Economic data paints a mixed picture of the Australian economy

Recent data indicates that Australia could be about to enter a period of lower economic growth. While there’s been a surge in business investment and stronger conditions in the resources states, it’s unclear if this can offset weaker consumer spending and residential construction.

We have been talking about the potential for a deterioration in household spending power to negatively impact economic growth in Australia, and therefore company earnings, for a while now. Weak wages growth due to high levels of underemployment combined with record levels of household debt, a step up in non-discretionary household costs like electricity, and a bottoming in mortgage interest rates are expected to tighten the screws on household discretionary spending budgets over the next 12 months.

While there was what is likely to have been a blip in NSW building approvals in July, the residential construction cycle has peaked and is likely to be a drag on economic growth going forward.

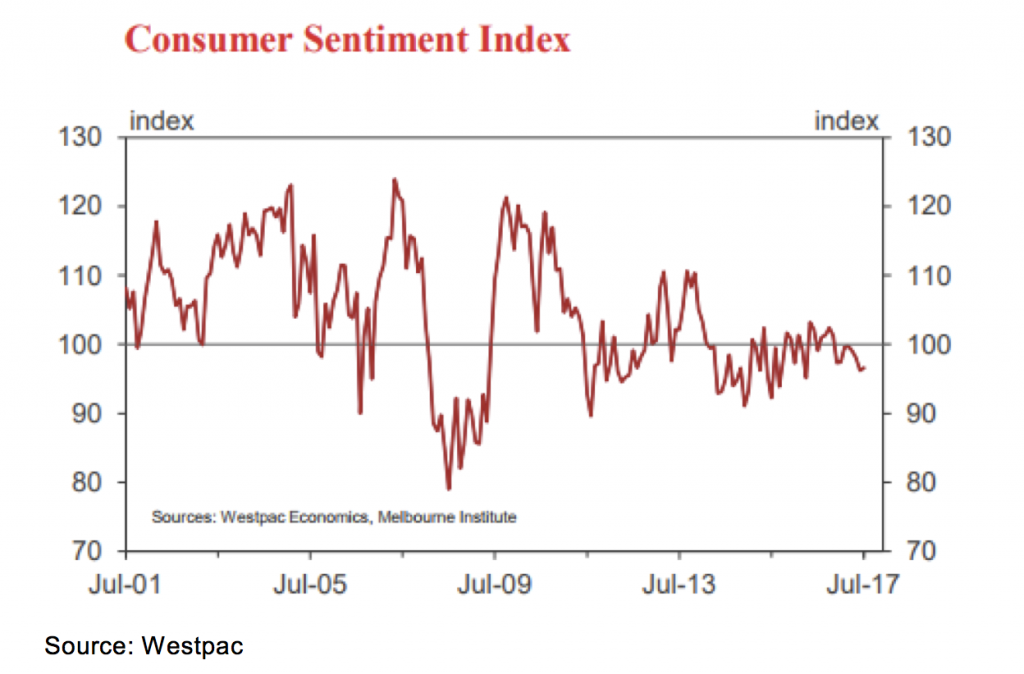

These concerns are reflected in the Westpac Consumer Confidence data, which shows that confidence has weakened over recent months. The consumer confidence survey indicates that there have been more pessimists than optimists on a net basis in Australia for the last eight months.

One of the components of the survey is an index of the householder’s outlook for their finances over the next year. Both this index and the index of current financial position have fallen relative to last year, and remain below a neutral position. Given this, it is unlikely that we will see a significant lift in consumer spending in the near term.

