Digital Income Class – October 2025 Performance Update

53 positive months out of 54, 22.52% p.a. since May 2021

In this video, I provide an update on the October performance of Digital Asset Fund’s Management’s (DAFM) Digital Income Class. Despite significant volatility in Bitcoin – rising to record highs before sharply retracing – the fund continued to deliver steady results, returning 2.72 per cent for the month. Because the strategy is market-neutral and driven by high-frequency trading algorithms that capture price spreads rather than take directional cryptocurrency exposure, October’s turbulence created additional trading opportunities. The month reinforced the fund’s ability to generate consistent, uncorrelated returns irrespective of broader market noise.

Transcript:

Hi there.

I hope you’re well.

I’d like to share a brief update on Digital Asset Funds Management or DAFM, Montgomery’s newest investment partner and their October performance.

DAFM’s Digital Income Fund Digital Income Class, which is the subject of this video, is a strategy I’ve invested in personally, and one that’s genuinely different from pretty much anything else you’ve seen.

The fund is a High Frequency Trading Fund, meaning DAFM uses algorithms to place thousands of trades per day and hundreds of thousands per month to capture fractions of a cent each time.

For example, they’ll buy a December Bitcoin (BTC) futures contract on one exchange and simultaneously sell the same futures contract on another exchange to capture the spread between the two. It doesn’t matter whether BTC goes up or down; they only place a trade if a profitable spread is available.

In October, Bitcoin surged to a record high above US$126,000, before falling sharply only days later to below US$105,000. And today it is trading at US$87,200.

Now, that sort of volatility makes headlines – but it’s important to remember the Digital Income Class is an investment in a market-neutral fund that takes no direct position in Bitcoin. When profitable-making opportunities appear – and October produced plenty – DAFM’s algorithms trade.

October’s volatility, helped the Fund deliver another strong month – up 2.72 per cent taking its 12-month return to 19.97 per cent .

Consistency and diversification

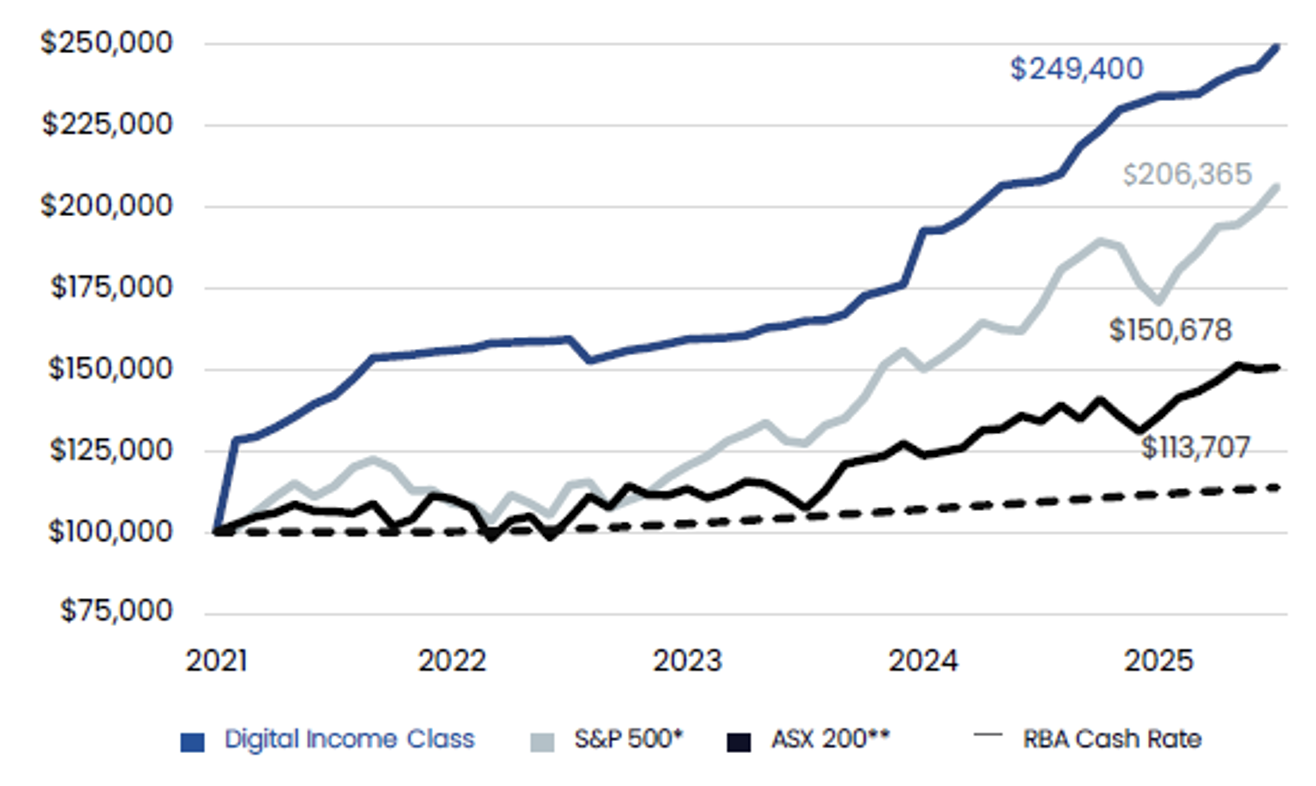

Graph 1: Digital Income Class vs. S&P 500*, ASX 200** and RBA cash rate performance ^

$100,000 invested and annualised return since inception to 31 Oct 2025

Source: DAFM, PinPoint Macro Analytics Macrobond, S&P Global.

Inception date: 1 May 2021. All figures are in AUD. Returns are net of fees and expenses and assume reinvestment of distributions.

^ Past performance is not an indicator of future performance. * S&P 500 Total Return Index in AUD. ** S&P/ASX 200 Accumulation Index.

You can see on this chart that since inception, in May 2021, the Fund has produced a 149.44 per cent total return or 22.52 per cent per annum, and while past performance is not a reliable indicator of future returns, the fund has generated 53 positive months out of 54.

Those uncorrelated returns are a big reason why this fund is a potentially powerful diversifier for a sophisticated or wholesale investor’s portfolio.

