Are the banks robbing sensible investment returns?

Amid all the talk of GFC II and the Eurozone unravelling, Warren Buffett’s Berkshire Hathaway Inc. (BRK/A) has been increasing its stake in US bank, Wells Fargo & Co (WFC – 420 Montgomery Street San Francisco).

Amid all the talk of GFC II and the Eurozone unravelling, Warren Buffett’s Berkshire Hathaway Inc. (BRK/A) has been increasing its stake in US bank, Wells Fargo & Co (WFC – 420 Montgomery Street San Francisco).

Buffett (or was it Todd Combs?) topped up Berkshire’s holdings in the world’s 24th biggest bank by 9.7 million shares in the three months to June 2011 (we don’t have more recent information because Berkshire requested and was granted permission to withhold stock specific information). Between 1 March and 30 June – the three months during which the stake was increased – Wells Fargo traded as high as $33 and as low as $27.

WFC currently trades at $25.65 and its book value is $26.10 per share. Paying a small discount to book value for a bank that earns a return of 11.86 per cent on that book value doesn’t seem like a fantastic bargain and paying a premium to book value is perhaps less so. But the fact remains one of the best investors of our generation, reckons it is ok to be selectively buying US banks. Is Buffett going to make off with a bank fortune the way Butch Cassidy did or will he be caught red handed this time? Should you be doing the same as Buffett with Australian Banks?

Wells Fargo is the biggest U.S. home lender (think Commonwealth Bank) and Berkshire is its biggest shareholder. Given Berkshire’s interest in Wells Fargo and Bank of America should be taking a look at our own Banks?

I know there are conflicting and well-articulated opinions here at the blog about the banks, so feel free to add your own thoughts.

Here are mine.

Broadly, the local banking system is in a relatively strong position compared to peers globally. The funding, capital and liquidity position of the major banks has been strengthened and those who fear a housing collapse in Australia should be mindful that such an event would impact consumer confidence and credit growth more than the immediate profits of the banks, who have insured their exposure.

From a funding perspective, bank deposit growth has outstripped lending growth and while further increases in wholesale funding costs could reasonably be expected, the banks are ahead of schedule in raising term wholesale funding that is said to provide 6 months grace. Of course if deposits continue to grow faster than loans, the gap that is funded from overseas wholesale markets diminishes.

As I have previously noted, high levels of leverage at the consumer, company and country level simply take time to pay off. You just don’t go off spending aggressively again until you feel your debt is under control. As a result, it is reasonable to expect bank balance sheet expansion will be muted over the next year or two at least. Some of you may think even longer or permanently…

Globally, the banking picture is at the very least, interesting to watch. The five biggest US banks excluding bank of America posted 8 per cent profit growth, while in the UK the five majors posted H1’11 profits that were half of those reported the year before. Predictably this has resulted in announcements of an intended five billion Sterling cost cutting drive by 2014. In Europe, the largest ten banks saw profits fall less than 8 per cent. Curiously some observers suggest that the present problems befalling sovereigns will have less of an impact on banks than the GFC because sovereign debt is less complex than credit default swaps on collateralized debt obligations and stress testing has been completed and widely reported. With little exposure to European debt and strong growth domestically, Asian banks (with the exception of Japan) are the one bright spot.

Globally, banks are targeting cost to income ratios of less than 40 per cent despite the higher costs associated with reengineering systems and procedures to meet a heightened regulatory environment.

Locally, our major banks have posted more than acceptable profits considering global financial conditions and local consumer and business sentiment, which has remained muted

Growth has been achieved at least partly by the reduction in the provision for bad and doubtful debts. Additionally, the reduction in the aggregate loan impairment charge was 37%; from $8.4 billion to $5.3 billion.

While significant reductions in loan impairment charges can be seen as a positive, future growth in profits – in the absence of a recovery in consumer and business confidence – will have to come from cost cutting.

