Pleasing results for Fisher & Paykel Healthcare

Fisher & Paykel Healthcare (ASX: FPH) reported pleasing numbers for FY16, but analysts that solely reference the company’s presentation may under appreciate the company’s earnings potential.

Fisher & Paykel Healthcare manufactures products that humidify gases for hospital patients and help sleep apnea sufferers breath at night. Their devices use a lot of high-margin consumables, and management is focused on increasing the penetration of consumables within its installed base. In conjunction, the company is expanding its production in Mexico, which is relatively cheaper than New Zealand, and has recently moved to a direct distribution model in the US with minimal disruption. All of these factors should contribute to margin expansion over time, and this forms a central part of our investment thesis.

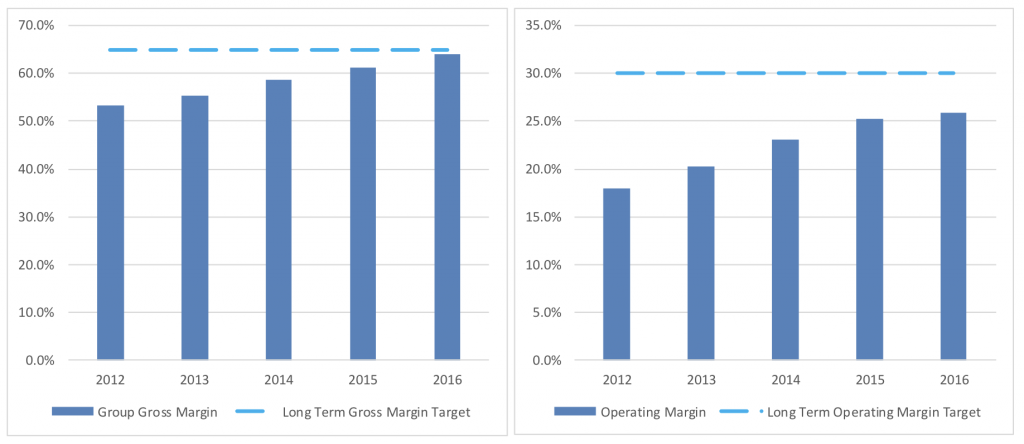

On the FY16 Conference Call, management shared plans to expand constant currency Gross Margins by 100 to 200 basis points per year over the next few years. Yet when you examine FPH’s full year presentation, the reported FY16 Gross Margin is broadly in line with management’s Long-Term Target. How can this be?

Well, in FY16 Fisher & Paykel Healthcare benefited from a significant decline in the New Zealand dollar against major currencies like the US Dollar and the Euro. As such, the company’s Constant Currency Gross Margin for FY16 was 61.6 per cent, versus the reported margin of 64.0 per cent.

Management is referring to these Long-Term Margin Targets as what could be achievable in any exchange rate environment. This means that should current exchange rates remain unchanged, then Gross Margins should increase materially above 65 per cent, and the implications for the Operating Margin should be even more pronounced with operating leverage.

Analysts that solely reference the reports and presentations to shape their long-term margin expectations may under appreciate the company’s earnings potential, which could result in a market divergence while we remain happy holders.

Ben MacNevin is an Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY