Copper traders have been TACO’d

Most of the time, prices for a security or a commodity trade in fairly narrow bands. Sure, prices trend because information isn’t distributed universally, and it takes time and confirmation for people to buy in or sell out, but on a daily (or even weekly) basis, price ranges and volumes are generally pretty narrow.

A few times every decade, however, you will experience or witness some truly epic moves over very short periods of time. When you see these, it may be helpful to be positioned with cash and access to research. I am not sure if the latest ‘epic’ move turns out to be one of those opportunities, but I do believe it is worthy of further attention. And like I said, they only happen a few times in a decade.

The latest edition of an epic move has just occurred in the copper market, where traders arguably correctly picked the tariff but not the product.

The White House read as follows:

On July 30, 2025, President Donald J. Trump issued a Proclamation under section 232 of the Trade Expansion Act of 1962, addressing a “national security threat” posed by copper imports. Based on a June 30, 2025, report from the Secretary of Commerce, the proclamation finds that copper imports in current quantities and circumstances threaten to impair U.S. national security by weakening domestic production and increasing reliance on foreign sources.

The Key Findings were that copper is critical for defense systems, infrastructure, and industrial applications due to its conductivity and durability. That U.S. copper production has declined significantly, with a single foreign country dominating over 50 per cent of global smelting and refining. And, that unfair foreign trade practices, global overcapacity, and domestic regulatory burdens have reduced U.S. competitiveness, creating vulnerabilities in supply chains and industrial resilience.

Effective 1 August 2025, a 50 per cent tariff will be imposed on imports of semi-finished copper and intensive copper derivative products, in addition to existing duties. A process will be established within 90 days to identify and apply tariffs to additional copper derivatives.

The Secretary of Commerce will monitor imports and assess the need for further actions, including a proposed phased tariff on refined copper (15 per cent in 2027, 30 per cent in 2028).

Domestic sales requirements for copper input materials and high-quality copper scrap will be implemented under the Defense Production Act.

The objective of the proclamation is to increase domestic copper production to reduce foreign dependency, strengthen supply chains, industrial resilience, and the defense industrial base, and promote investment, employment, and innovation in the U.S. copper sector.

Consequences

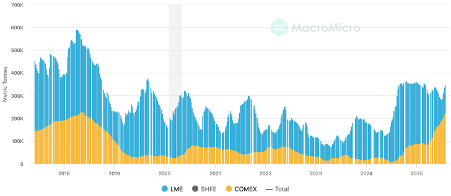

Up until this point, and as Figure 1., reveals, physical copper traders had been importing huge tonnages of copper into the U.S. ahead of anticipated tariffs being imposed by Trump.

Figure 1. World Copper Inventories of LME, SHFE & Comex (cumulative total)

Source: MacroMicro

Figure 1, in yellow, shows the acceleration in U.S. (Comex) inventories as traders front-loaded purchases ahead of expected tariffs. According to Bloomberg reporters, “For months, traders had fallen over one another to ship copper to the U.S. to capture sharply higher prices. They rapidly built up a stockpile worth more than US$5 billion spread across U.S. ports – particularly New Orleans, which has improbably become host to the world’s largest exchange copper inventory.”

The result of all this buying was a massive premium in the price of copper traded on Comex/CME compared to the London Metal Exchange price. And that created the most profitable arbitrage in the careers of many veteran copper traders, buying in London and selling in the U.S.

Trump (always) chickening out (TACO), and The White House proclamation – that tariffs won’t be immediately imposed on refined copper ‘cathodes’ – has put an end to that arbitrage, with the premium for U.S. copper now collapsing, as shown in Figure 2.

Figure 2. Premium for U.S. copper collapses after tariff surprise

Source: LME, CME Group

The collapse in the spread is the result of the collapse in the price of Comex High Grade Copper Futures from circa US$6.00/lb to less than US$4.50/lb in two days. The more than 25 per cent drop has taken the copper price back to levels traded four years ago.

Contrary to prevailing expectations that the new tariff regime would encompass the entire copper supply chain, refined copper, cathodes, ores, and concentrates were notably exempted from the imposed duties. Trump’s 50 per cent tariff applies only to semi-finished copper goods, which include pipes, tubes, cables, and electrical components.

The resultant evaporation of the key arbitrage driver and the collapsed price means the U.S. faces an inventory glut of an estimated several hundred thousand tons, which will need to be liquidated.

In the medium-term, demand is positively influenced by estimated Chinese consumption growing eight per cent annually thanks to demand from appliances and auto manufacturers, and improving global purchasing managers’ indexes reflecting a recovery in industrial demand. On the negative side, U.S. tariff fears may have pulled demand forward, which could weigh on the second half of the year’s demand.

Meanwhile, on the supply side, it’s worth noting that Chilean exports, which represent 25 per cent of global supply, are up six per cent, analysts note Peru’s exports are down four per cent and licensing issues constrain Indonesian exports. And globally, delays in investment decision making have generally hindered supply growth.

Longer term, analysts at Barrenjoey believe deficits are emerging, noting the copper market has now endured 30 months without a major new project commissioned, a trend that could result in shortages in two to three years.

My take

Every decade, a few market moves are so dramatic they force you to sit up and take notice.

I remember, for example, during the COVID-19 lockdown period, when crude oil futures traded at negative prices (Figure 3.). Friends called me then and asked what, if anything, they should do. I responded rather flippantly, ‘empty your swimming pool and fill it with petrol!’ By that, I meant they should ‘back the truck up’ because prices for oil wouldn’t remain negative for long. Two years later, prices peak, having risen six-fold.

Figure 3. West Texas Intermediate crude oil future prices 2020 ($/Barrel)

Source: EIA

The world isn’t shrinking. The current global population of eight billion people is expected to grow by 25 per cent to 10 billion people in three decades. Historically, these forecasts have almost always been exceeded.

Nobody is suggesting you buy and hold copper futures for thirty years, but you might not have to. Demand for all metals will rise over the coming decades – copper included – and investors only need the current extremely negative narrative and sentiment to shift marginally from where it now seems to lie. Today’s copper price tantrum has the hallmarks of being temporary.

Of course, there is no price floor, and the price could fall further, but an arguably more relevant question, if you believe demand for copper will grow in future years, is what rate of return, over the next three, five or ten years, an investment in copper will produce.