the highly respected Chief Economist at Citigroup, and when he speaks, people tend to listen. Last week, in an interview with the ABC, Buiter sounded a strong warning about China’s debt bubble, and the ramifications for Australia.

Here are a few of the points he made:

1. No country has ever had a debt problem, both the level of debt to GDP and the increase (in debt) since 2008 – and an excess capacity problem of the magnitude that China has – and has been able to work its way out with debt restructuring and excess capacity elimination without at least a cyclical downturn.

2. Sometime in 2018 we could see an attempt at more aggressive debt restructuring and capacity elimination (in China). Expect a stronger cyclical downturn in the second half of 2018/2019.

3. Of all the advanced economies, Australia is most dependent on China. A stronger cyclical downturn in China would hurt Australia. Authorities must be willing to let the (Australian dollar) exchange rate go.

4. Australia will need a long list at the Federal, State and local level of shovel-ready infrastructure projects where all the environmental impact assessments have been done, all the NIMBY issues have been settled and which are only waiting for a “Yes” and the money; and that, apparently, has not been achieved.

5. Australian household debt at a record high is a serious concern. At the end of a housing bubble and a major construction boom, house prices are likely to fall rather than rise from here. The price of excessive leverage is painful deleveraging. Buiter says he has never seen a household bubble and a household leverage boom like the one in Australia, and indeed Canada, that did not end in a bust.

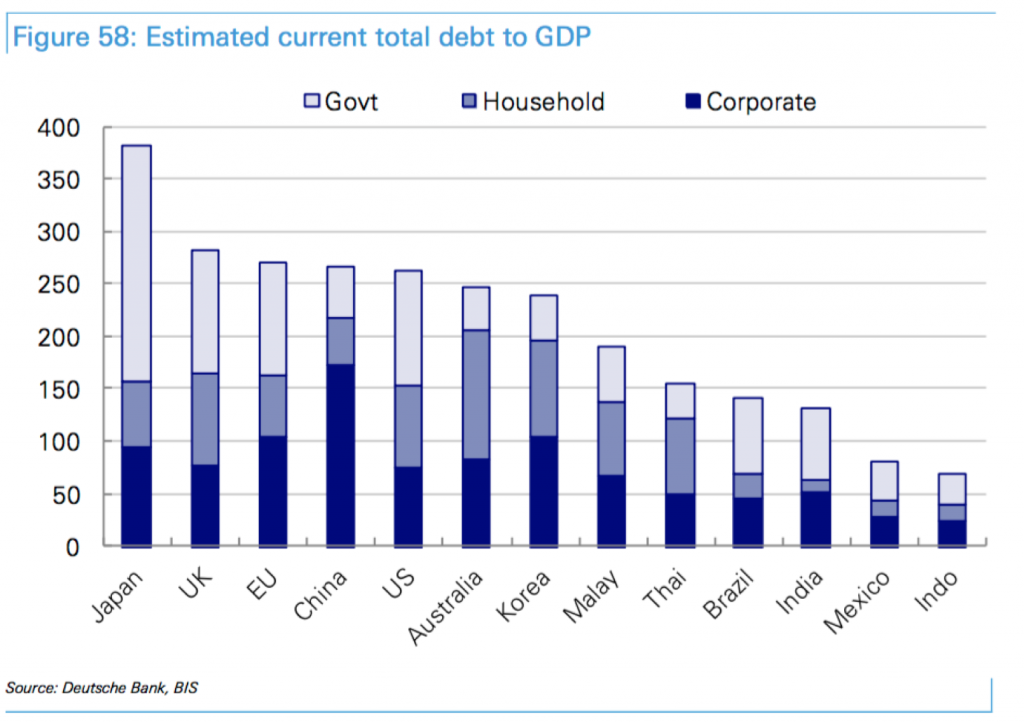

And here are some tables, care of Deutsche Bank and the Bank of International Settlement, which may give some context. China’s debt to GDP ratio is expected to exceed 300 per cent in the next few years.