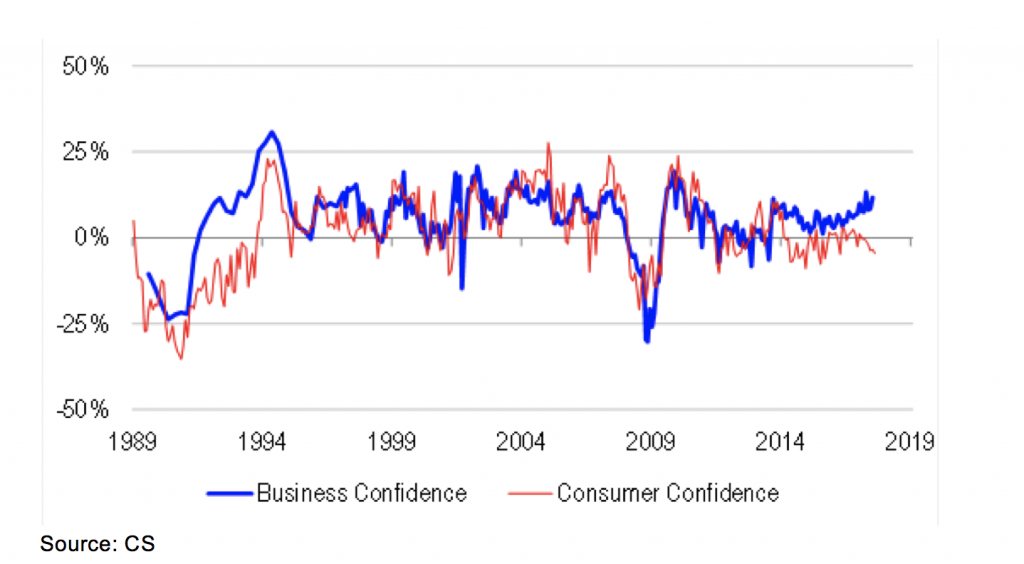

Despite the weakening in the outlook for consumer spending and residential construction, business sentiment, as measured by the NAB Monthly Business Survey, remains positive and has strengthened in recent months. The divergence in sentiment between the consumer and business is unusual from a historical perspective.

So why is this divergence occurring, and is it possible that a surge in business investment can plug the gap in economic growth that is likely to be left by weak consumer spending and residential construction?

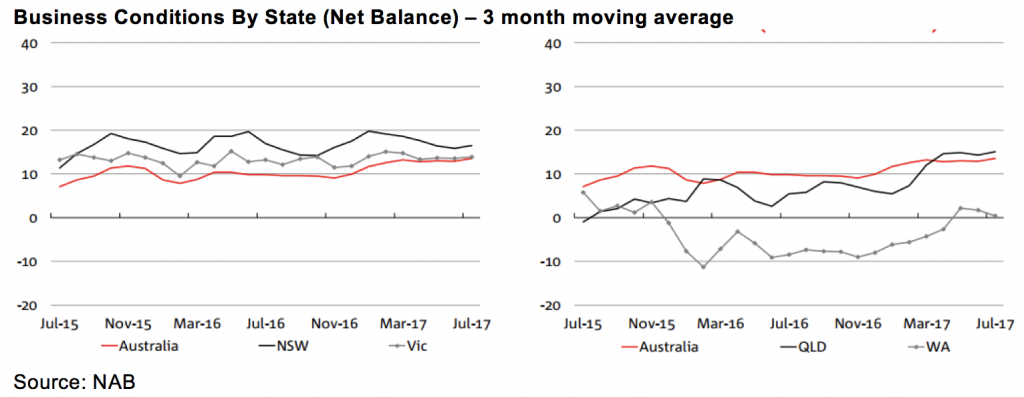

One of the explanations for the improvement in business sentiment has been the rebound in commodity prices like iron ore and coal. The results from the business confidence survey in WA and QLD support this with a recovery in sentiment in calendar 2017, albeit from levels well below the national average. By contrast, business sentiment in NSW and VIC has been flat to down in 2017.

