Video hasn’t killed the movies (yet)

Disney will move its Disney and Pixar branded movies from Netflix to its own streaming platform in 2019. It’s not surprising that Disney is pursuing a direct relationship with the consumers of their content, but you may be surprised to learn that Disney still desires one middle-man to remain.

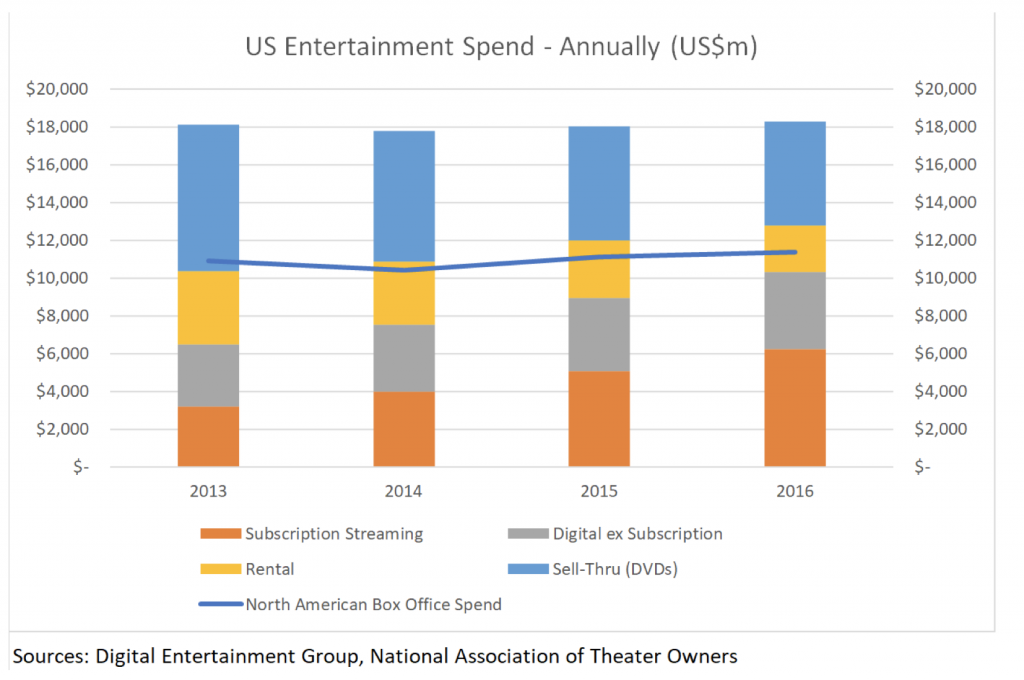

Let’s take a look at how Americans consume content. In 2016, US consumers spent $18.3 billion on Home Entertainment, and this spend has been relatively stable in the past 4 years. The share within this spend is changing rapidly though, with the spend allocated to subscription services like Netflix having doubled at the expense of DVD sales and rentals. Indeed, 2016 was the first year we spent more on online subscriptions than DVDs.

Yet amidst this disruption a relatively old technology has remained untouched, with the North American Box Office taking in $11.4 billion in 2016.

Disney acknowledges that their blockbusters are an important part of their earnings base. Consumers still crave the immersive experience of cinemas, and the strength of a title’s big screen launch will determine how lucrative its recurring earning stream will be (would Frozen have been as successful if Disney had put Let It Go directly to mobile?).

So while Disney’s pursuit of online streaming has been borne from our increasing consumption of mobile content, it seems that the theatre is still where the big money lies. This is why the theatre associations that serve as the middle-man of these blockbusters still wield considerable control over screening windows.

This may very well change in the future, but with Disney enjoying 6 of the top 10 grossing movies in North America in 2016, it seems this relatively old technology still has a place in this time of digital disruption.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Ben,

some good data for Oz:

https://www.screenaustralia.gov.au/fact-finders/cinema/australian-films