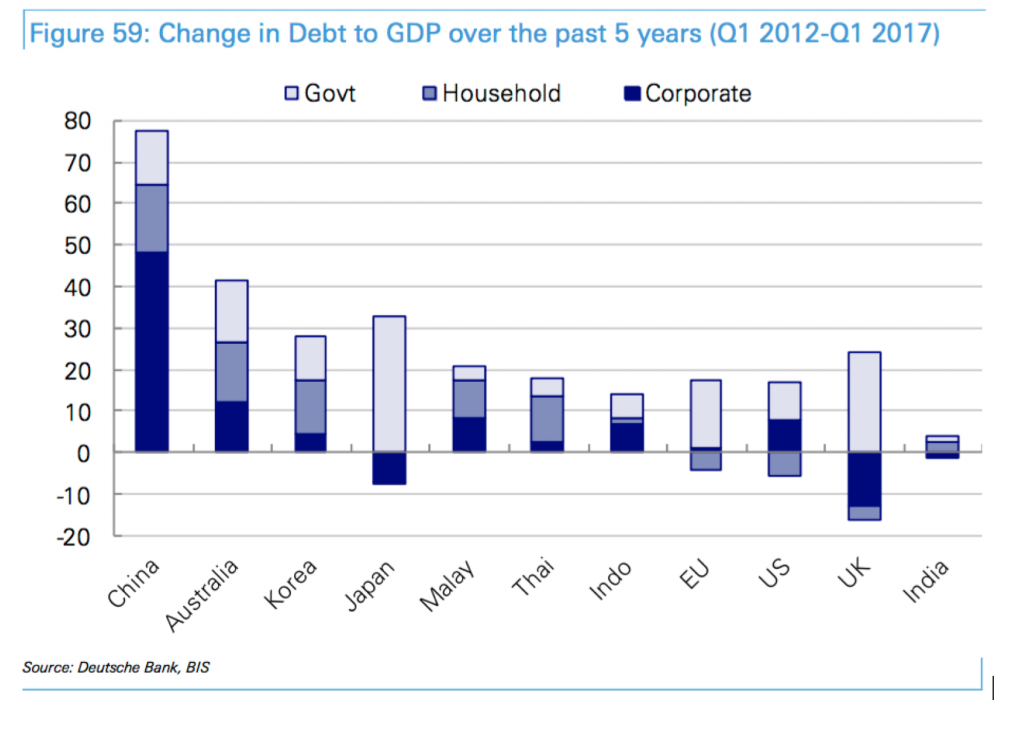

With debt levels, it is often the rate of change that matters, and China is a standout in the change in debt/GDP over the past five years with an 80 per cent increase.

Totally agree David. With China posting a 6.9% GDP print people are looking completely away from China these days. Prof Michael Pettis says China’s GDP growth will go south of 6% over the turn of the year and your forecast of debt/equity swaps and forced mergers for 2018 would fit in nicely. Everybody should begin to start shorting the AUD and mining stocks as a 1st play. I believe 2017/2018 is stage 1 of China’s decline – short AUD and mining. Stage 2 is 2018/2019 – short Aussie/Asian banks as the bad debts ramp up, FDI weakens, mining crisis 2.0, jobs weaken and this Asia – Pac property bubble unwinds.

I’m short FMG from $6 and will short on rebounds such as the one currently in place. I’m waiting for this AUD rally to finish before beginning my AUD short, but I think this is only weeks or possibly a month or 2 away.

Thank you Laurent. The Chinese command economy is a little more resilient than some have expected; but a lot of the more recent growth is debt-funded, and that usually doesn’t end well.

Yes. “As the lending gets bigger and the quality of assets behind the loans deteriorate …..” casts pretty grave doubt about the risk management of banks. If they’re prepared to structure mortgages on bubble-inflated land prices, why should we have to bail them out when the bubble pops? Seems banks can make billions on the upside then lose billions on the down with absolute impunity. Wish I had that sort of guarantee with my investing! Maybe a Royal Commission into banking might finally resolve this conundrum?

Hi David this scenario has had me scared for a long time and now everyone is talking about it, I think it goes, Aussie housing bubble burst + china debt bubble burst x China property bubble burst = commodity bust + Aussie economy bust x Aussie equity bust squared. Not to mention the wave of calamity rolling across the globe from the China issues unfolding. Will cash rise from Dunce to King ?

I suspect cash will be King one day Andrew; as it tends to about for about eighteen months per decade (on average). Unfortunately it is impossible to know exactly when that occurs.

Cash may be king someday but in which currency? By Andrews doomsday scenario it seems the AUD will be more of a pauper. Will USD still be king, or (to use Monti’s favorite term) is it different this time? Which currency to hold this cash in?

I suspect with our household indebtedness levels, the bull market in residential probably coming to an end, the construction boom getting a bit long in the tooth, wage growth at multi year lows, and China likely to go through a cyclical slowdown sometime in 2018/2019, the US$ will continue to appreciate relative to the Australian dollar and the slide from US$1.05 in 2013 to US$0.75 today will continue into the mid US$0.60s area at some stage.

What I don’t understand is who is owed all this debt? Is everyone borrowing off each other?

Yes Steve, thats effectively the way it works. The Wealth Management Products I have written about in the past have been part of the credit growth – meaning the bank assets have grown so much more quickly than the broad economy. As the lending gets bigger and the quality of assets behind the loans deteriorate, a traditional credit crunch normally results. Think Australia in the early 1990s. With the Chinese command economy, I expect forced mergers and debt for equity restructuring to commence in 2018.