Montgomery News and Updates

-

Another Montgomery Investor Wins

Roger Montgomery

October 15, 2013

Australia, it is said, loves a winner, and I must confess it would be irrational at Montgomery for us to celebrate anything less. Our investors should demand, over the long run, a series of wins that compound to maintain or increase their purchasing power. That’s our job and so we aren’t backwards in coming forwards when we ourselves rank Number #1 or Number #2 in the fund manager rankings – as has been the case recently. continue…

by Roger Montgomery Posted in Montgomery News and Updates, Value.able.

-

The Montgomery Fund – a nice 13.44 months

David Buckland

October 5, 2013

The Montgomery Fund was designed for retail investors with a minimum initial investment of $25,000. continue…

by David Buckland Posted in Montgomery News and Updates.

-

Best of the Best magazine

Roger Montgomery

September 12, 2013

This month’s edition of Best of the Best, our new digital magazine for Montgomery investors, is on its way. If you’re a Montgomery investor, look out for it in your inbox today.

by Roger Montgomery Posted in Montgomery News and Updates.

-

The Australian

Roger Montgomery

August 27, 2013

We at Montgomery were delighted to be featured by The Australian’s Andrew Main in the Wealth Section this week. In an article entitled “Power team looks to long term for competitive advantage” and Photographed by Nikki Short, we enjoyed giving the leather wingback a tour of the grounds – as you can see.

by Roger Montgomery Posted in Montgomery News and Updates.

-

Thanks M

Roger Montgomery

August 21, 2013

When you become a Montgomery investor, it’s not just about the returns – albeit they’ve been pretty good. Ensuring you understand how to make the most of your newfound freedom and time, and making sure you know my mobile phone number so that you can call at any time with a question, are just as important. Indeed, in the final washup, it’s all about relationships. continue…

by Roger Montgomery Posted in Montgomery News and Updates.

-

The Montgomery Fund celebrates its first birthday

David Buckland

August 19, 2013

Launched on 17 August 2012 and designed for retail investors, The Montgomery Fund celebrated its first birthday over the weekend. continue…

by David Buckland Posted in Montgomery News and Updates.

-

WHITEPAPERS

Become a Member – Subscribe Now!

Roger Montgomery

November 2, 2012

Here’s what you are missing out on. This is sample of the feature reports our members receive each and every month.

Become a member and don’t miss the next report exclusively for members. Join Now – Its Free!

Download SAMPLE REPORT – ‘Don’t Reject The The Reject Shop (TRS)’ HERE

by Roger Montgomery Posted in Montgomery News and Updates, Whitepapers.

-

Welcome to RogerMontgomery.com

Roger Montgomery

August 6, 2012

Welcome to the new Roger Montgomery website! You will notice there are some changes across the site, which will be continuing over the coming weeks to provide enhancements to the usability of the site for your enjoyment. If you have any problems in using the site, or would just like to provide some feedback, please email the development and support team here Feedback & Support.

To experience optimum results, we recommend viewing this website using the latest version of your web-browser.

by Roger Montgomery Posted in Montgomery News and Updates.

-

An Important Announcement

Roger Montgomery

June 5, 2012

It is with some excitement that I announce that Mr Tim Kelley will soon be sitting alongside David Buckland, Russell Muldoon and myself at the offices of Montgomery Investment Management.

It is with some excitement that I announce that Mr Tim Kelley will soon be sitting alongside David Buckland, Russell Muldoon and myself at the offices of Montgomery Investment Management.Tim’s background as a director at Gresham Advisory included M&A advice to the likes of BHP in their bid for RIO as well as their merger with Billiton. You can read our Media Release Here: 20120605_Montgomery_Media_Release.

Tim will be joining at a time of great consternation worldwide and I am sympathetic to the nervousness pervading our markets and more importantly, investors’ portfolios.

We expect volatility to continue for some time as Greece moves another step towards deja vu on June 17.

One of the real issues for the United Nations of Despair of course is that their currency does not reflect their individual predicaments.

Germany is arguably less interested in a collapse of the Euro because it is more competitive than it would be if it returned to the DMark. On the other hand Greece’s exchange rate is overvalued.

But for Australia, Greece is a sideshow that ironically has a huge and real impact. This is because Europe is a giant consumer of Chinese and American products and services. In turn, America is a giant consumer of Chinese products. The butterfly effect ensures China – the driver of the one cylinder of our economy that has been working – slows down.

The Chinese slowdown comes just as the supply of Iron Ore ramps up and Australian economic growth, which was being held up by the resource boom, will be hard hit by a slowdown in resource investment and expansion if iron ore prices resume their slide.

At Montgomery Investment management we have been navigating this latest turn of events with both confidence and a little trepidation. Value investors tend to be early to leave the party and the rally between January and April – a rally in many undeserving companies – left us with a little of an egg-on-the-face feeling.

But sticking to our processes (which involves moving to cash in the absence of companies that meet our criteria for value and quality) will inevitably lead to periods of underperformance. Nevertheless we took advantage of the strong, and arguably unjustified, prices on offer in April to take profits on anything with exposure to the materials sector.

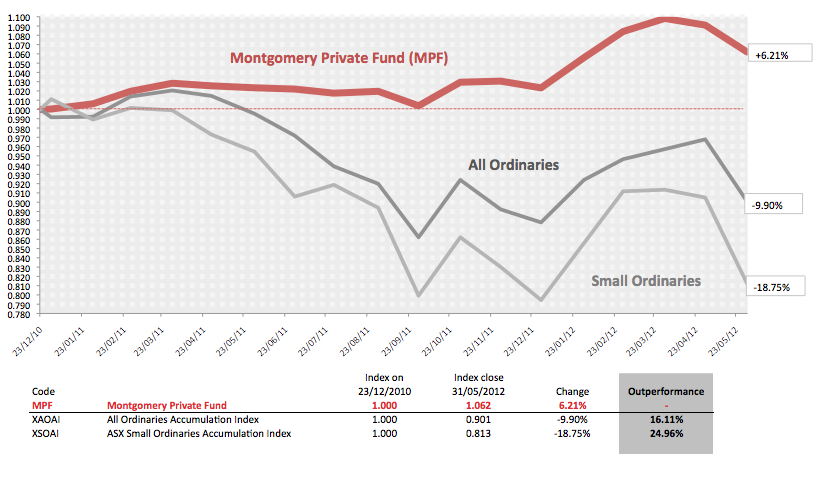

Those of you who have been watching our appearances on TV over the last six months will be familiar with our staunch distaste for mining particularly coal and iron ore. The result of this action to take profits amid what we believe to be declining commodity prices and related-company valuations, has been continued outperformance (see chart, which is net of management fees and charges – an investment in the Montgomery [Private] Fund can only be made by wholesale or sophisticated investor through an application attached to The Information Memorandum).

And so, with market prices declining significantly, we are excited about the value Tim will quickly add for investors in The Montgomery [Private] Fund, right when bargains abound and as markets correct.

If you would like to discuss an investment in The Montgomery [Private] Fund for wholesale investors upon its next opening, please send an email by clicking here and selecting the Apply To Invest tab at the top right hand side.

Finally if you have some time and would like to watch Tom Elliott, Nabila Ahmed (AFR companies Editor) and myself chat with Alan Kohler about Hastie, Iron Ore and Europe click on the screenshot:

Could things get worse? What’s the impact of low interest rates? Who forecastIron Ore prices of $187 tonne?

Should Greece Default?

And a more recent chat on ABC newsPosted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 5 June 2012.

…Oh and let us know if you like us:

by Roger Montgomery Posted in Montgomery News and Updates.

-

The title. What is the title Roger?

Roger Montgomery

August 3, 2011

I never dreamed a simple little question about the title of a video series would have sparked almost 300 comments. Thank you!

Your suggestions have been entertaining, insightful, and in some cases, ingenious. It has been wonderful to meet so many new Value.able Graduates, and also those of you who have observed from afar (for far too long!).

Here are some of our favourites…

Montyvision, Mike

Video.able, Ben

Montcommentary, Emily

The Value.able Low.Down, Sean

Cooking with Roger, Chris L

Value.Cast, Tim P

Report.Able (Peter

Roger Direct (Matthew R

Roger’s Montgom-o-logue, Robert F

Value.Blast, Rob

Rogernomics, Tony

RMTV, Tim

Value.Bytes, SapporoSteve

Roger’s 2 Cents, Anthony

Value.View, Craig

Value.vision, Jonesy

Value.able report, Orlando

Report.Able, Rod

Value.judgment, Mike

Invaluable insights, Lloyd

InCompany, MarkH

Vis.able, Grover

The Value.able View, Ken F

Talking Cents, Bruno

Video.ables, Nolan

Crunch Time, Brian A

Value.able Vision, Chris L

The Value.able Report, Ian

View from the Mont, Stuart

Value.Log, David

The Montgomery ReTort, Kim

Cents.Ability, StephenSo without any further ado, the winner is… Value.able TV.

Mark came very close with Value.TV, however it was the final suggestion from Greg (and reassurance from Brad 17) that we have selected as the winner. Greg – I’ll personally sign you First Edition copy of Value.able when I return from Melbourne tomorrow afternoon.

Tune in later this week (maybe early next week) for Episode 2.

If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have 1. read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 29 July 2011.

by Roger Montgomery Posted in Montgomery News and Updates.