Fintech SME lending in Australia

Fintech-based lenders have emerged since the introduction of the peer-to-peer platform Zopa in the United Kingdom in 2005. Fintech lenders aim to reduce friction in the borrowing process for their customers, reducing the turnaround time from application to funding and offer products which best suit the borrowing needs of the customer. Most offer risk-based pricing to borrowers, which rewards customers with good credit records, rather than offering a single rate for all borrowers, as is common in the banking sector. The enhanced user experience, superior pricing and tailored product aim to disrupt the lending businesses of the banking sector.

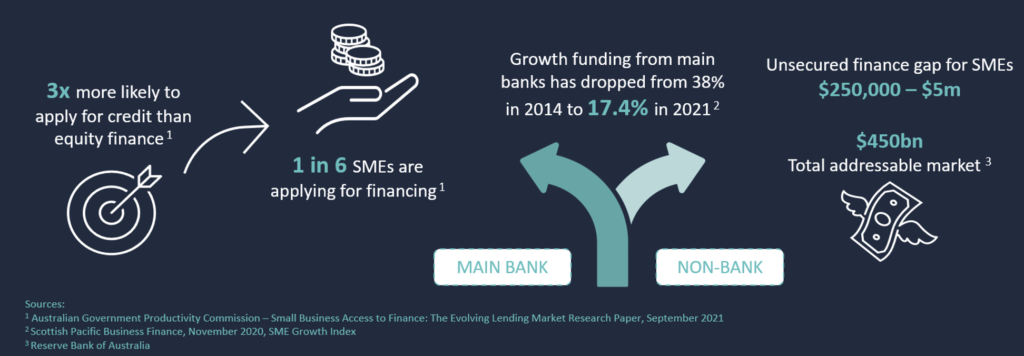

Small to medium enterprises (SMEs) have long been neglected by the banking sector in Australia. The amount of data required to assess the credit, application processing time and associated costs of processing has meant that the banks have pushed SMEs towards real estate-backed loans. This does not suit the SMEs in many cases. Given the increased complexity of the credit assessment, many SME loans have higher yields than consumer loans.

SME Alternative Finance (AltFi) lenders have developed products that allow SMEs to borrow to match the duration of their funding needs, on an unsecured basis or secured against non-real estate business assets such as invoices or stock. Technology, in particular cloud accounting software and online access to bank account information, has enabled significantly faster credit assessments and reduced funding times for SMEs, opening an underbanked market within the SME sector. The market opportunity is significant for Fintech-enabled SME AltFi lenders.

The main impediment to growth for Fintech-enabled AltFi lenders is access to funds to lend to SME borrowers. Banks have proven reluctant to fund these Fintech businesses in recent years, potentially due to their relatively short track record or ethical considerations due to perceived higher rates being charged by these lenders.

This opens a yield play for investors and a credit opportunity within global debt markets.

