Exposure to the Generational Avalanche

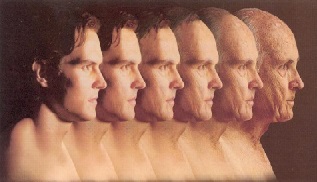

It is estimated that the number of people over the age of 70 will double in Australia over the 2006-2021 period. This “grey market”, or the Generational Avalanche as we refer to it internally, is going to fundamentally shape the landscape of the Australian economy.

In doing so, we feel that there will a number of opportunities for investors. You see, an ageing population will expect to see out their days in the quality of life to which they are accustomed – age does not change one’s desire for a high quality of life, community or independence.

While there are a number of Australian healthcare companies that are perfectly positioned for this growing market, only a handful are listed for us to take advantage.

In our portfolios we own; Ramsay Health Care Limited (ASX: RHC), which is the leading private hospital operator, CSL (ASX: CSL) which is at the cutting edge of biological advances, and Sirtex Limited (ASX: SRX), which has developed potentially game-changing medical devices to treat inoperable liver cancer. To this group, we have recently had a close look at the recent IPO of Japara Healthcare Limited (ASX: JHC), the 4th largest aged-care provider in Australia.

Japara is a business we feel has long-term structural tailwinds given its focus on caring for elderly Australians (aged care) and specifically, those who can no longer live independently. While Japara does not provide surgical services, it is typically compared to private hospital providers because the majority of its revenue is derived from fees. Fees are charged based on a variety of living arrangements, amenities, services, meal plans, social activities and care options (Respite, Dementia and Alzheimer).

Fees are predominantly sourced through a prescribed fee schedule termed ACFI, which bases reimbursement on the acuity of residents (acuity refers to the required level of a resident’s dependency). Higher standards of service comes with higher associated costs, and therefore higher fees. To protect residents the fees are regulated by the government, indexed to CPI and the facilities are audited regularly.

Large amounts of government funding is a positive in that it provides a high level of certainty over revenue (not earnings). But it is also a negative in that Japara is unable to exert pricing power, given the government regulates annual fee increases.

The industry also has heavy union involvement, which results in constant upward wage pressures. Given around 80 per cent of Japara’s expenses are wages, if the government chooses to limit fee growth below that of wage growth, then underlying margins / profitability can be impacted. It’s worth noting that over the past six years, the annual change in government funding for the aged care industry has been an increase of 9.2 per cent.

Another potential negative stems from the government regulating the amount of beds in the market. The number of beds has only grown by around 1.9 per cent each year, which means the market cannot grow organically at above system growth unless the Government says so.

These negatives have to be weighed up by the quality of the Japara’s assets, the surety of its revenue and the constant ongoing and rising demand for the business’ services. There is also plenty of room for acquisitions in a highly fragmented industry and the occasional Brownfield development provides further upside.

Another positive is the industry growth in bonding, whereby customers make an upfront payment towards accommodation. These accommodation bonds essentially provide the business with a zero cost of capital which can be used for many purposes, such as repaying bank debt, financing business operations and funding acquisitions. You can see why we at Montgomery Investment Management watch businesses within the Healthcare industry closely.

Upon listing, Japara’s share price increased by 35 per cent. Japara is a business with bright prospects, providing a quality level of care with the tailwind of an aging population. It is clear to us that such businesses will continue to receive high demand from investors.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Another in the medical services arena, is the seemingly high quality 1300 smiles ONT (it ranges A1-A3 recently) providing dental services. Government intervention, like the situation outlined with JHC, has been a problem too for ONT. Any comment Roger or others on this company and it’s prospects?

What about Resmed, you guys still holding it?

We own it (small) and its on our watch closely list.