Emerging Markets’ Bond Yields In A Massive Bubble

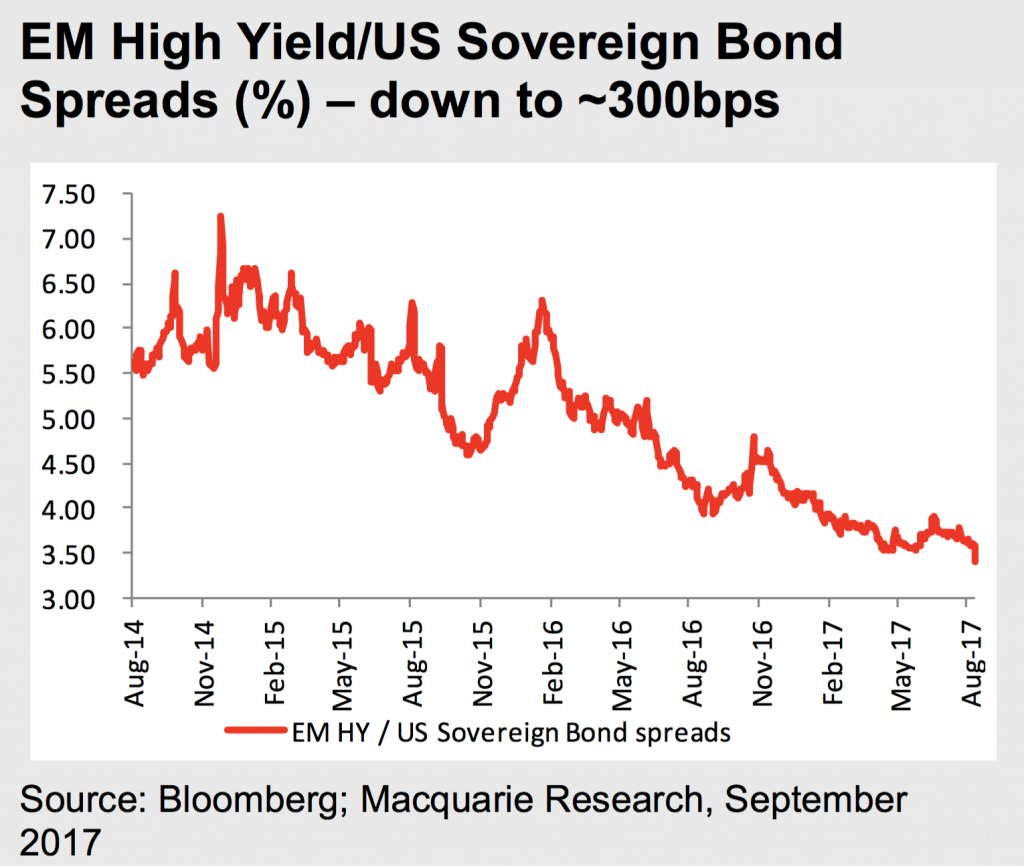

An interesting piece of research from Macquarie Equities came across my desk, illustrating the massive bubble we are living through. Despite the chequered history of many Emerging Economies, the spread on the yield on their sovereign bonds relative to US Bonds has come down from seven per cent to three per cent over the past three years.

Examples of the massive bubble of Emerging Market bonds include Ivory Coast and Senegal 16 year bonds yielding 6.25 per cent; Ivory Coast 8 year bonds yielding 5.125 per cent, Argentina 100 year bonds yielding 7.92 per cent; Greece 5 year bonds yielding 4.63 per cent; Iraq 5 year bonds yielding 6.75 per cent and Ukraine 10 year bonds yielding 7.3 per cent. For context, US 30 year bonds are yielding 2.7 per cent while their 10 year bonds are yielding 2.2 per cent.

While Central bank policy-makers threaten to withdraw, over the next 12-18 months, their US$100 billion per month bond buying program, the market has consistently gotten the timing of this normalisation process wrong. Every time there has been an economic or market wobble, Central Bank tightening has been delayed.

