Growing inequality shows how the pie is being sliced

In the recent US elections, Donald Trump successfully harnessed strong voter discontent about rising inequality. He had a point. Recent data show an ever widening gap between the haves and have nots, and falling confidence in the political class.

Wages and corporate profits as a share of gross domestic profit (GDP) tend to move in an almost perfectly inverse fashion. Technological improvement and globalisation have significantly reduced the bargaining power of labour. And this has led to rising income and wealth inequalities, as discussed here.

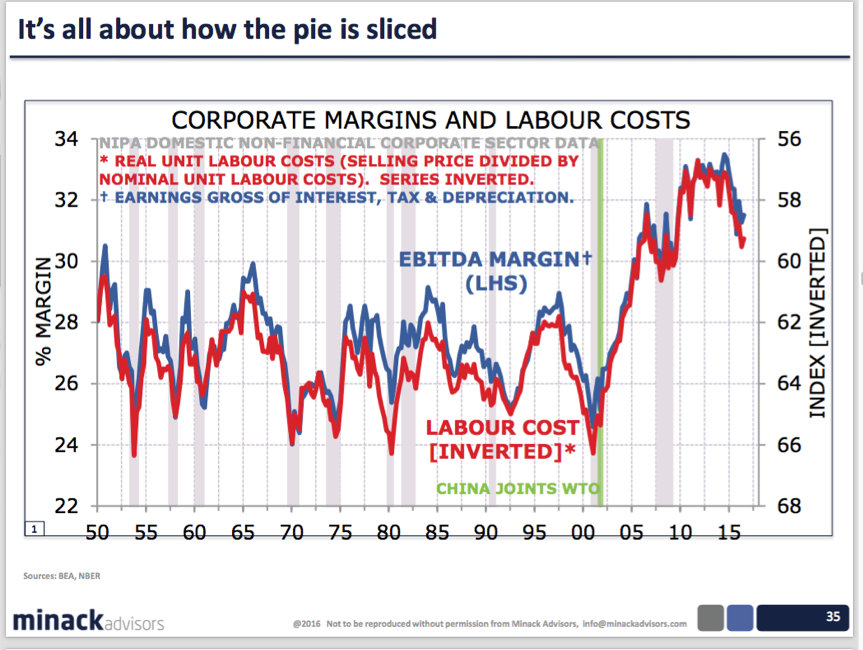

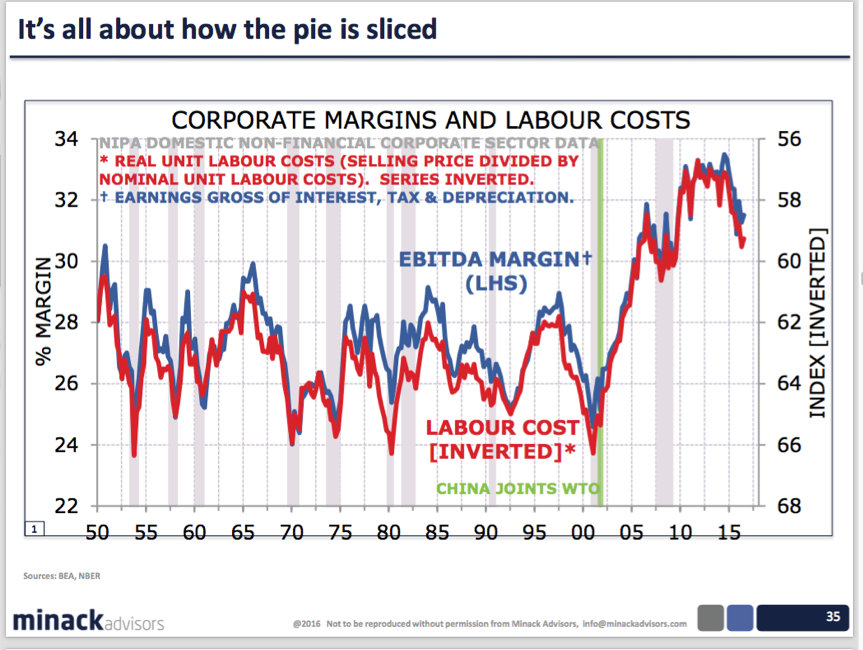

The attached graph from Gerald Minack of Minack Advisors is titled “It’s all about how the pie is sliced”. It shows that US corporate margins, in blue and on the left hand axis, troughed at 24 per cent in 1970 and peaked at nearly 34 per cent in 2014.

The US Labour Cost Index, in red and inverted on the right hand axis, peaked above 66 in each of 1953, 1970, 1980 and 2001 and troughed at 57 in 2012.

While it is difficult to know where these ratios move to over the medium term, it seems likely confidence in the political class is in structural decline.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Income Equality has never existed at any time in any society.

two facts of nature: the inequality of human abilities and the variety of the external conditions of human life on the earth.

What, in fact, is “equality”? The term has been much invoked but little analyzed. A and B are “equal” if they are identical to each other with respect to a given attribute.

This means, of course, that equality of all men — the egalitarian ideal — can only be achieved if all men are precisely uniform, precisely identical with respect to all of their attributes. The egalitarian world would necessarily be a world of horror fiction — a world of faceless and identical creatures, devoid of all individuality, variety, or special creativity.

A short story by Kurt Vonnegut provides an even more comprehensive description of a fully egalitarian society.

The year was 2081, and everybody was finally equal. They weren’t only equal before God and the law. They were equal every which way. Nobody was smarter than anybody else. Nobody was better looking than anybody else. Nobody was stronger or quicker than anybody else. All this equality was due to the 211th, 212th, and 213th Amendments to the Constitution, and to the unceasing vigilance of agents of the United States Handicapper General.

https://mises.org/library/egalitarianism-revolt-against-nature-0

The fact that that product today is as great as it is, is not a natural or technological phenomenon independent of all social conditions, but entirely the result of our social institutions. Only because inequality of wealth is possible in our social order, only because it stimulates everyone to produce as much as he can and at the lowest cost, does mankind today have at its disposal the total annual wealth now available for consumption. Were this incentive to be destroyed, productivity would be so greatly reduced that the portion that an equal distribution would allot to each individual would be far less than what even the poorest receives today.

https://mises.org/blog/mises-inequality-wealth-and-income

https://www.youtube.com/watch?v=fKc6esIi0_U

Pareto distribution known since 1896

Pareto originally used this distribution to describe the allocation of wealth among individuals since it seemed to show rather well the way that a larger portion of the wealth of any society is owned by a smaller percentage of the people in that society. He also used it to describe distribution of income.[8] This idea is sometimes expressed more simply as the Pareto principle or the “80-20 rule” which says that 20% of the population controls 80% of the wealth.[9]

https://en.wikipedia.org/wiki/Pareto_principle

“The more things change, the more they stay the same.”

Demagoguery is an appeal to people that plays on their emotions and prejudices rather than on their rational side. Demagoguery is a manipulative approach — often associated with dictators and sleazy politicians — that appeals to the worst nature of people.

You make some fair points Xiao, but I don’t think anyone believes that absolute equality is possible.

The concern is more about the current and expanding divide between the haves and have nots. Unless we want to surrender our futures to the inevitable outcomes of unbridled economic rationalism, we have to accept that all men are not created equal in all ways, and rebalance the scales a little.

History has shown this to ultimately work better for those at the top anyhow.