Are the big banks about to raise mortgage rates?

While you may not follow movements in the bank bill swap rate (BBSW), right now they are worth paying attention to. You see, rates are on the rise. And that means the funding costs for our major banks are also going up. This could force them to raise mortgage rates – and take mortgage stress to another level.

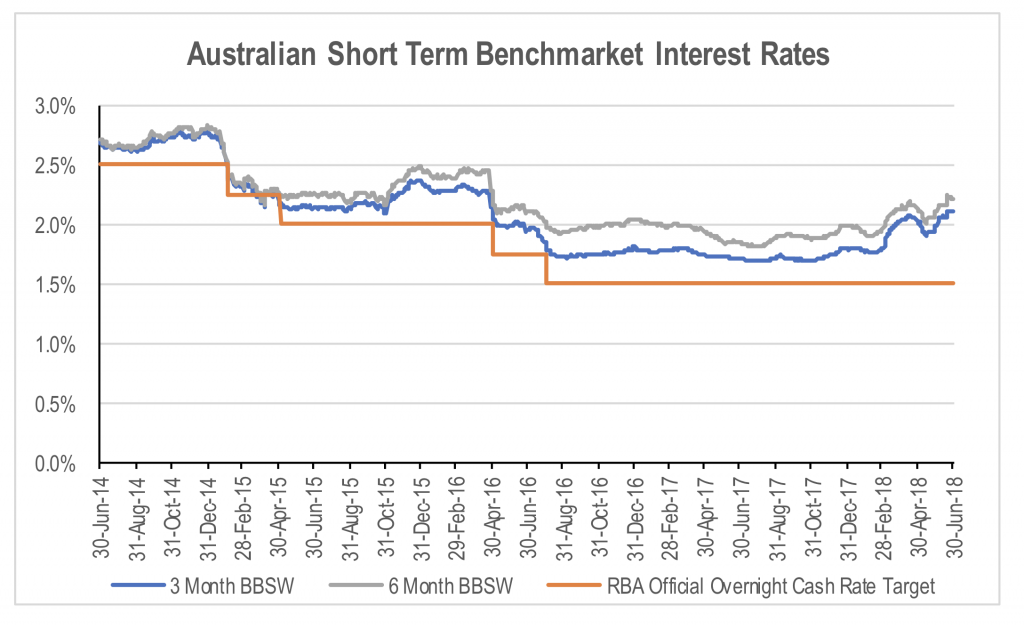

Over the last six months, we have seen a significant rise in short term benchmark funding rates in Australia despite there being no change in the RBA’s official overnight rate. This has material implications for the banks, not only because of the signal it is potentially sending the market, but also due to the impact it has on bank funding.

Bank bill swap rates are the reference rates used for most wholesale (i.e. non-deposit) bank funding. They are set on a daily basis with maturities ranging from 1 to 6 months. The most commonly used reference rate is the 3 month BBSW rate. Over the last 4 months, the 3 and 6 month BBSW rates have risen significantly relative to the RBA’s official overnight rate. With most of wholesale funding rates set as a margin over the 2 month BBSW, higher BBSW rates mean higher funding costs for the banks.

This can occur for a number of reasons. The most common reason is as a result of the BBSW rate reflecting the market’s expectations of future rather than current RBA rates, while the RBA rate is a one day rate. If the market believes the RBA is likely to increase rates imminently, BBSW rates will increase relative to the RBA rate.

Over the last 20 years, there have been 15 periods in which the 3 month BBSW has been more than 0.5 per cent above the RBA’s official overnight rate. In all but 2 of these instances, the widening of the spread occurred ahead of an RBA rate increase. In other words, the increase in the spread reflected the market’s prediction for a near term rate increase by the RBA.

The two times when the increase in the spread did not precede an RBA rate increase were during the GFC between February and July 2008 and now. Given that the BBSW rate also incorporates a credit spread for the major banks on short term funding, the tightening of liquidity and rising default risk during the GFC meant the banks had to pay a higher than normal premium to access wholesale funding.

