Have mining investments passed their peak?

For some time now, we have been cautious about the prospects for listed EPC (Engineering, Procurement and Construction) contractors (mining services). And neither the recent rebound in share prices, nor the following RBA announcement, made last week by Christopher Kent, have done much to impact this view.

“. . . there is still a sizeable amount of work in the pipeline, including a number of large LNG projects. This means that the level of mining investment is likely to remain quite elevated for a time.”

Since they made these comments, the largest of these projects, the $45 billion Browse LNG plan, is understood to have been shelved.

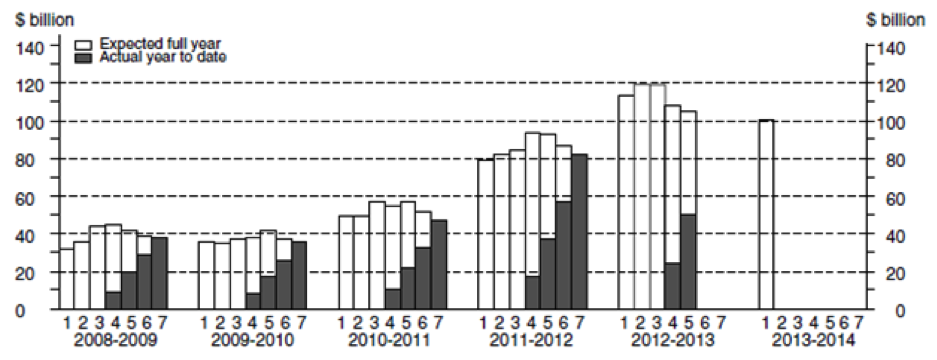

And on top of this, despite the RBA’s outward show of confidence, the Australian Bureau of Agricultural and Resource Economics (ABARE), Australia’s leading economic research agency, has already projected that mining investments for 2013-14 will be 11.6% lower than for the corresponding period in 2012-13 (see chart below).

Whilst Kent stated that mining investments are likely to peak this year, it seems that if anything, they have already peaked. I wonder if the RBA even read ABARE’s report on actual and expected new capital expenditure?

If mining investment is falling (as we suspect it is, based on our own internal research and market announcements by investment heavyweights BHP, RIO and now WPL), competition for work in a shrinking (and unstable) marketplace will intensify, placing immense pressure on margins and profitability for those who tender for this capital spend.

So it’s probably obvious why we are currently spending our time researching other market sectors for investment opportunities. We highly suspect that a serious shakeout – that we have been warning of for some time – is gathering momentum, and until it has largely run its course, we will continue to avoid making any new investments in the mining contracting space.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY