Guest Post: Thoughts on fast maturity

Investor Point: Andrew observes that companies in fast changing industries are prone to misguided adventures with shareholders funds after they mature (which they do very quickly in a country with a population of a mere 23 million).

Investor Point: Andrew observes that companies in fast changing industries are prone to misguided adventures with shareholders funds after they mature (which they do very quickly in a country with a population of a mere 23 million).

(if you’d like to contribute a post send it to roger@rogermontgomery.com with the word CONTRIBUTION in the subject line)

The internet list companies have long been considered favourites of some of the community here (including myself). Their ability to generate lots of free cash and earnings against very little equity makes them prime considerations as a company some would like to own, especially as some have great competitive moats around them. However, is there an inherent risk that needs to be considered and compensated for when choosing to value and/or invest in these companies? This is a question I have been considering as of late and would like some help to answer.

Valuing companies is a forward looking exercise and so we must make certain decisions and adjustments based on how we think this company will grow over the years.

A company must be able to earn attractive rates of return on the incremental capital it puts to work. As a company moves further along on its life cycle this gets harder to do. When a company reaches maturity, earning these attractive returns becomes even more difficult and organic growth opportunities dry up. A company must then look for other avenues of growth and/or use its capital wisely to increase shareholder value whether it’s through increased dividends or share buy backs.

Usually a company can grow organically by opening up new stores for example, however you cannot do this on the internet. This lack of organic growth opportunities causes the growth stage of the business to be shorter and therefore the maturity stage to come around in a quicker timeframe than a tangible business. The lack of costs needed to operate this kind of business also means that when these companies reach maturity, there is very little scope to increase profits by becoming leaner.

This only leaves the option of new product offerings, purchased growth (M&A) and/or offshore expansion as the remaining avenues for growth. All of these options have risk to both the company and investor and could see real damage done to the return on equity of the business if not done well (for example paying too much for another company).

The growth versus profitability conundrum is one that has seen many companies go down a route, which leaves the investor worse off.

It is my opinion that acquisitions cannot be seen as abnormal or opportunistic exercises for these internet businesses. They are, instead, an inevitable result of the companies journey through the life cycle and therefore needs to be considered when making investment and valuation decisions. As an investor cannot know exactly when and where this acquisition will be made nor how much it will cost until it happens it therefore clouds the waters of valuation.

As has been said many times, it is better to be conservative and wrong than optimistic than wrong and one could easily use more conservative inputs to compensate for this unknown. Another option to consider is that there is a higher implied risk for this investment and there for an investor should ask for a higher required return (higher risk premium) or seek much larger margins of safety.

The investor cannot with the same certainty be able to invest in these companies over a long-term time horizon as some other businesses as the expected life cycle of such a business is shorter and involve constant corporate activity, which will require a meaningful amount of analysis. So far the main companies (REA, SEK, WEB, CRZ, WTF) have been negotiating the path reasonably well and hopefully that continues. However, some have been especially active in purchasing growth and/or going offshore. If this continues it is my opinion that the risk becomes higher as the risk of management error (paying too much etc) becomes greater.

Posted by Andrew

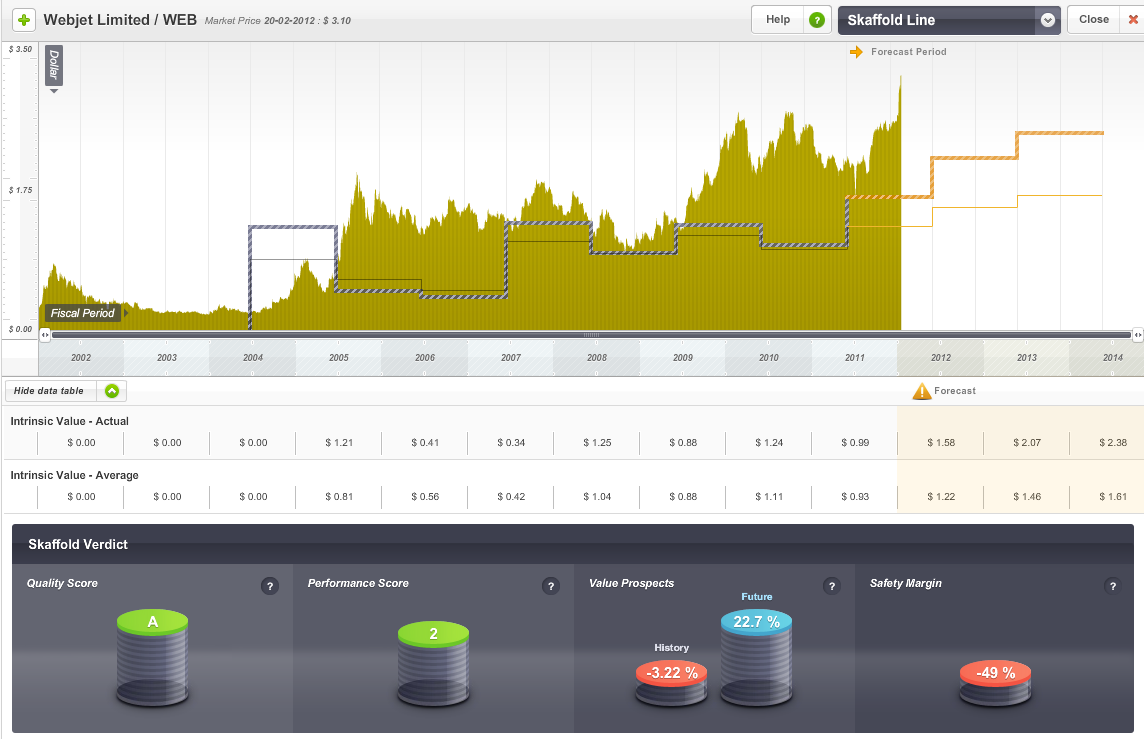

Postscript: Paying too much for the companies themselves is also possible (see valuation/price chart below for WEB)!

Posted by Andrew L with permission of Roger Montgomery, Value.able and Skaffoldauthor and Fund Manager, 21 February 2012.

Hi

RE. CREDITCORP

Yes good performance now but many like me have held since pre GFC when it dropped to nothing.

As it is now nearly back to what it owes me allowing for divs would you sell now?

Care to comment anyone?

Hi everyone,

Haven’t had a chance in the past week to really come i and see how this post was going. Thank you Roger for putting this up, it means a lot to me and i hope people enjoyed it. I look forward to see what others contribute as i think it is a great chance to get some unique views out there.

The guff below are just thoughts, and maybe one or two can add grist to the mill. If I were to rewrite this tomorrow, I would change some of them.

The point-in-time IVs that are central to this forum, although great for short-listing candidate stock for consideration, could be a trap for the unwary if applied to stocks that manifestly do not fit within the growth, profit margin, equity requirement and lifespan parameters of a reasonable range of ASX-listed companies – say 68% of profitable ASX listed companies, which is one standard deviation either side of the average in a normal distribution.

What is the use of a 50% margin of safety on an IV today of $10 if the IV tomorrow is $1 and the day after it is zero? With out-of-pattern companies, irrespective of how wrong I may be, I would be inclined to guesstimate an EPS scenario for as far into the future as possible, and uses a NPV technique to arrive at an intrinsic SP value that gives a value for today that looks into the future, discounted for uncertainty. With spreadsheet, one can easily mechanise the growth of a metric like EPS to allow for “decay”, and the periods can easily be made to be sub-annual (e.g., quarterly) to give a less stepped result. One thing one can be sure of is that these guesstimates will never be accurate, and less so for each period further away, but by its nature, NPV calculations tend to mute the significance of the numbers that are distant in time to the degree that one can truncate the number sequence with little change to the NPV.

Although for run-of-the mill stocks I often use EPS-based rule-of-thumb techniques to ascribe intrinsic values to them, these techniques over value stock that require little equity – internet stocks, for instance. For example, If a person knows an incantation that if recited once a month wearing a paper hat (balance sheet value 1 cent) earns a million dollars a year, we may value that business at about $10 million ($1M x 1/RRR), if one assumed RRR is 10%. The same would be true if the incantation only worked if one wore a gold crown with a fair balance sheet value of $10 million. One can use the ROE/RRR x Equity approach to get the same answers as above – (($1M/$.01)/RRR) x $.01 = $10M and (($1M/$10M)/RRR) x $10M = $10M respectfully.

If offered either business at a 20% MOS, I would take the one that came with the $10 million golden crown. This suggests we should be careful with IV calculations for firms that requires very little equity. If the incantation only worked for a few years, or its power decayed over time, I would want to adjust my calculations – that is, swing over to an NPV valuation technique.

Internet companies can have a short life (witness Steve Outrim’s company Sausage Software). Although Steve personally did very well financially by skipping out ahead of the dot.com crash, I am unaware how the investors who bought shares in Sausage fared, or what it did for SMS Management and Technology, who acquired, or merged with, Sausage.

It need not be the technology that creates the moat. The moat could go to the company that first gains the economics of dominance. Dominance may last a decade or more, but the internet has not been around long enough to allow us to know. In contrast, we know that firms like SGH and TGA have been around since the early twentieth century, and there is still life in them.

And thats why in Value.able I talk about bright prospects for intrinsic value growth (or as the academics like to say, value added). Its really much much simpler than that…Go back over the posts regarding intrinsic value and competitive advantage here at the blog for the last year or two and you will build an excellent library to consider.

Michael raises some interesting points that I’ve also been thinking about. I agree that the ‘point-in-time’ valuations can indeed be misleading if one doesn’t know its limits and assumptions.

For businesses such as Matrix, I do not believe a sensible valuation could fall from upwards of $10 to half that due to one or two years of lower than expected growth, as I have observed from this blog. You cannot look at say the Reuters analyst forecasts of $0.24 EPS for 2012 and simply assume that will continue indefinitely into the future. If you would then plug in the forecast of $0.47 for 2013, you may come up with a valuation twice as high as 2012. Common sense would tell you that if the value were to increase that dramatically, surely the 2012 valuation is too low or the 2013 too high.

This leads me towards a more commonly used discounted cash flow valuation (DCF) or NPV valuation. As Roger importantly pointed out years ago, many of the models unwittingly double count cash flows, once paid as a dividend and again reinvested into the company. After testing the dividend discount model, I find it to make theoretical sense, and when combined with a careful analysis of equity, ROE and payout ratio, a significantly more transparent and flexible model than these ‘point-in-time’ valuations. Roger, if there is one thing that irritates me about Value.able, it would have to be the Appendix, where you dismiss the dividend discount model on the basis that it produces a different valuation to the one you suggest. I’d be happy to be proven wrong, but the appendix didn’t really prove anything substantial.

Having said all that, the Value.able formula seems to work quite well in many situations and is quite conservative, so I suppose it can be a quick way to produce a rough valuation for stable companies. My point is, don’t blindly rely on some formula, make sure you understand what you are doing.

As a side note to Michael, I don’t think businesses having a low amount is equity is necessarily bad, however they may be more risky. You might have to increase the discount rate or decrease the cash flows to adjust for this uncertainty but in many cases the business with less equity can be a more attractive investment.

Hi Chris,

Not all that much to add but my problem with the dividend discount model is that a company like Apple to my understanding would be worth nothing. I have only had a brief look into this model and please let me know if it is wrong but as i am buying into a company and there for looka t the companies value instead of the value of an income stream than i don’t think it is for me as i cannot fathom Apple (or berkshire for that matter) being worthless.

In saying all that, i have found it extremley helpful researching different valuation mdoels and techniques and will continue to do so. I quite like the value.able model and i use it my own way in regards to the future which i think works well for me, it makes it even more conservative for future valuations so combining that with a large margin of safety and a pretty rigorous screening process i think i have given myself a good enough insurance policy.

To me, i think the valuation technique is secondary to good stock selection. What is good is up to the beholder. Purchasing a great company will help insure against the wishy washy estimates of valuation.

Great post Michael – thanks

However, if we only look at businesses that satisfied your criteria of wide stable margins, mature industry etc then your company with $0.01 of equity is the standout. It has considerable intangible equity & can grow with small amounts of new capital while throwing off mountains of free cash flow. It is the See’s candy investment.

In fact, if you looked at these two businesses as two runners training on a 400m track, although they are side by side at the point you describe one runner is moving much more quickly.

Michael raises some interesting points that I’ve also been thinking about. I agree that the ‘point-in-time’ valuations can indeed be misleading if one doesn’t know its limits and assumptions.

For businesses such as Matrix, I do not believe a sensible valuation could fall from upwards of $10 to half that due to one or two years of lower than expected growth, as I have observed from this blog. You cannot look at say the Reuters analyst forecasts of $0.24 EPS for 2012 and simply assume that will continue indefinitely into the future. If you would then plug in the forecast of $0.47 for 2013, you may come up with a valuation twice as high as 2012. Common sense would tell you that if the value were to increase that dramatically, surely the 2012 valuation is too low or the 2013 too high.

Therefore that leads me to a more commonly used discounted cash flow valuation (DCF) or NPV valuation. As Roger importantly pointed out years ago, many of the models unwittingly double count cash flows, once paid as a dividend and again reinvested into the company. After testing the dividend discount model, I find it to make theoretical sense, and when combined with a careful analysis of equity, ROE and payout ratio, a significantly more transparent and flexible model than these ‘point-in-time’ valuations. Roger, if there is one thing that irritates me about Value.able, it would have to be the Appendix, where you dismiss the dividend discount model on the basis that it produces a different valuation to the one you suggest. I’d be happy if you could prove me wrong, but the appendix didn’t really prove anything substantial.

Having said all that, the Value.able formula seems to work quite well in many situations and is quite conservative, so I guess it can be a quick way to produce a rough valuation for stable companies. My point is, don’t blindly rely on some formula, make sure you understand what you are doing.

Thanks for those thoughts Chris,

1) You must UNDERSTAND the business,

2) Excess return models such as that in Value.able are superior in my estimation,

3) Skaffold is a couple of steps better again…and

4) Consistency is the hallmark of all great investors.

I was specifically not addressing businesses that were mature and were enabled to grow faster by retaining earnings. I was thinking of companies with short histories, perhaps short life cycles, unknown future trajectories and little need for equity (and hence no use for retained earnings). That is, out-of-pattern companies where rule-of-thumb valuation techniques like 1/RRR times EPS, or corollaries thereof, may not suffice. Some internet-driven businesses have these characteristics, and none have been around for as long as the banks, BHP, CSL, QBE, Woolworths, Thorn Group, Slater Gordon and many others that had their genesis a hundred years ago, more or less.

If the two out-out-of-pattern mythical businesses that I put forward could be bought for $8m each, and both only lasted for a decade, then you would end up getting $10m income spread over ten years, plus a dilapidated paper cap at the end of Y10, whereas I would get for the same price get $10m income spread over ten years, plus a $10m golden crown at the end of Y10. If the businesses lasted for ever, then their NPVs would be the same, because the mathematics behind NPV is based on a geometric progression of a fraction (smaller than 1), and hence the value of the factor calculated gets smaller as the number of iterations grows, tending to be zero for an infinite number of iterations. The NPV of the residual would be inconsequential in the very long term.

You mentioned See’s Candies – like my mythical two businesses, See’s Candies cannot optimally employ the profit it generates. Rather than slay the goose that lays the golden eggs, Warren Buffet keeps See’s Candies, and diverts the income to different investments that can optimally use the funds. Warren’s February 2012 letter to shareholders’ states “Our flexibility in respect to capital allocation has accounted for much of our progress to date. We have been able to take money we earn from, say, See’s Candies or Business Wire (two of our best-run businesses, but also two offering limited reinvestment opportunities) and use it as part of the stake we needed to buy BNSF.”

Hi Roger,

I would be interested to know using your valuation metrics what value you currently have on VOC and any thoughts about its business prospects going forward?

Regards,

peter

Hi pete,

We were as surprised as anyone to see that data traffic almost doubled last year. We have been optimistic about this trend continuing but were surprised by the absolute change. It should have a positive impact on valuation provided VOC maintain price discipline when it comes to acquisitions.

Hi Roger, Andrew,

This is a very good post indeed and I quite agree, but I am going to play devils advocate….

Unfortunately (or fortunately), I hold WEB and brought it quite early, one of my rare good stock selections. Based on the same criteria applied above, I decided to take half of my profits off the table and bank them. I only took half off becuause of the other company I invested in, mentioned below. I took half off when WEB was $2.00, and way above it’s intrinsic value as the graph correctly shows above. Alas, they are now over three and one of the best performing stocks on the entire stock exchange – doh. So I delved a little bit further to find out why it has run so hard, and it is the expansion they are undertaking in hotel rooms as well as expanding overseas, especially the announcement the company made only two weeks after I sold half. Whilst for many companies this can be the death nell, WEB has one major advantage, to do so costs them very little in asset terms. The major cost is marketing/advertising. If their advertising and marketing can pay for itself and they gain some small market share in other countries, the rate of return for the money invested is still going to be a lot higher than those that need physical assets to conduct business. This is why I believe the stock has a lot further to go, maybe not in the shorter term, but certainly in the longer term (3-5 years).

It reminds me of another stock which I bought in at 14 cents and sold at 28 cents. They have traded over $14, oh the shame of it all. If only I held those REA shares, I would have done quite nicely for myself indeed.

There will always be some stocks that will be hard to evaluate using intrinsic value only. REA is one example where the share price was in front of its intrinsic value for almost its entire life, whilst it’s share price was appreciating in value. Using only intrinsic value you would have never bought the share, and you would have missed out on some great returns. Roger, you correctly point this out in your book, intrinsic value isn’t everything, and if you can pick the stocks that have great growth potential sometimes that is far more important. WEB could be one of those shares.

Seany Biel

And we have chatted here also about other examples like Cochlear. What we do here in cases such as COH and REA is look to the path of future intrinsic values. That helps enormously and it is my success with that approach that prompted me to share it first in Value.able and here at the insights blog.

Hi Seany

I think buying business at a descent/substantial discount to current intrinsic value is the most prudent thing to do for an average investor like myself.

Personally, I like COH, FWD, IRE but these great businesses have been trading at premium to their intrinsic value most of the time (except during GFC) . If I only look at current intrinsic value then I will never buy these businesses. Forecasting future intrinsic value of a business is very difficult and depends on the predictability of future earnings and company’s “economic moat” . I think COH and IRE have wide “economic moat”and will continue to maintain it. FWD is the same to an extend if the mining boom continues in the foreseeable future.

This is where diversification comes into play, I think it would be ideal to have capital allocated to businesses purchased at substantial discount to intrinsic value

Then you want to have some allocation to companies which can improve current earnings at sustainable rate, maintain their economic moat and substantially increase their intrinsic value. Therefore even though they trade at premium to their intrinsic value, IV will eventually increase substantially in the future.

Finally, the hardest part, finding 1 or 2 “100-bagger” like REA will substantially boost your long term return.

Hi Seany,

I do agree with your points. Whilst writing this article i did stop for a second to think if one should see marketing and advertising for these types of businesses to be the equivalent of capital expenditure in physical companys.

I only wish i knew about REA when it was at $0.14, i didn’t till much later but i think we all have some stories. My problem was myself being a little too conservative with my first home savings and talking myself out of opportunties that would have doubled and tripled that money (no doubt making the first home even easier to get) instead of sitting in an account at an interest rate between 4.5% and 5% per annum.

However, if you are like me and think back, you will decide that even though you missed an opportunity, it still was the correct call to make at the time based on the facts and assumptions of that time.

Not only that, but i think it led to even better things down the road that might not have happened if i did make the call, but now i getting to wishy washy into the world of fate and sentiment so i will end.

BGL was mentioned by Shammer at $0.22 and it has now shot up to $0.375. This is certainly in a fast moving industry but its fundamentals were just too good to pass up.

Thanks for the post.

SGH is trying to expand in Europe. Anyone have thoughts about this.

Do you think the stock offers long term value or becoming a value trap if they paid to much for the business’s for growth?

I bought 18,000 SGH in October 2010 at $1.68. Last year they were up at $2.50 for a brief moment – just not long enough for me to skip out as I had planned, and then they went backward, culminating in a recent downward skip on the back of a result for H1 ending 31/12/2012 that saw the EPS decline, forecasts unmet and one of the recent acquisitions underperform. The SP dropped to about $1.53 a week ago. It is now about $1.60.

As for paying too much for the UK acquisition, SGH has a long history of expanding via acquisition, so it is something about which management know a thing or two, especially the contractual provisions to protect the value of what they thought they were buying – witness the $3 million reduction in the price of Keddies, which did not perform as projected. Also, what one may pay to gain a strategic position in the UK legal market can tolerate a premium, especially if the total acquisition is a relatively small percentage of SGH’s equity. I am fairly sure SGH would not have dithered over the UK deal for the want of a few million dollars either way if other factors like perfectness of fit and the attitudes and quality of the acquired firm’s senior management. SGH were very keen to get into the UK quickly to take advantage of being an early mover in the new UK setting – the sanctioning of alternative ownership structures. Until recently only lawyers could own legal practices in the UK.

Management have in the recent H1 announcement acknowledged that they must desist from acquisitions to settle the business down and reduce debt. I concur 100% with that. The MD, Andrew Grech, seems to think the SP was undervalued, because he recently bought 94,257 shares (55,787 at $1.65, and 38,470 at $1.64). He now holds 8,022,356 SGH shares.

A recent acquisition, Keddies, was a personal injury firm based in the western suburbs of Sydney (Liverpool), and it was notorious rather than famous. The performance shortcoming occasioned the sales price being reduced by $3 million, and things are improving there – so that acquisition is not a concern, because its problems are easily fixed. SGH rebadge its acquisitions, so the odium of the Keddies connection will be soon forgotten. The $3 million clawback indicates that SGH knows what it is doing when it comes to acquiring legal practices.

The expansion abroad is specifically an expansion into the UK, because the laws, legal processes and language there are similar to the situation in Australia. The Joe-&-Jane lines of legal business that are SGH’s forté are as a group four times the size in the UK market compared to Australian.

SGH has similarities with TGA (which I hold). Both are in there eighth decade of existence. Their customer demographics are fairly similar. The low number of matters per client in a lifetime is similar. Both are fairly immune to the economic vicissitudes like interest rates, petrol prices and the like. Both need to have a physical presence in each hinterland they target. Regional advertising works for both. This means that when SGH has reasonably covered Australia, it will, other things being equal, only grow as quickly as its customer demographic grows, and hence the UK could give SGH room to grow faster than population growth for longer. I suspect that SGH will cease acquiring legal practices in Australia for a long time, but as soon as it can it will grow its UK business in attempt to access economies of dominance there. What I write about the similarities with TGA, applies also to CCV, which has done well to expand into the UK where its business mirrors its business model in Australia with the emphasis of owning stores, rather than franchising them.

I like investing in companies that suffer social odium – money lenders, ambulance chasers and the like, because they tend to be undervalued, although not always, otherwise I might have invested in IVC (Invocare) who are into dispatching mortal coils.

The recent half-year announcement stated that SGH had overcome some acquisition-related digestion issues that held it back in H1, so I’ll hold for another six months, and then see what I can guesstimate will happen in 2012/2013, and beyond, if possible. If I had the funds I would buy more SGH, and I kick myself for not bailing out at about $2.40 last year, and thus having the funds to jump back in at the current SP of about $1.60.

At current SP of about $1.60 I do not think SGH is a value trap, particularly as its recently stated policy is to stop further acquisitions and grow organically what they now have, and hope to pick up in the UK in April. I concur 100% with that approach, and welcome the news. SGH can digest what they have acquired, but it could not continue acquiring more practices at the rate that has occurred in recent years.

I bought 18,000 SGH in October 2010 at $1.68. Last year they were up at $2.50 for a brief moment – just not long enough for me to skip out as I had planned, and then they went backward, culminating in a recent downward skip on the back of a result for H1 ending 31/12/2012 that saw the EPS decline, forecasts unmet and one of the recent acquisitions under perform. The SP dropped to about $1.53 a week ago, and it is now about $1.60.

The MD, Andrew Grech, seems to think the SP was undervalued, because he recently bought 94,257 shares (55,787 at $1.65, and 38,470 at $1.64). He now holds 8,022,356 SGH shares.

One of the recent acquisitions was Keddies, a personal injury practice based in the western suburbs of Sydeney (Liverpool). Keddies was notorious rather than famous, and some commentators have voiced their disapproval of the acquisition. The performance shortcoming occasioned the sales price being reduced by $3 million, and things are improving there – so that acquisition does not concern me, because the problems are easily fixed. SGH rebadge its acquisitions, so the odium of the Keddies connection will be soon forgotten.

SGH’s expansion into Europe is specifically an expansion into the UK, because the laws and legal processes there are similar to the situation in Australia for the Joe-&-Jane lines of legal business that are SGH’s forté. The UK market is four times the size of the Australian market. Also, until recently only lawyers could own legal practices there, so SGH wants to jump in early with an alternative ownership structure. The mooted price of the UK firm is 4.9 times EBITDA, which does not appear to be excessive if one bears in mind that this is a strategic investment to get into the UK, where SGH can attempt to replicate its Australian model. If one divides SGH’s current capitalisation value by its EBITDA, one gets about 5.5.

SGH has similarities with TGA (which I hold). Both are in their eighth decade of existence. Their customer demographics are fairly similar. The low number of matters per client in a lifetime is similar. Both firms are fairly immune to the economic vicissitudes like interest rates, petrol prices and the like. Both firms need to have a physical presence in each hinterland that they target. Regional advertising works for both. This means that when SGH has reasonably covered Australia, it will at best only grow as quickly as its customer demographic grows, and hence the UK venture could give SGH room to grow for longer. I suspect that SGH will cease acquiring legal practices in Australia for a long time, but although it claims it will grow the UK business organically, I think that as soon as it can, it will grow its UK business via bolt-on acquisitions to access economies of dominance there. What I write about the similarities with TGA, applies also to CCV, which has done well to expand into the UK where its business mirrors its business model in Australia with the emphasis of owning stores, rather than franchising them.

I like investing in companies that suffer social odium – money lenders, ambulance chasers and the like, because they tend to be undervalued, although not always, otherwise I might have invested in IVC (Invocare) who are into dispatching shuffled-off mortal coils.

The recent half-year announcement stated that SGH had overcome some issues that held it back in H1, so I’ll hold for another six months, and then see what I can guesstimate will happen in 2012/2013, and beyond, if possible. If I had the funds I would consider buying more SGH shares, and I kick myself for not bailing out at about $2.40 last year, and thus having the funds to jump back in at the current SP.

SGH wants to expand into the UK where language and the legal scenario are similar to Australia – there is no intention to expand into Europe generally. The mooted purchase price of the UK law practice is 4.9 times EBITDA, which, intuitively, is not high, and SGH’s own capitalisation value is about 5.5 times EBITDA at the current SP, so to pay 4.9 times EBITDA to gain a strategic foothold in the UK via a good-fit acquisition is not over the top.

In my opinion, it is not what SGH wants to pay for this acquisition, and others in the recent past, that is the issue – rather, it is that SGH needs to digest these acquisitions before it takes on more. Management have stated that their current plans are to desist from further acquisitions and grow organically. If SGH sticks to this plan, it will reverse the worsening metrics that the recent half-year announcement reported, and it should not be a value trap.

The MD has in recent weeks bought about 90,000 shares in two tranches at $1.64 and $1.65, and he now holds over 8 million SGH shares, which suggests that he does not think it is a value trap.

Sorry for the repetition – every time I submitted a post it vanished into the ether, so I resubmitted. Usually one can see the post with the proviso that it is up to Roger to allow it to be published. Anyhow, SGH went up today to close at $1.635, and with many more buyers than sellers.

On another topic, FLT posted a good result yesterday. At first read through the accounts I raised an eyebrow at the negative cashflow, although they posted a good explanation of it in their supplementary material.

You raise a good point Andrew, because when these companies fall, they normally fall very fast.

The market often prices in a so-called “growth premium” and when the day comes that they signal the growth is disappearing or even slowing, the “growth premium” gets stripped away in a heartbeat.

Applying strong discipline and ensuring an adequate margin of safety can protect against this.

It’s a great post Andrew. I don’t know the answer so this is both a comment and a question. The ones that seem to work fulfil a valuable purpose and create a critical mass before a competitor can take a foothold. As well, people talk about them if someone mentions buying a car or house. This is valuable revenue; advertisers and sellers.

Management is a potential risk for every company. I think a key risk is ‘new’ technology; whatever it may be.

You mentioned purchasing growth by going offshore. If the company has proprietary technology, do they necessarily have to pay, or might they be paid to enter the market because of their technology?

The source of the comp ad is the network effect and because it’s a relatively recent comp ad type, only time will reveal its dynamic.

I think we have discussed the network effect here before and i am still very sceptical of it but it is fundamental to these type of businesses. I only need to look at Yahoo and Myspace and i think in the future Facebook for examples as to why i am sceptical.

I agree with you Liz, the ones that work provide something useful and also create that critical mass that leads to the network effect. As they provide something useful (unlike say, a social media) they are less effected by fashion and sentiment.

In all cases i think they need management who not only understand their market but understand the technology and future advances so they can continue to be that first mover, otherwise it gives an opening to a more savy competitor who may find away around that critical mass by offering something even more useful. I am still shocked for example that i do not seem to be able to find an app on the Apple App Store for Seek, wehre as i found one of their competitors very easy.

Thanks, Andrew, for taking the time to contribute an interesting article.

You speak of the risks of going offshore. Risky indeed when you consider the target markets likely have businesses that have also reached a degree of saturation themselves, and who are also looking elsewhere.

The growth versus profitability conundrum you speak of often sees business leaders head down the wrong track, I suspect, at least partly due to one being a more glamorous option than the other. After all, which of the following do you think the mainstream would find more impressive on a resume?

“In my time as CEO I…

…expanded operations into 3 new countries”

…bought back 20% of the stock”