Earnings expectations under pressure

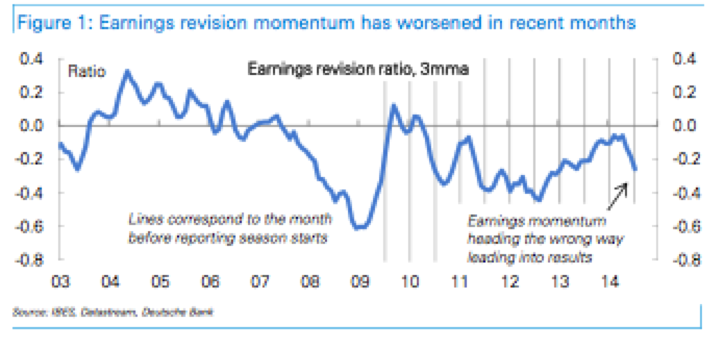

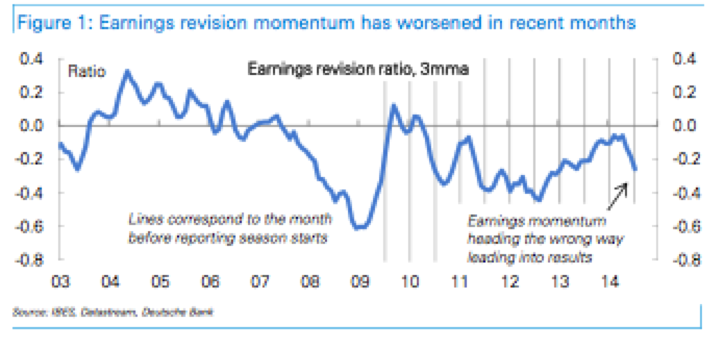

According to Deutsche Bank Research, earnings expectations for the Australian listed market have been cut in recent months. Forecast earnings growth for the year to June 2015 has come down to 6-7 per cent, slightly below expectations for the year to June 2014.

The softer momentum in earnings per share growth is attributable to weaker commodity prices – blamed on the cooling Chinese property market and flat year-on-year Industrial Production growth from the Euro zone; negative sentiment from the “tough” Federal Government Budget affecting near term spending; and the persistently high Australian Dollar/ US Dollar exchange rate.

While a mild improvement in revenue is forecast for FY15, there is an expected pick up in margins from ongoing efficiency and cost cutting programs. Record low interest rates are supportive of Merger and Acquisition activity, which has ramped up aggressively overseas.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.