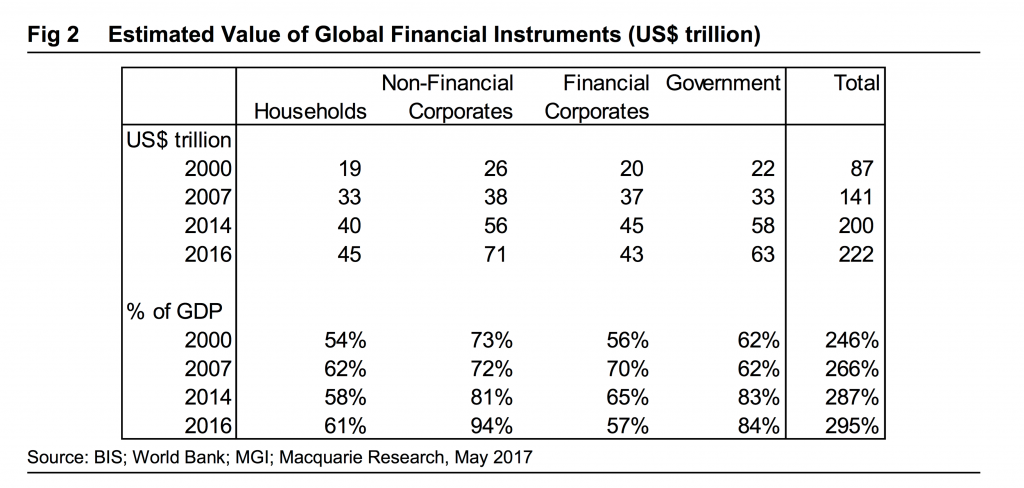

And with US economic growth now in its 100th month, Central Banks have relatively little ammunition if the world ever slumps back into recession. This point is accentuated as Global Financial Instruments have, so far this Century, been growing at twice the rate of Gross Domestic Product (GDP) and are now sitting at three times GDP. Viktor Shvets of Macquarie Research claims “We seem to require at least $3-5 of incremental financial instruments for every $1 of nominal GDP”.

With the frantic search for yield, the bubble has extended to sovereign bonds from the Ivory Coast, Senegal, Argentina, Iraq and the Ukraine. Investors need to be aware of the prospect for a decline in the supply of global liquidity from Central Banks and this, combined with the threat of a rising US Dollar, would likely see the spread on Emerging Economy sovereign bond yields reverse very quickly.

The bubble in bonds is not restricted to emerging markets. Its everywhere. The bond market is the biggest threat to the worlds economy. The governments cannot manage their budgets now. Imagine if they have to pay 5 or 6% interest on their massive debts. DEFAULT! One thing David that you have not pointed out is that these emerging markets have been forced to issue these bonds in US dollars. A rise in the US dollar will lead to a DEFAULT. The other issue is WHO has been buying these bonds. Pension funds looking for yield. This is the prelude to a massive pension crisis. These inexperienced individuals that run these central banks are completely clueless. They do not know what they are doing. Within the solution to every crisis lays the seed of the next crisis. These central bankers are caught in the cycle. Perhaps after this crisis we can get some people with real world experience not academics!

Hi Aaron, please read my articles of 26 September 2016 and 29 January 2015 where I discuss the incredible jump in Emerging Market indebtedness to GDP ratios over recent years; and the fact much of the debt is US$ denominated- so things will inevitably end badly when US$ interest rates rise, which now seems more likely with the FED’s normalisation indications – all part of the Great Central Bank Unwind. Thank you.

thanks

The socialist Keynesians will not stop until they blow the entire world up Venezuela style, its about time we jailed a few central bankers and maybe give the butchers or plumbers a go at running the system, I’m sure it’s not possible to do any worse that the current crop of criminals, the reality simply amounts to stealing from the productive people of the world and giving to the unproductive, this is sure to end well.