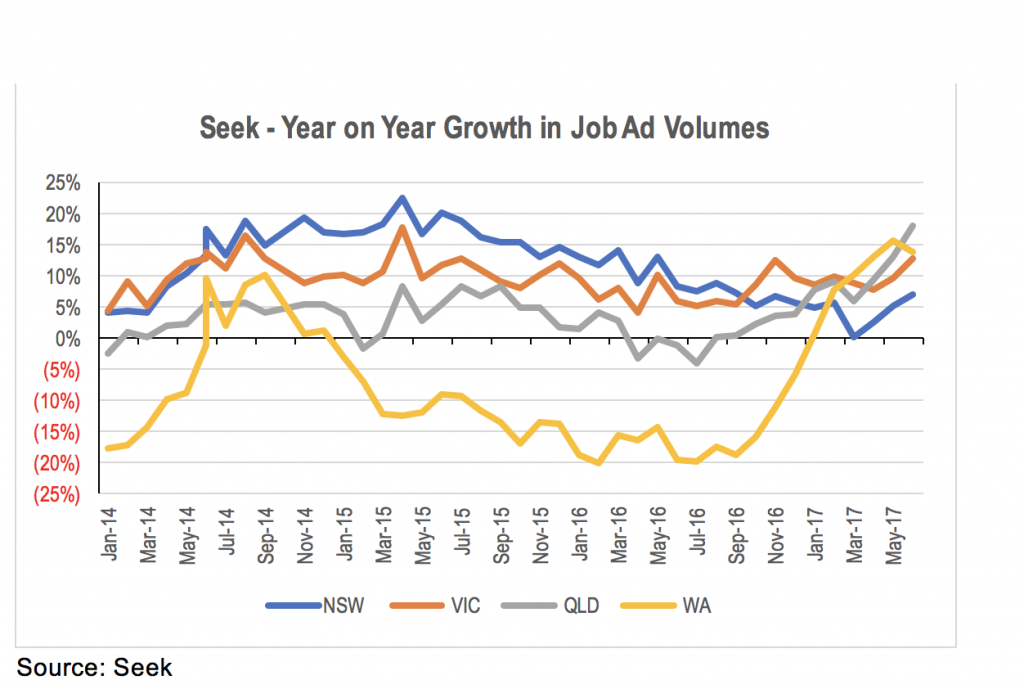

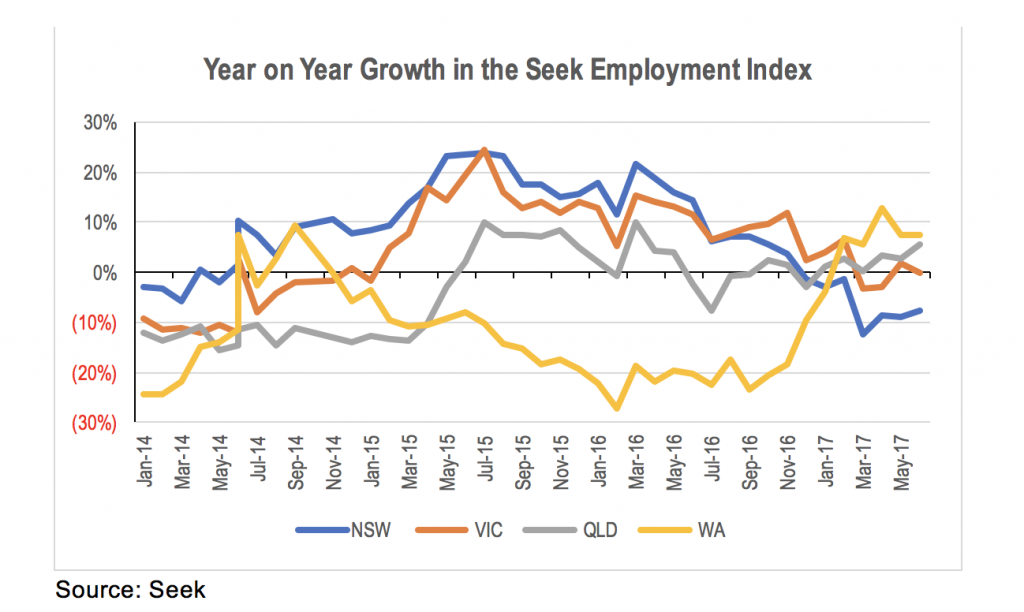

Rising commodity prices is seeing increased investment in the main resources-exposed states of WA and QLD. Evidence of this is shown through the growth in Seek job advertisement volumes in WA and QLD relative to NSW and VIC. While job ad volumes are still growing in NSW and VIC, the chart below shows the huge turnaround in the trajectory of job ad growth in WA and QLD since this time last year.

Not surprisingly, the Seek Employment Index, a measure of the balance between the supply and demand for jobs, similarly shows that the labour market in WA and QLD has tightened significantly in the last year. At the same time, the labour market balance in NSW has started to move back toward balance.

This suggests that economic conditions in WA and QLD might be starting to bottom, while the risk of a deterioration is in the states that benefited most from the residential construction boom.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY