Could new technology threaten bank profits?

Forget the Royal Commission. An even greater threat to Aussie banks lies just over the horizon in the form of new high-tech competitors that can price financial products at levels that our banks find impossible to match.

The Royal Commission has monopolised the market’s focus regarding the banks over the last few months. There are likely to be some enduring implications for the major banks in terms of increased regulatory impediments to their competitive positions, and potentially some ongoing brand equity damage.

However, the challenges confronting the major banks extend well beyond the implications flowing from the Royal Commission. One of the issues we believe gets little focus but has major implications for the long-term outlook for investor returns is the potential for technology to dramatically change the cost of financial products over the next 5 years.

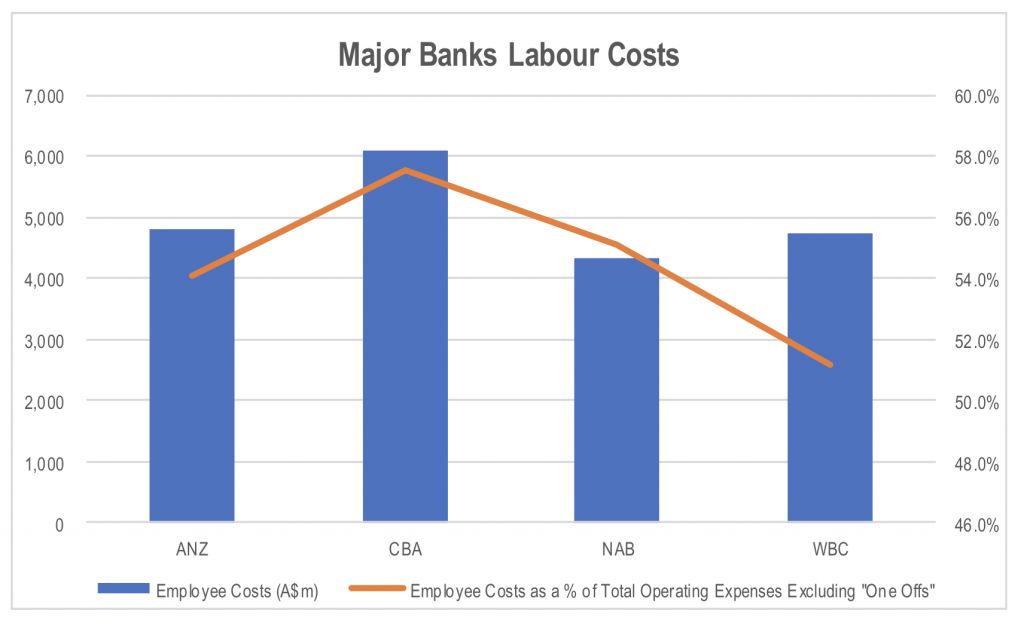

Labour related expenses make up just over 50 per cent of the cash operating cost base of the major banks, with an aggregate annual cost of A$20 billion over the last reported 12 months of reported results.

Source: Company results

A large proportion of the labour costs relate to the middle and back office processing of transactions, which, despite the heavy investment by the banks in technology over the last five years, remains a very manual process. Improvements in the capabilities of technology through continued advancement of artificial intelligence will progressively provide an alternative to manual processing of transactions, leading to significant improvements in speed and a reduction in errors, while reducing costs.

Given the scalability of technology relative to human labour, the cost base becomes incrementally fixed rather than variable. This also has the potential to radically change the competitive dynamics of the market because the incremental profit generated from the extra dollar of revenue is significantly higher in a business with a predominantly technology delivered product base. A shift in thinking from pricing products on the basis of average costs to marginal/incremental costs could see the price of financial products fall dramatically, materially reducing the profit pool for the industry.

The high variable capital requirements that are set for Authorised Deposit-taking Institutions (ADIs) by regulators will continue to put a floor under loan product pricing, but the component of pricing that reflects the current high marginal cost of middle office staff is likely to come under significant and sustained pressure as technology replaces the bulk of these costs.