An overview of the Australian SME sector 1,2

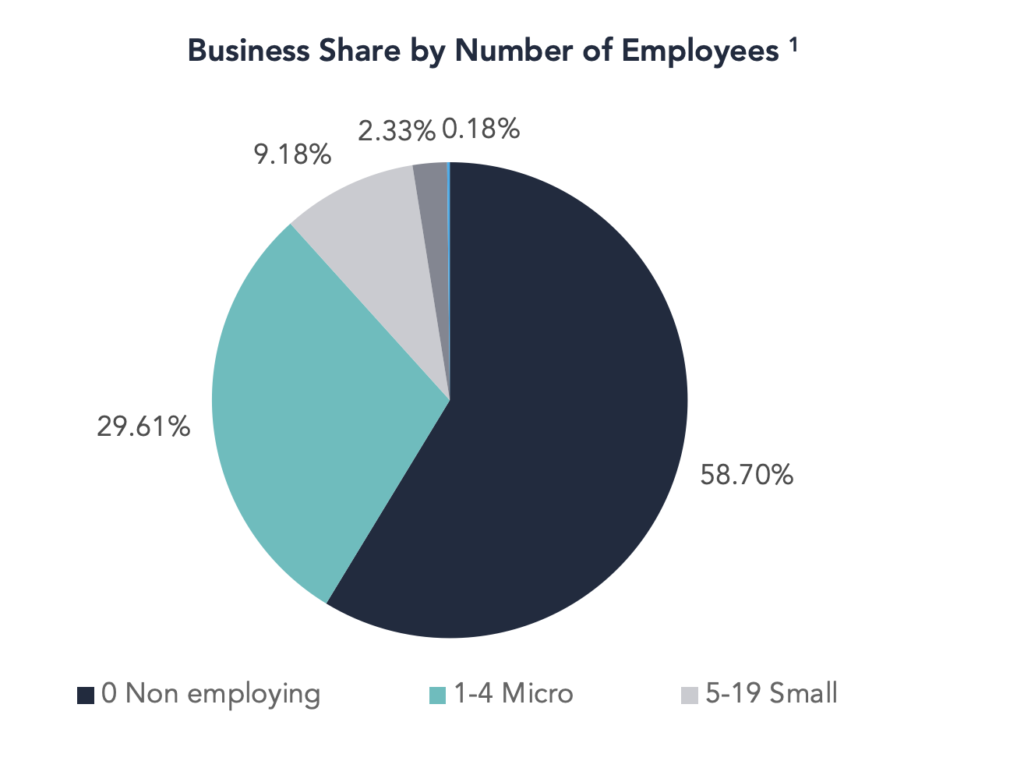

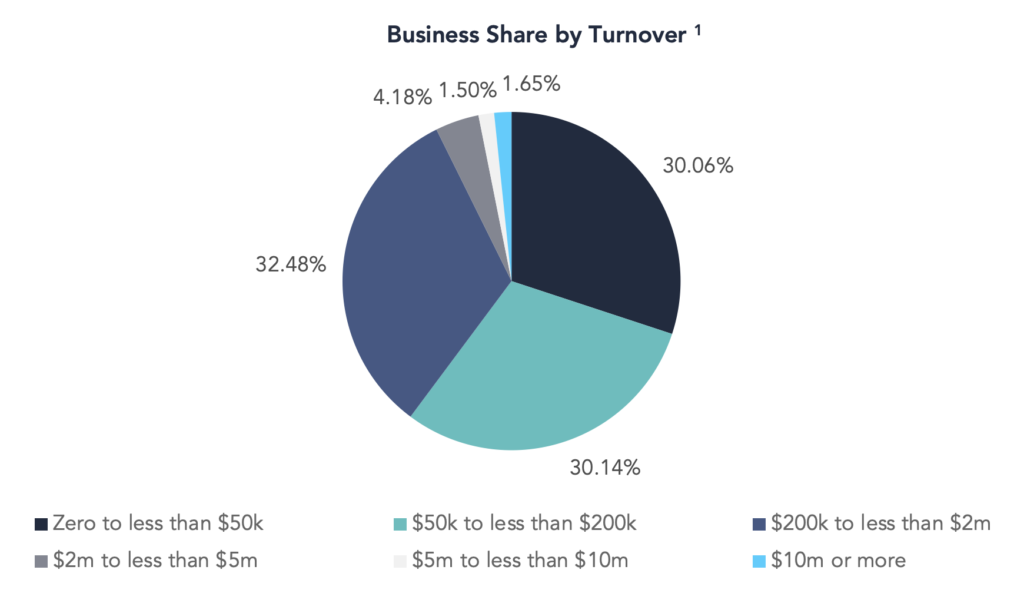

Small business is typically defined as companies with 5-19 employees, while medium-sized businesses are defined as companies with 20-199 employees. As of 30 June 2021, there were 220,427 small businesses and 56,046 medium-sized businesses in Australia. Moreover, as of 30 June 2021, businesses with fewer than 200 employees accounted for 99% per cent of employment.

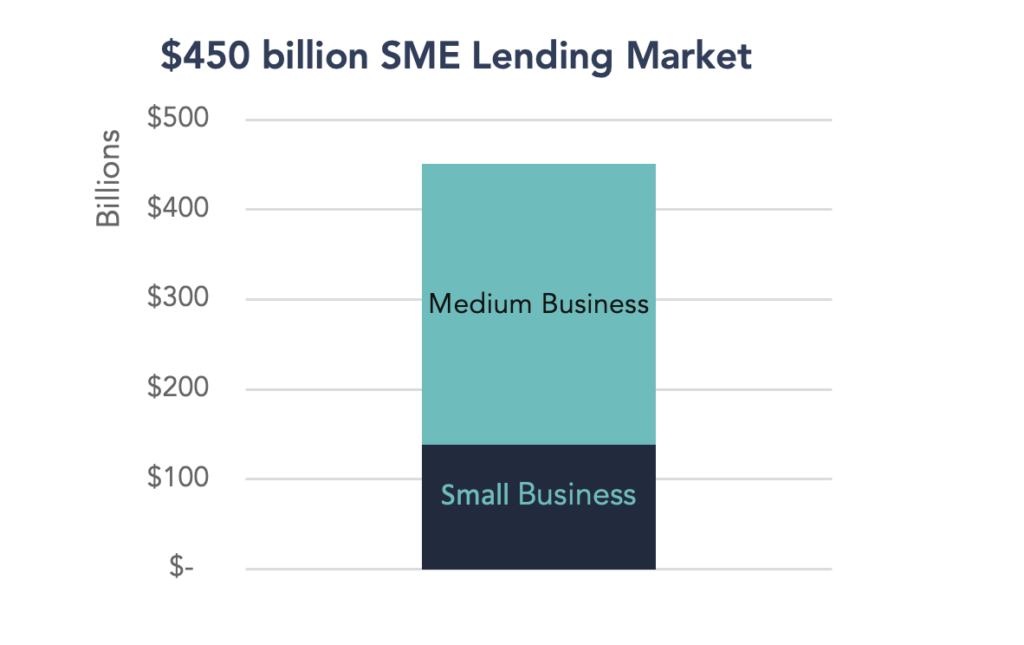

According to the Australian Banking Association, 98% of Australian businesses are small or medium-sized enterprises. In April 2022, the total SME lending market was $450 billion.

- Small businesses accounted for $138.4 billion, and

- Medium Businesses accounted for $312.6 billion.

The problem

Australian SMEs are not being financed by traditional lenders

Whilst SMEs in Australia continue to make a significant contribution to the economy, they have not been well supported by the banking sector. The main friction points SMEs suffer within the banking sector include:

- Bank requirements for owners of SMEs to post significant personal collateral for the business lend;

- Time required for the application process with the bank to be finalised and approved;

- Time lag between loan application and loan funding; and

- Products don’t always match the borrowing needs of the SME e.g. the duration of the loan may not match the SME’s borrowing requirements where the bank requires the loan to be held for a minimum term with penalties imposed for early repayment.

Banks have been unable to efficiently process the smaller end of the SME credit space as their current processes take time due to the manual nature of information collection and processing. This has led to SMEs seeking out alternative sources to fund their growth.

We are seeing the banks shift to larger business secured funding opportunities, leaving behind the businesses seeking smaller funding tickets. There is an unsecured finance gap for SMEs within the loan range of $250,000 to $5 million3.

The solution

Technology enabled lenders removing friction for SME borrowers

SME AltFi lenders have been set up to target the underbanked markets within the Australian business landscape to provide financing solutions to Australian SMEs.

The underbanked market includes businesses which have passed on potential growth opportunities due to difficulty in receiving finance, although not necessarily due to poor credit, but potentially due to its lack of size, or where, from the business’ perspective, there is a lack of human resources to complete the application process.

Some lenders in the AltFi SME sector use technology applications to collect data from borrowers and monitor the financial health of the business on an ongoing basis, whilst the loan is still live. This allows the lender to have an insight into the ability of the counterparty to repay the loan on an ongoing basis. A further extension to this is the ability to work with the borrower on their forward cash flow projections and tailor funding solutions to the business.

Lenders may use application programming interfaces (APIs) to plug into cloud-based accounting software and bank accounts to share data and reduce much of the friction in the application process, saving time for the borrower and making borrowing funds a less manual and much smoother process.

SMEs are choosing to seek funding from non-bank lenders with growth funding from main banks having almost halved. Funding from the banks dropped in 2021 to 17.4% from 38% in 2014, illustrating a rapid and significant shift in SME lending away from the banks to alternative financiers 3.

Asset overview and risk-based pricing

Lenders in the SME AltFi sector will predominately apply risk-based pricing to their product set. Risk-based pricing is simply pricing according to the risk of the lender, so a higher rate for a higher risk borrower, and a lower rate for a lower risk borrower. This pricing methodology is not used in the bank models, where rates are offered at each product type.

Loans made by SME AltFi lenders are typically structured in the manner outlined below:

|

Asset Backed |

|

|

Invoice Finance |

Originators in the invoice finance space will lend to an SME as either an advance on the value of an invoice where the invoice is used as collateral or will purchase the invoices from the SME and run credit risk against the organisation the invoice is issued against. |

|

Secured Term Loans |

This segment is a bank-like loan where the lender will require specific assets (most commonly property or business assets) as collateral against the funds being lent. The differentiating factors between a Fintech lender and a bank are generally the ease of application and a risk-based pricing benefit. |

|

Unsecured |

|

|

Prime |

Loans in the prime unsecured market are loans that are made to high-quality borrowers or those that are most creditworthy and are not secured by any assets. These loans have the lowest probability of default in the unsecured segment; thus the rates are generally the lowest in the unsecured space. The borrower will benefit from a clean credit record. |

|

Near Prime |

Near prime unsecured loans are a rung down from prime loans. The borrower may have had repayment issues in the past or a higher deemed risk due to a lack of credit history. |

|

Sub Prime |

Sub-prime unsecured loans are made to those borrowers who may have had difficulty maintaining a repayment schedule. These are the highest-risk SMEs in the unsecured market segment and the risk is reflected in the highest rates charged in the market. |

The Aura Core Income Fund aims to preserve capital and provide a stable monthly income through exposure to a diversified pool of Australian private debt assets, predominantly made up of small to medium enterprise loans.

If you would like to find out more, please visit the Montgomery website to download the Product Disclosure Statement:

If you have any immediate questions, please call the Sydney office 02 8046 5000 and speak to David Buckland or Toby Roberts.

1 Counts of Australian Businesses, including Entries and Exits

2 Australian Banking Association

3 Australian Government Productivity Commission – Small Business Access to Finance: The Evolving Lending Market Research Paper, September 2021

The Aura Core Income Fund (ARSN 658 462 652)(Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230). Montgomery Investment Management Pty Ltd (ACN 139 161 701| AFSL 354564) (Montgomery) is the authorised distributor of the Fund. As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Fund before making any decision about whether to acquire, or continue to hold, an interest in the Fund. Applications for units in the Fund can only be made through a valid paper or online application form accompanying the PDS. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from the Montgomery website: https://www.montinvest.com or from the responsible entity; www.oneinvestment.com.au/auracoreincomefund.

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

ACH, Montgomery and OMIFL do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.

Where information provided by Brett Craig, Portfolio Manager of the Fund, consists of General Advice, this is provided as an Authorised Representative (AR No. 001298683) of Montgomery.