Domestic retailers still control online game

Management consultant, A.T. Kearney claims the Australian supermarket duopoly will eventually come under attack from pure-play online retailers and packaged goods suppliers.

Reported in yesterday’s AFR, A.T. Kearney’s global consumer and retail consultant Michael Brown was quoted as saying: “What Woolworths and Coles offer is the convenience of the one-stop shop, but if online players start to siphon off pet care, heath and beauty… the more that gets siphoned off, the one-stop shop is not as important.”

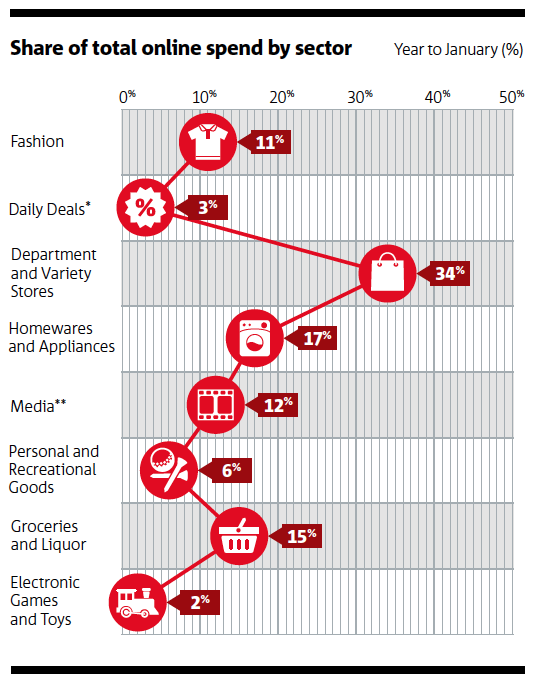

Online grocery and liquor sales represents about 15 per cent of the Australian market, however, we understand the grocery component accounts for just 2 per cent. Online grocery-only sales in the US is 8 per cent, and 12 per cent in the UK.

A.T. Kearney expects online grocery sales to eventually reach 20 per cent.

Online has already taken 34 per cent of the department and variety stores category, 17 per cent of the homewares and appliances category, and 12 per cent of the media category. Online spending in Australia approximates $15 billion per annum, which is about 6.5 per cent of the traditional retail market.

However, A.T. Kearney’s findings should be taken with a grain of salt: according to NAB, it’s the domestic retail giants (read: Coles and Woolies) that are continuing to dominate the market, controlling about 74 per cent of total online sales.

David, I question those numbers. My main gripe is: when you purchase something from, for example, eBay, whether it is a toy, media, fashion, etc., and you pay through the hugely predominant PayPal, how would NAB know what it’s for? The PayPal transaction is simply “$X to this person”.

PayPal is so ridiculously huge online that it would absolutely be skewing numbers.