Resilience in Down Markets

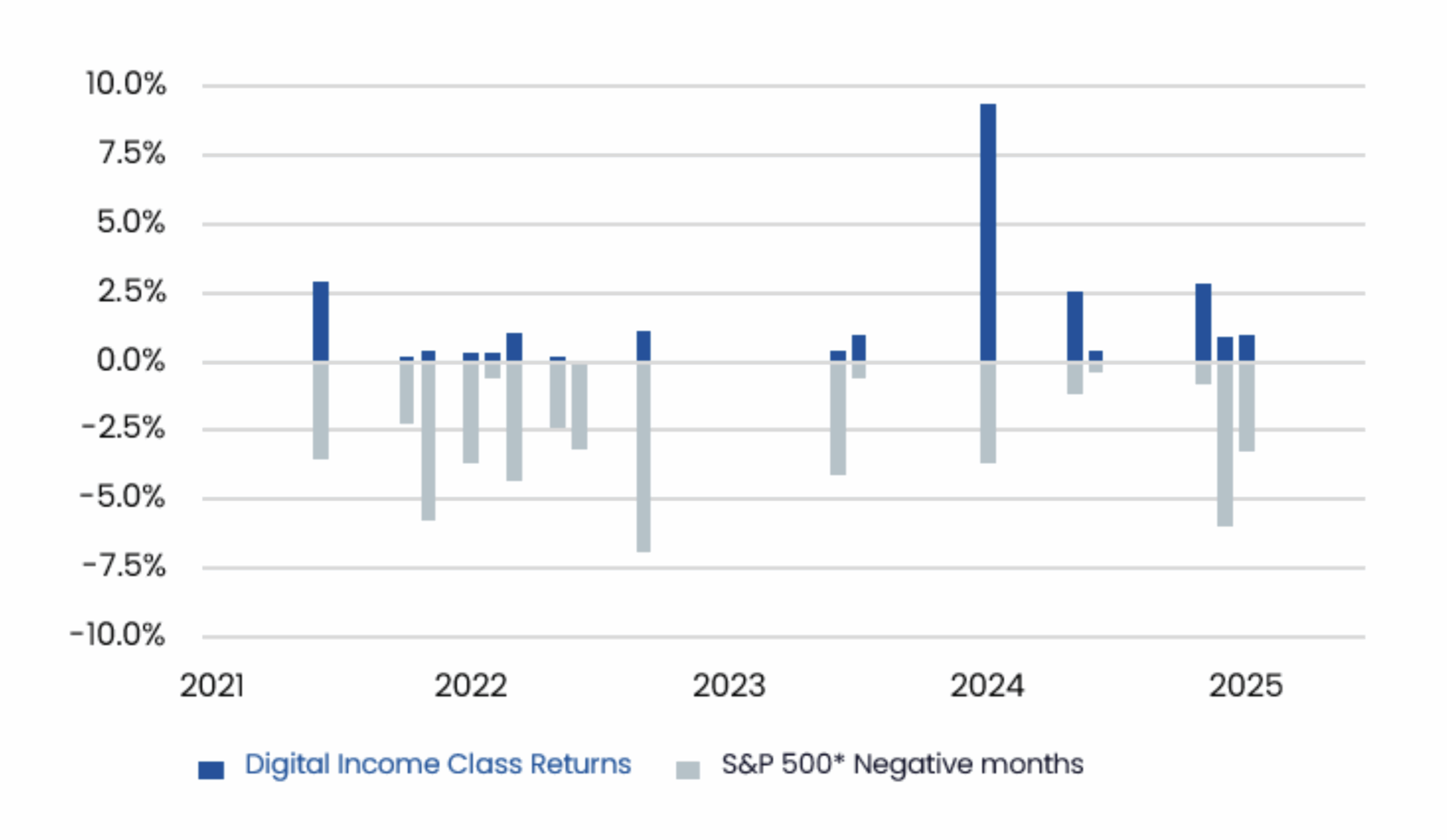

Graph 2: DIC performance in S&P 500* negative months ^

Source: DAFM, PinPoint Macro Analytics, Macrobond, S&P Global.

Source: DAFM, PinPoint Macro Analytics, Macrobond, S&P Global.

Inception date: 1 May 2021. All figures are in AUD. Returns are net of fees and expenses and assume reinvestment of distributions.

^ Past performance is not an indicator of future performance. * S&P 500 Total Return Index in AUD.

Here’s the diversification in action.

Remembering these are past returns, The Digital Income Class has generated positive returns in every single month the S&P 500 declined since inception. The same is true for the Australian ASX200. On average, the fund outperformed the S&P500 by about 4.5 per cent over those negative months.

To my mind that’s defensive, uncorrelated and diversified.

October again demonstrated the reason we’ve partnered with DAFM to bring you unique opportunities that can add real value to your portfolios.

At this time in history, it’s worth remembering The Fund is designed to take advantage of volatility, not be hurt by it – and in October it added to its track record of steady positive returns, irrespective of market noise. Please keep in mind past performance is not a reliable guide to future returns.

If you’d like to find out more about the Digital Income Class, please contact us on (02) 8046 5000 or investor@montinvest.com

IMPORTANT INFORMATION

Montgomery Investment Management disclaimer

This video may contain general financial advice that is prepared without taking into account your personal objectives, financial circumstance or needs. Because of this, before acting on any of the information provided, you should not act on any of the information provided without considering its appropriateness in light of your personal objectives, financial circumstance and needs, and should consider seeking advice from a financial advisor if necessary.

© Montgomery investment management Pty Limited. (AFSL no. 354564)

Digital Asset Funds Management disclaimer

Past performance is not indicative of future results. This information is intended for wholesale investors only and is general in nature; it does not take into account your objectives, financial situation or needs. Investing involves risk, including the potential loss of some or all capital. Before making any investment decision, you should consider whether the information is appropriate to your circumstances and seek independent financial advice.

The Digital Income Fund is managed by Digital Asset Funds Management Pty Ltd ACN 645 472 813, a Corporate Authorised Representative (001285765) of Quay Wholesale Fund Services Pty Ltd ACN 647 044 602 (AFSL 528526), which is the Trustee of the Fund. Montgomery Investment Management Pty Ltd (AFSL 354564) is the appointed distribution and marketing partner. Investors should read the Information Memorandum before making any investment decision.