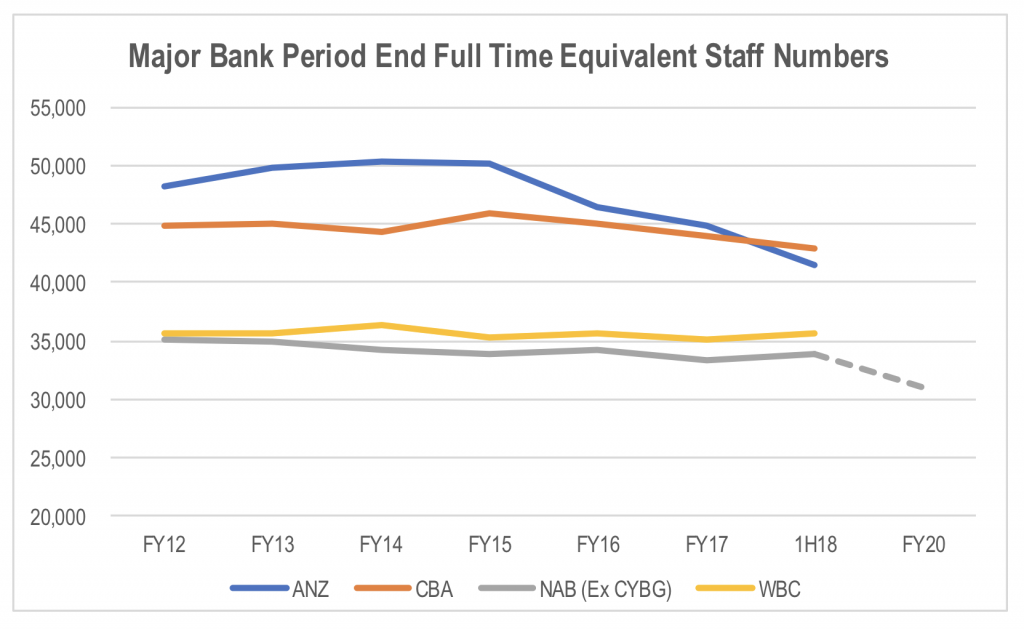

Late last year, NAB announced plans to cut 6,000 Full Time Equivalent (FTEs) positions from its head count over the next 3 years as it steps up its annual investment in technology, automation and its internal capabilities by around 50 per cent. While the headcount reduction would be offset by the addition of 2,000 new roles, the net 4,000 reduction in FTE’s equates to around 12 per cent of NAB’s total employee numbers as at the end of FY2017.

Over the last 5 years, the number of full time equivalents employed by the major banks has been relatively flat. The exception has been ANZ which has scaled back its previous expansion into Asia and Institutional business.

Source: Company results

Technology offers cost reduction potential that would step change the productivity of banking operations. However, it also presents a competitive threat in that it could allow a new competitor that starts with a clean sheet of paper to build an operating platform that, upon achieving sufficient scale, can economically price products at levels that cannot be matched by the banks in their current form.

The question is whether the major banks can restructure their operating cost bases and processes quickly enough to prevent any new entrant from reaching a scale position and fundamentally changing the competitive landscape in Australian banking.

The Montgomery Funds own shares in the Commonwealth Bank of Australia and Westpac. This article was prepared 14 June 2018 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade the Commonwealth Bank of Australia or Westpac you should seek financial advice.

Forget the Royal Commission, an even greater threat for banks lies in the form of new high-tech competitors. Share on XThis post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

I think it’s just inevitable that the banks will be Ubered and should be so as soon as possible, it’s just redicules how they have become such a large part of the economy and the stock market capitalisation and yet produce nothing, and only facilitate capital flows. They are a truly protected species in the economic ecosystem, they take huge risks with other peoples money and then socialise their losses using government bailouts, this is still the case today as the Australian government guarantees all deposits under $250000 in most banks, and they unashamedly point that fact out to you when selling you a term deposit account. I say selling because they give you less than inflation and then you are taxed on the money you actually lost in the process.

And inspite of all the butt wiping they receive from government, they still resort to thieving from the public as the royal Commission has shown.

They are the only so called business that can legally lend out money they don’t have and charge interest on it, if I were to try that I’d be jailed for counterfeiting money. They call it extending a facility, yes a “facility” they conjured out of thin air with the stroke of a keyboard.

And that “facility “ makes my hard earned deposit nearly worthless to them .

Please someone Uber the banks ASAP.

Recently in your blogs, I have been seeing “not so positive commentary regarding banks” from Montgomery Funds personnel and yet you hold banks in your funds. Why?

Hi Yavuz, That’s a good question. The composition of the portfolio is determined though an examination of both risk and return outlook in the context of the investable universe. While the blogs often cite the negatives, this is essentially an examination of the risks of an investment. Just because owning a company’s shares involves risks, it doesn’t mean it’s a poor investment per se. The risks need to balanced against what is priced into the stock to determine the return outlook. As the share price falls, the potential return increases, providing more of an offset to the assessed risks. Additionally, these risks need to be assessed in the context of the risk exposures within the broader portfolio, and the investable universe. Because risk is a function of uncertainty, the amount of return required to mitigate it is not a single number. So as the potential return increases (through a reduction in the share price), the size of the position should be adjusted to reflect the increase in return. What I would add however, is that the 30% weighting toward the major banks in Australia equity index funds means that investors in these funds are taking a very large bet on the banks without necessarily recognising their exposure.

Isn’t this a good thing for banks? Pardon me but I’m confuse why this is threatening to banks. Seems like a good opportunity for banks to cut costs specially in this environment.

Hi Dylan, it is possible that the opportunity to reduce costs through technology is a good thing for banks, but the size of the task ahead and the slow and inefficent way that such bureacracies move means that there is a risk that new businesses/banks/financial companies that are able to start out with this lower AI driven cost base, could have the time to grow and become a credible competitive threat to the current oligopoly structure

“A large proportion of the labour costs relate to the middle and back office processing of transactions, which, despite the heavy investment by the banks in technology over the last five years, remains a very manual process.”

The labour intensive parts of the business, I guess would, be the parts that don’t make much money anyway. I guess that everyday face to face operations are mostly useful in that they facilitate the possibility that a consumer might take out a home loan with that bank (I am guessing that’s where the money is made.

I am guessing that the labour involved in issuing and maintaining home loans is not much in the scheme of things anyway? Probably not much backroom work done as mostly automated process.?