Financial year to 31 May 2015

The Montgomery funds recorded solid results in the 11 months to 31 May 2015.

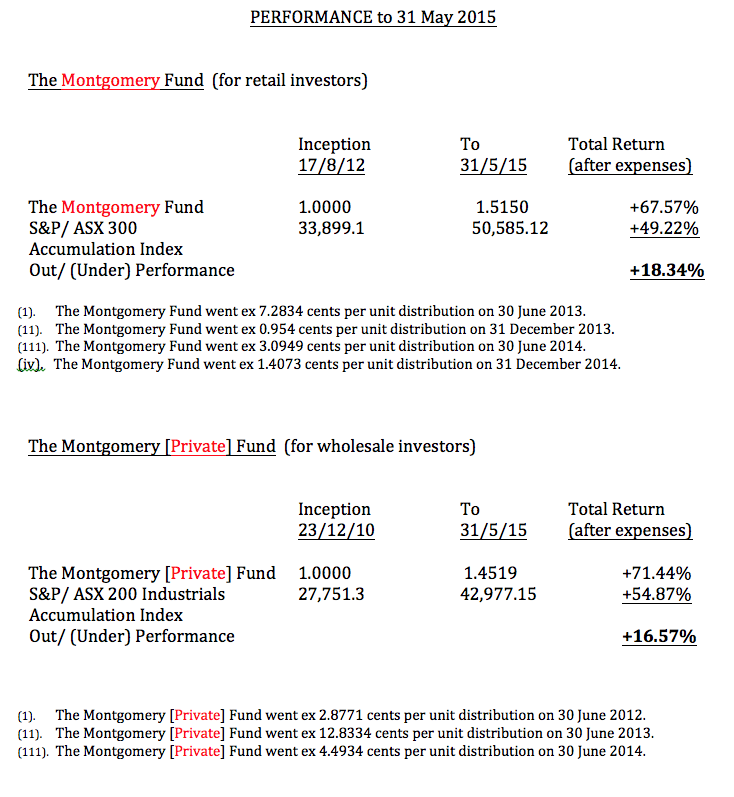

The Montgomery Fund was up by 18.89 per cent, outperforming its benchmark by 7.35 per cent. Over the period under review, the S&P/ ASX 300 Accumulation Index, which assumes reinvestment of dividends, was up 11.54 per cent.

The Montgomery [Private] Fund was up by 17.60 per cent, out-performing the broader market by 6.06 per cent.

In the period between inception (23 December 2010) and 31 May 2015, The Montgomery [Private] Fund has out-performed its benchmark by 2.55 per cent per annum, after expenses.

In the period between inception (17 August 2012) and 31 May 2015, The Montgomery Fund has out-performed its benchmark by 4.81 per cent per annum, after expenses.

Pleasingly, these results have been achieved when both Funds have generally maintained a significant cash weighting.

For those readers who may be having trouble understanding the difference between the total return and the unit price, can I please encourage you to read the following post, How Do We Calculate Returns?

Investors who either do not have the time or the inclination to follow the share market so closely, may want to consider outsourcing some of the management of their funds to Montgomery Investment Management.

Investors who either do not have the time or the inclination to follow the share market so closely, may want to consider outsourcing some of the management of their funds to Montgomery Investment Management.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Hi Roger and team

Outstanding result and the unite price is so stable

Disappointed to hear the new long short fund is 500k only as i cannot do that much and archive the desired diversification in my SMSF.

Why such a high barrier to entry ?

Thanks Tony. The reason is the very great challenges and longer wait times getting a more sophisticated strategy approved for what ASIC refers to as ‘retail’ investors.

congratulations.

hopefully the new global fund will perform even better

Roger

I wish to say how professional Fundhost is. It takes just seconds to answer a phone call and efficiency of informing client with a query is second to none IMO.

For Montgomery Fund itself, apart from good track record even the paper that Montgomery Transaction Confirmation is written on is of the highest quality. Am looking forward to Global Fund forms .To top it up David “loves” my town Hawks Nest :)

Best

Really appreciate the encouraging words and thank you for noticing the little details.