Darth Veda II – Return of the bid lord?

For a quick recap on our last post on Veda Group Ltd (ASX: VED), readers might want to revisit our blog here and the reasons we decided to exit our holding late last year.

To quickly summarise our thinking which still stands today, our view was simply that compared to the growth in earnings reported in 2014 (approximately 42 per cent), based on our modelling we estimated that an almost immediate slow-down in this trajectory would occur over FY15, FY16 and FY17.

Having just reported their 2015 result, we note that earnings growth indeed followed this path, and whilst 14 per cent growth is still an impressive result in an otherwise sluggish market in aggregate, we note that guidance for 2016 points to a further slowdown.

The slowdown is of course due to the material uplift in the amount the business needs to invest (and capitalising on the balance sheet) in order to develop the infrastructure required to support the industries move from negative to comprehensive reporting.

Thus, unless we see a reason why earnings growth will accelerate from high single to low double digits, we remain on the sidelines waiting for better prices to present given the need of a higher level of earnings trajectory to justify its market valuation.

On this point, we note the following in today’s Australian;

The Veda Group could be positioning itself to make a play for the $690 million iSentia Group. There have been suggestions that the $1.8 billion data analytics company may have run the ruler over the newly listed media intelligence provider in recent weeks.

Both companies have distanced themselves from the speculation, which leaves open the question whether discussions about a prospective deal happened at a deeper level of the organisations. Veda Group and iSentia were divested by Pacific Equity Partners and Quadrant Private Equity, respectively, through floats on the Australian Securities Exchange in buoyant market conditions.

Each has experienced a strong uplift in their share prices since their IPOs in the past 18 months. Last month, Veda posted a 13.8 per cent lift in its net profit to $55.7m and flagged that it was cashed-up for future acquisition opportunities.

Whilst both companies have naturally come out publicly and stated “there’s nothing to see here”, if we think about it further, a tie-up actually makes a lot of sense.

Veda is an amazing business and in our opinion of very high quality. It’s the clear market leader with much of Veda’s strength lying in its long standing / trusted-provider status and its incumbency with more than an 80 per cent market share. Further, Veda’s credit reporting systems are highly automated with the majority of service done online and also embedded into client decision and workflow systems, making them very hard to dislodge and giving them a highly scalable platform.

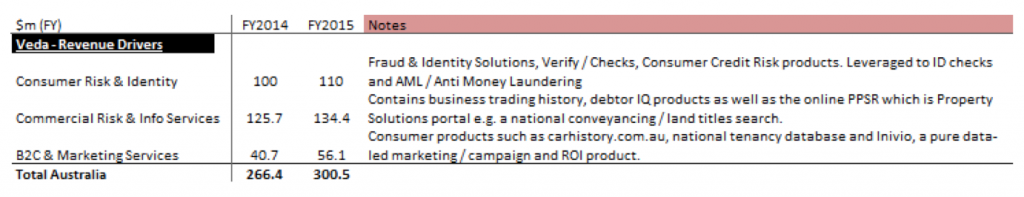

Outside of its core credit reporting bureau segment, the business has bright prospects in several other products it is developing, particularly Inivio, which is a fast growing segment of the businesses B2C (Business to Consumer) and Marketing Segment. The segment is also their smallest and could use some scale and product power to really get it moving;

Likewise, iSentia (ASX: ISD) is an extremely high quality business. iSentia’s core Australian and New Zealand business boasts around 90 per cent market share – about as close to a monopoly as you can get these days. Yet instead of its clients reluctantly dealing with such a powerful vendor, clients appear to love iSentia.

One of the reasons why customers love iSentia so much is the value they derive from the service. Not only are the current offerings (including real-time news monitoring, media database, integrated social media monitoring, reporting and analytics) valuable to customers; but iSentia actually works with customers on a collaborative basis to bring about new value-added-services. These are developed iteratively with the clients, then sold to the clients at higher prices. It’s a win-win for both iSentia and customers – which suggests the model is sustainable into the future.

This is perhaps evident in the fact that not only did iSentia report strong growth in 2015 of 44 per cent, but with the mix of their core-organic growth guidance and the recent acquisition of King Content, we are expecting mid-20 per cent earnings appreciation for the 2016 financial year. A standout Australian growth business.

Therefore not only would a tie-up lead to higher growth rates for Veda Group overall, its worth noting that given iSentia offers over 5,000 clients a proprietary cloud-based media monitoring tool that captures and interprets content from over 5,500 mainstream media outlets – including TV and radio; 50,000 online news sources; and 3.4 million user generated content sources, such as Facebook, Twitter and China’s Weibo. Indeed, iSentia collects and interprets around 8.5 million news stories per day, something iSentia is able to capture and interpret in near-real-time.

Think about it – if they were to get together, not only could the merged entity continue to inform its clients of how conversations are evolving real time, but any trending content could be turned into powerful marketing pieces or even to modify marking campaigns on the fly and redirect that activity accurately targeting potential customers as identified via Veda’s Invivo product, connecting the final piece of the puzzle.

Ininvio is Veda’s pure-data driven marketing solutions application which has 40 years of data on both businesses and individuals. The product is growing in penetration given its superior data power and analytics and appears to have great prospects. Just imagine the power of redirecting content, measured and monitored in real-time via iSentia being matched and redirected / connected to client and customers that matter, when it matters most – maximising their relevance and minimising their marketing services and hence return on investment. Extremely powerful stuff.

It makes sense to us that Veda eventually lobs a bid and combines these two high-quality power houses. Let’s see how this one develops.

The Montgomery funds own shares in iSentia.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

VED last week officially declared no interest in ISD to the ASX. For this statement to be issued and not correct it would be considered illegal in a full disclosure scenario to shareholders.

I think you can see that although there is growth in the need for their services, they need to find other methods where they can provide more detailed analytics.

If you can imagine the tools to scrape a variety of media and feed that directly into someones database, it would be a very valuable tool

When you’re doing a risk and compliance check for a new client, and not only can you verify their identity, but check out the news media for what they may or may not have done in their past, it gives a more accurate intelligence perspective on your customer. That’s something in this world of Anti Money Laundering and Counter Terrorism Financing that would be of real value.

DowJones already has a service which they have for Risk and Compliance http://new.dowjones.com/products/risk-compliance/ – you tie iSentia up with an identity and credit reporting tool and that’s actually something that has real value to any business that has large value clients where rep risk is big.

Hi Lucas, excellent thoughts – thanks for sharing. Theres alot of synergies with combining the two businesses – it would be a game changer for both of them and boy, what a business!

they have announced a denial to the ASX

If you wanted to buy something, would you rather you said to everyone that, ‘absolutely, I have no interest in that whatsoever’ and be seen as OK, nothing to see here.

Or would you want to shout from the rooftop that yep, we are interested and in doing so invite competitive tension and in doing so likely have to pay a higher price?