Coming to a bank near you…

ANZ has announced that it has signed an agreement with Google for ANZ customers to be able to upload their credit and debit accounts to Android Pay. This will allow customers to use ANZ accounts to make contactless payments for goods and services. ANZ expects to begin offering access to Android Pay by mid 2016, and will also be able to provide contactless payments through its own app on Android phones (allowing it to retain 100 per cent of the interchange fee if it can convince customers to use its app rather than Android Pay).

Note that CBA already provides an Android app that allows its customers to perform contactless transactions with an Android phone. WBC customers can do the same on its app with some Android phones. NAB and ANZ don’t offer anything at present.

The major banks have resisted the pressure from Apple and Google to allow customers to utilise Apple Pay and Android Pay in Australia on the basis that the fee the service providers wanted as a percentage of the transaction value was too high given Australian interchange fees are lower than in the US. In the US, Apply Pay charges a 15bpt interchange fee. This effectively comes out of the bank’s 100bpts overall fee charged to merchants.

In Australia, the interchange fee is around 50bpts. Despite this, Apple is still pushing for a 15bpt fee on Apple Pay transactions.

This is a fight that has been going on for over a year. Apple Pay made its first incursion into the Australian payments system last month with the announcement that Australian Amex customers can now utilise Apple Pay, but only on Amex issued cards (ie not on Amex cards issued by banks).

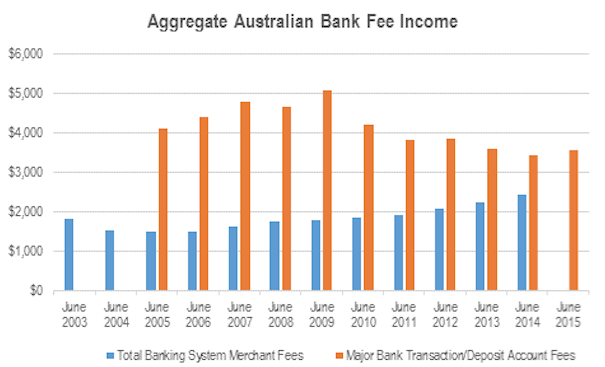

Transaction fee income is high return and scalable for the banks. According to APRA, the major banks generated around A$3.6 billion in total transaction and deposit account keeping fees in the year to June 2015. The majority of this is transaction fees. This revenue line has been under pressure over the last few years due to various legal disputes and PR issues around excess penalty fees, but interchange fees have been a source of fee growth. Additionally, the RBA has been actively pushing for reductions in the interchange fee. So adding Apple Pay and Android Pay to the system will further reduce bank fee revenue growth on top of any downward pressure on interchange fee rates. Note that the 15 bpt Apple Pay fee would amount to around A$422 million of the A$2.4 billion of total merchant fee revenue generated by the banks in FY14 if applied to all transactions. In reality it would only be a proportion of the total transactions given around 60 per cent of transactions in Australia are contactless at present (but increasing).

Note that the 15 bpt Apple Pay fee would amount to around A$422 million of the A$2.4 billion of total merchant fee revenue generated by the banks in FY14 if applied to all transactions. In reality it would only be a proportion of the total transactions given around 60 per cent of transactions in Australia are contactless at present (but increasing).

Ultimately it will be the customer that determines whether the banks will need to give in to Apple and Google, resulting in additional players taking a cut from transaction fees. The move by ANZ indicates that there is mounting pressure. The development of apps by each of the banks will be seen as a means of reducing the threat, but ultimately consumers will opt for the simplest solution. This is likely to be an Apple Pay or Android Pay in which accounts across banks can be stored and utilised in a single app.

The big change will occur if (when) the banks eventually give in to Apple given the penetration of the iPhone in Australia. But this is yet another area of threat to bank returns and profit growth, with pressure on fee income shifting the mix of residual earnings toward more capital intensive and less scalable returns from lending.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

hey, sorry im late to the party on this one, maybe the horse has bolted.

But I think AmEx are under attack from all sides and I think that the deal with Apple Pay is going to be irrelevant, as the network effect will demand that Apple capitulates and allows MasterCard / VISA onto it.

These interchange fees and merchant fees and network fees, they’re quite lucrative. There are barrier to entry but with a market size in the billions there’s obvious motivation for people to compete these margins away. AmEx just needs to find its way onto more platforms otherwise it will find itself more and more marginalized as it becomes less and less relevant.

Great article Stuart! I suspect that once a few more of the foreign-owned subsidiary banks (i.e. ING, HSBC etc) give in and offer Apple Pay the avalanche of consumer take up will be such that the major aussie banks will fold and offer it was well. Of all places throughout the world it is most likely to happen here due to the high penetration of iPhone.

Using my Amex more and the bank MasterCard less since Apple Pay introduction.

Older shop assistants seem to think it is some kind of witchcraft.

I must admit I have been doing the same. There is definitely a novelty factor to tapping the phone on the EFTPOS machine. The added security of fingerprint recognition on the iphone to approve the transaction is also a plus over the tap and go credit card which can be used by anyone.