There have been a number of explanations offered for the increase in BBSW rates relative to the RBA official rate over the last few months. These include the impact of changes to US corporate tax laws that have allowed US corporations to repatriate the billions of dollars of cash that was previously trapped overseas. The repatriation of this capital has resulted in a material withdrawal in capital that funded overseas corporate credit markets.

Irrespective of the reason, the implication for the major banks is that funding costs are on the rise. This will put pressure on net interest margins, with those banks that are more exposed to wholesale funding likely to feel more pressure than those that are more reliant on retail deposits.

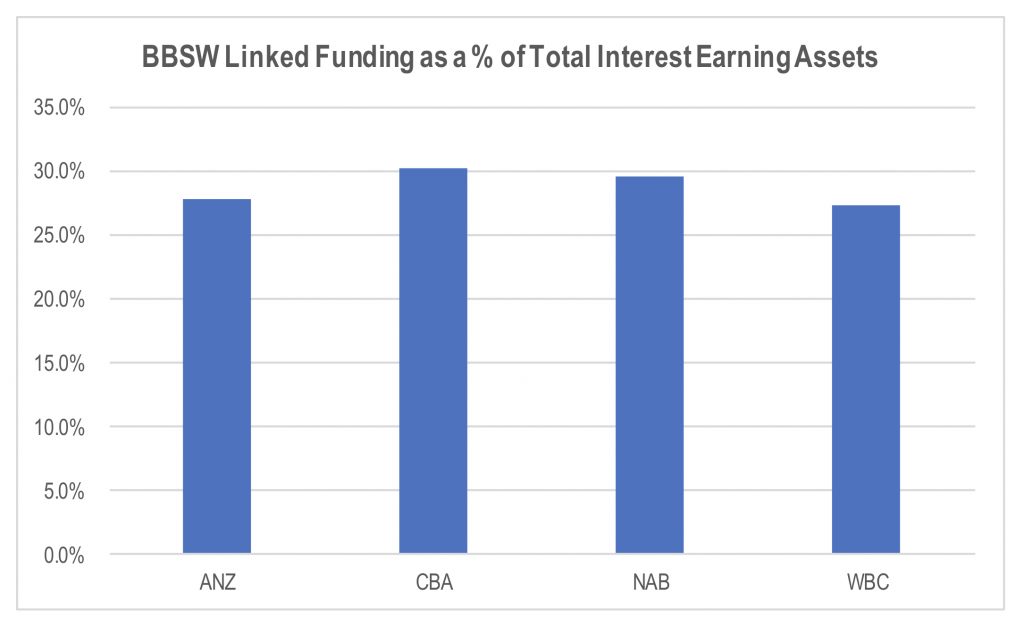

If we compare the major banks in terms of the proportion of total interest earning assets that were exposed to BBSW linked funding by either group debt of Australian certificates of deposit as at the last reporting date, the exposure is fairly similar.

Source: Companies

This says that a 35 basis point increase in the average 3 month BBSW spread relative to 1H18 would add around 10 basis points to average funding costs if it all flowed through to wholesale funding costs. The impact on net interest margins is reduced given some business lending rates are linked to BBSW, providing an offset to the impact on funding costs. The problem is that mortgage pricing is not, at least in the mind of the consumer. This creates a mismatch between bank funding costs and asset prices for mortgages.

As a result, we have seen a number of smaller banks lift mortgage rates in recent weeks. These include BOQ, IMB, Citibank, Bank SA, and ME Bank. The pressure on the majors is no doubt rising, but the political ramifications of lifting mortgage rates while the RBA holds official rates flat is likely to be holding them back. In the meantime, shareholders are footing the bill from higher credit spreads.

The added risk for near term margins is that higher wholesale funding spreads could trigger increased competition for retail deposits, given that retail deposits have effectively become a cheaper form of funding on a relative basis. To date we have not seen any material change in deposit pricing, but it is something to watch out for given the additional impact this would have on net interest margins for the industry.

The Montgomery Funds own shares in the Commonwealth Bank of Australia, Westpac and NAB. This article was prepared 14 June 2018 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade the Commonwealth Bank of Australia, Westpac or NAB you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Thanks for your reply Stuart.

A final question – do you think the gap between P&I and interest only rates will continue to widen? Or post the Royal Commission, when the dust settles, with demand for IO loans falling off a cliff, banks will look at reducing the gap to entice some demand back? Up until the last year or so I think P&I and IO rates have been priced much the same.

Thanks again

Sam

Hi Sam, the reason why there is now a higher interest rate on interest only mortgages is due to APRA’s 30% cap on the proportion of new mortgage loans a bank approve with this feature. This effectively creates a supply constraint on this feature in the market as compared to the ‘relatively’ unconstrained capacity to provide principle and interest loans. It is difficult to say whether the gap will widen or narrow going forward. It will depend on the demand for the feature relative to overall demand for mortgages. If demand increases while the capacity to supply the product is constrained, the gap will widen to ration that demand. In the near term, there is room for the gap to narrow, given that the major banks have come in well under the 30% cap. However, we also know that the volume of interest only loans that are rolling off their interest only period is set to increase significantly over the next 2 years. If the customers with these loans need to roll over into a new interest only period due to affordability issues, this could see the gap widen again.

Thanks for the article Stuart. Nice clear explanation for us laymen. But I am somewhat confused by the forgein funding situation. The big 4 are funded partly by around $500 billion in overseas debt if I am not mistaken. With US bond rates now higher than Australian, combined with housing price falls at what point do these foreign investors start leaving? I am really surprised this hasn’t begun to happen already.

Hi Peter, while the Australian banks are raising wholesale funding from investors in the US, these US investors receive USD interest payments and the rate they receive is based on US rather than Australian interest rates (plus a credit quality margin). The Australian banks then use derivatives to convert their interest payments into AUD currency that is based on Australian reference interest rates. This is done using swaps, with the counterparty being an investment bank. So the fact that US interest rates and bond rates have increased is in itself not that relevant, other than to signal more broadly the amount of liquidity/demand for fixed interest assets. Concerns around the risk of a housing market crash would be reflected in the margin paid and could explain some of the move in BBSW relative to the RBA rate as investors demand a higher return to take on this underlying credit risk from the banks.

I have often read this notion that swaps are used to protect against currency and interest rate movements. I see 10’s of billions in derivatives on the bank balance sheets which I assume represents these swaps. So credit availability relies then on the availability of these swaps and that relies on the price paid for the swaps. As credit conditions worsen these swaps would become less available / more expensive and foreign capital would then leave as a result of this. Is this not what happened after the GFC. I believe this is referred to in this video of Bernanke being grilled by the US Senate https://www.youtube.com/watch?v=n0NYBTkE1yQ .

We can see the effect of the reduction in global liquidity during the GFC by looking at the significant increase in CDS spreads at the time. A reduction in the dependence of the major banks on foreign wholesale funding, as well as short term wholesale fund, were a key focus of APRA regulations a few years ago. While a similar liquidity event would still cause issues for the banks, their exposure has been reduced in recent years.

Thanks for the article Stuart.

Where does Macquarie Bank fit into this? Do you view it as one of the majors as well? Like the big 4 I’ve noticed that they havent moved their owner occupied rates yet.

Thanks

Sam

While Macquarie has increased is share of the mortgage market significantly over the last 8 years, it remains a relatively small player with around 1.8% share of the overall market according to APRA and RBA data. To put this in context, each of the big four have between 14% and 24% of the overall mortgage market. Additionally, the mortgage business is a very small part of the overall value of Macquarie.