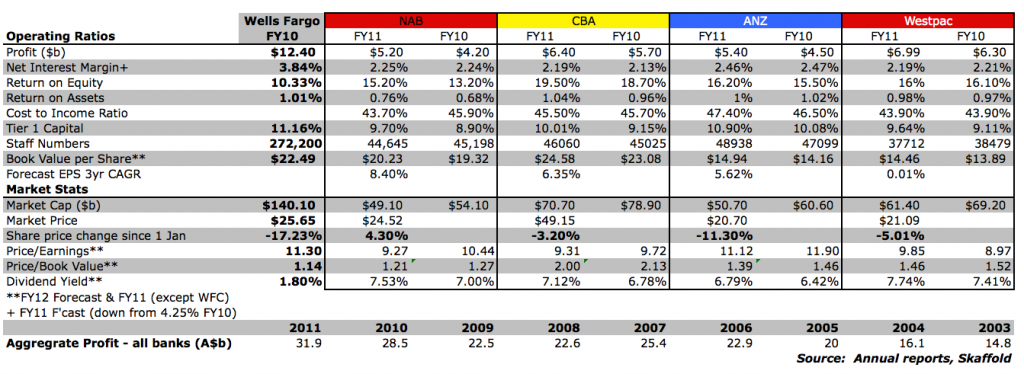

Collectively, cost cutting is being reflected in some results – cost to income ratios improved for the CBA and NAB and less so for the ANZ and Westpac. Further improvements should be expected and I have been reliably informed to expect significant retrenchments – in the thousands – in the financial services sector, even though full time employees increased at the ANZ and CBA last year. The changes in cost to income ratios should also be seen in the light of the dramatic reductions achieved since the early nineties when cost to income ratios were; ANZ 74%, WBC 68%, CBA 67% and NAB 57%.

Net interest margins – the net margin earned or the difference between interest paid on deposits and interest earned on loans – were broadly unchanged and while the CBA recorded an improvement, this has not been widely reported elsewhere as being materially due to an accounting reclassification of net swap costs. Competition for retail deposits and higher-cost, post-GFC funding as well as regulatory changes forcing an increase in liquid assets put pressure on margins. A broad maintenance of margins is therefore laudable.

The banking industry’s preferred measure of profit is Cash Profit (after tax), which removes the impact of discontinued operations, adjustments for acquisitions, Treasury shares and fair value adjustments.

On this measure, all the banks posted healthy increases.

The ANZ increased profits from $5.1 to $5.6, the CBA $6.1 to $6.8, NAB $4.6 to $5.5 and Westpac from $5.9 to $6.3.

Non-interest income, which includes trading, fees & commissions and Wealth management & insurance (which includes life insurance, superannuation and investment management products), declined in aggregate. Fees & commissions across the major banks were largely steady at just under $12 billion due to a drop in lending offset by an increase in corporate M&A. Wealth management profits fell for all the banks bar Westpac (BT). Profits here are largely a function of equity market performance given the big brand’s focus on index hugging and fund inflows/outflows. Funds under management and administration grew only for the CBA.

The outlook for Australian banks will remain mired by the general ‘funk’ Australian consumers and business are in. Our one-cylinder economy is not going to spur rapid balance sheet expansion (read credit growth) for the banks in the near term. With property prices and volumes in some areas also depressed the number of mortgages and the size of a loan on any individual property is necessarily lower. Banks love mortgages the most because their perceived lower risk means the banks have to provision less for each one they write. You are welcome to discuss your views about the direction of property in Australia in the comments below and I would welcome your thoughts. I think that we shouldn’t expect any immediate recovery in property activity to spur bank balance sheet expansion.

With the details broadly out of the way what are the current estimated valuations and prospects for intrinsic value growth for each of the banks? Keep in mind the intrinsic value expectations for the next three years are based on earnings growth and equity figures as stated in the table included with this column.

Skaffold’s (www.Skaffold.com) current estimated intrinsic values for the banks are: WBC $22.12, ANZ $24.49, CBA $51.54 and NAB $27.69. Of course these will change over the next weeks and months as estimates are updated and the banks make announcements about prospects, acquisitions or capital raisings etc. and I may not update those details here at the Insights Blog.

The bank displaying the greatest estimated margin of safety currently is ANZ, which at the current price, is displaying an estimated safety margin of 16%. Of the others NAB appears to be next, with an estimated margin of safety of 11%, WBC 5% and CBA 3%.

Despite being second on this list, the NAB has produced the lowest returns on equity and assets but also the lowest cost to income ratio, second highest Net interest margin and the highest forecast earnings per share growth for the next three years.

In aggregate the opportunity to buy at either very large discounts or smaller discounts but with solid growth potential does not appear to be available. An investor requiring meaningful margins of safety, would demand lower prices before being seriously interested. I will leave that decision to you after taking personal professional advice of course – from Buffett or your advisor. Growth doesn’t have to be sensational to make attractive returns but in such cases, one should require a large margin of safety to be more certain of a reasonable return.

What are you thoughts about the banks? Have I missed an angle that you would like to add? For example do you think the economic growth prospects are bright for the US compared to Australia? What are your estimates for earnings growth and what are your expectations for the residential, agricultural or commercial property market? I would be delighted to facilitate a discussion on these subjects.

Posted by Roger Montgomery, Value.able author and Fund Manager, 16 November 2011.

I like your post , thanks for sharing with us. It was helpful to me .

Thanks for giving such a good information .

Thanks Mark.

Hey David,

I agree with you, affordable housing is safe, and I was there with double digit interest rates and unemployment too.

And the debt level does contain all the lifestyle and fashion debt.

And i purchased a rental property in 2009 for 305k (melb)and equivalents in the same street are selling for 405k.

Doing a lot better than my MCE shares at the moment( but i’ll wait)

And I too will keep waiting for the bank shares to drop further, not going to make the mce mistake twice, good learning experience.

Doom and gloom is really starting to build up which is good because at some point in the future it will all get better again.

Personally the best thing about property is you dont have the price fluctuating on a screen on a minute by minute basis.

Good book Roger, enjoy reading the posts and comments.

The biggest driver for the Bank’s profit growth has been credit growth – the surge in their balance sheets caused by compound credit growth of 10% plus year after year enabled them to generate significant profits and push down their cost to income ratios. Fee growth has also greatly assisted their total income, and a strong economic environment has kept credit losses to a minimum. All of this was assisted by the one income household becoming a one and a half or two income household.

But there are some strong headwinds now facing the banks. The NAB is now playing a different game on fees, the RBA is trying to remove price gouging on merchant/card fees, credit growth has stalled and wages growth, the ultimate driver of credit growth is at its lowest level in years. And with two people already working, you can’t send the kids or dog out to work !!

With baby boomers starting to retire and underfunded in their super, the customers who drove the credit boom will be deleveraging just as fast (and permanently). APRA is placing tighter regulatory requirments on the banks (Basel III) as well as tighter liquidity which will drag on interest income. The drivers of income growth are being diluted, thereby limiting upside for the banks.

Their ultimate lever becomes repricing their loan margins, so it will be no surprise that any further RBA rate cuts will see the banks pass on only a portion of this. The lurking danger is rising unemployment and borrowers being forced sellers. However, Australians have an extra resilience in meeting their mortgage payments because they can’t hand back the keys like in the US and walk away. So falling house prices won’t hurt the banks if only a few of their mortgagors are forced sellers. It’s when a big chunk of their client base is doing this, and this is highly unlikely.

My final point is that the Aussie banks are too big to fail, as too many Australians are shareholders by virtue of their super. This doesn’t mean their share price can’t fall, but it does imply that the Govt. would definitely provide taxpayers funds to ensure they survive (or get taken over).

As such, the Aussie banks remain a good investment, but with global investors looking at trading prices relative to book value, you may find that this premium reduces over time as they can get better value elsewhere.

I always saw myself as a glass-half-full optimist, and I’m still that way because I’m OK, I have some blessings to count. BUT:

There is some serious trouble looming for investors, and it’s well within our headlights right now. And yet just like bunnies out for a gambol at twilight, we seem to be missing the headlights’ glare. Why are we still talking of the relative merits of this stock or that, of Woolworths or The Reject Shop, or whether ANZ is a better bet than NAB, or whether Forge will meet its targets, or Matrix has some new contracts with wet ink on the paper?

Surely it’s plain to see that this is THE time to batten down hatches, hang five, wait for Santa, keep powder dry, keep calm, put discretion ahead of valour, embrace all other favourite cliches, and WAIT AND SEE???

My FERVENT appeal to Roger’s many friends (I’m one,too) is to go watchfully right now, make no big moves to buy anything, take profits if you see that opportunity, break even if you are under-funded and have something to sell, and if you are one of those who are still losing money and you can’t bear to take a dive, just hang in and get under cover till the better weather arrives.

Don’t you feel the icy wind, the hairs rising in suspicion on the back of the neck, don’t you smell the faint scent of something fishy all over the world right now? Or is it just me? Can’t you smell the word “Con” in all the jigsaw pieces that represent the present world order?

I think anyone presently making a serious investment in anything with the serious hope of gain, should be carrying a letter from his/her psychaitrist certifiying his or her sanity. I hope I’m wrong.

Hi Roger – Good article. It is also worth noting (i) the majors have been de-risking over the last few years (e.g. CBA recently closed their proprietary trading desk) which is likely to impact on the profit line and (ii) Global regulation particuarly around Basel 3 due to start in 2015 which will result in higher capital holding requirements. Investors might need to get used to nominal/flat profit growth and dividends over the next few years.

Can I see over the the weeds to find the real returns, not with certainty. With insight and hope cash must be better then uncertainty when the globe is heading one way, so how can I see at least some certainty ? Well not in the next 2 years in banks. What say anyone who insight.

Hi Roger

So are you saying banks are good value at these levels?

Hi Tracey, we don’t offer advice here so I will let some of the other bloggers offer their thoughts.

Dear Roger,

Thanks for generously sharing your insight.

We learned that bank shares are presently solid but not very exciting investment.

But this all may appear different when we look at the alternatives. Mining shares are much more exposed to global problems, and our government taxes interest income without allowance for the inflation so the result is just about zero.

In view of alternatives, would not the banks’ dividends appear more attractive?

Interesting angle Stjepan. If you arent beholden to relative investing, There is always the alternative of ‘no shares’.

I think Buffett discovered the absolute margin of safety in banks. It is called a government bailout. No matter what the banks do, or how poorly they are run they get bailed out by the government. This represents a very low risk of ever losing one’s money.

Unfortunately, massive government spending required to sustain such bailouts, will ensure the money loses its value. While Buffett’s investments are bound to do well in nominal terms when measured in dollars, they will not do well in real terms when measured in gold, oil or other commodities.

Thanks for your insights. I guess when referring to bailouts you mean ‘from now on’. Lehman et . al. being the exceptions…

The mainstream economic thinking has it, that it was the collapse of Lehman that triggered the GFC. Therefore, we now can’t let anyone else fail after Lehman… just in case.

I thought it was the scapegoat…

Hi IIya,

I recently heard someone much smarter than me say that capitalism without bankruptcy is like cristianity without hell.

I think this is why we are where we are and It is time we relearned this principle

Regards

Rodger and others,

My view for what its worth is that CBA is an A2 company today at a price of $48.61 a MOS of 5.75% and forecast in 2 yrs of $57.08.

Divs of $3.20 Franked which is $4.48 pa. for 2 yrs

= $8.96 add ($57.08- $48.61)= $17.43 increase in value and divs gives a total of $66.04 in 2 yrs. So $8.71return on $48.61 = 16.65%pa for 2 years.

Nothing flash but I would like to get it and double my money every 4 and a half yrs.

Also if the banks are going poorly you can almost guarantee that nearly all other business’s are also doing poorly.

. Regards Ian Bowditch

Ian Bowditch

Ash a brilliant post your best

The old hollow log used for smoothing profits

2 years ago at the nadir i doubled my SMSF exposure

to banks to 15% My opinion being that they were increasing

their provisions to hide good profits

Now they are using them to increase flat profits

Next years results will be very interesting

The “Hollow Log” is close to empty

Just last week i reduced my bank exposure well below 10%

I hadn’t been energetic or smart enough to the analysis

Ash & Roger have done

Macca

Roger, I agree with your basic sentiment about the 4 banks, I have held bank stocks for 15 years and I do think that the next few years will more difficult. But I have also heard many times over the last 15 years that the banks run is over, yet they seem to find efficiencies and way to redefine their business. They do operate in a controlled space in Aust and that is not likely to change so while these stocks might not be no.1 pick , I can’t see the price dropping much and they do pay very good dividends that many retirees need to live off.

I am fairly comfortable continuing to hold the banks.

Spot on John, Thanks for sharing your views. The share price performance of the banks reflects exactly what you have said; Nab share price below where it was in 2002, CBA back to where it was in 2006, WBC – 2005 and ANZ – 2004 partly due to environment and partly due to high payout ratios. But stable and growing dividends.

He John,

I rememebr when NAB was $40 and a friend of mine said they are going to buy because they cant see the price droping much lower.

He was wrong………Banks are risky guys………..

Hey Roger…Nice post

Just looking at your comment “Growth has been achieved at least partly by the reduction in the provision for bad and doubtful debts. Additionally, the reduction in the aggregate loan impairment charge was 37%; from $8.4 billion to $5.3 billion”

So this reduction in provisions have lead to a pretax profit increase of 3.1B for the big 4(8.4B-5.3B=3.1B) so let’s add up pretax profit increases of these leprechauns.

By my math’s net profit growth before tax of the 4 banks and comes to $3.375B for 2011….Perhaps your comments that growth have been achieved in part by provisions is perhaps the biggest understatement of the year……Yes it is in part ………..but the part is nearly as big as the whole.

What concerns me most is that why are provisions being reduced at the moment……Surely the people in charge of this and the people auditing them don’t live in the real world….

Honestly can the 4 pillars say hand on heart that the Australian economy is in a much better place than 12 months ago and prospects are exceedingly bright?

With bankruptcies and loan defaults going up in the last 12 months surely this can’t be the case.

My childhood memories of Pinocchio come immediately to mind………….Surely these are fibs…They can’t possibly expect us to actually believe it.

If provisions remain constant (and they probably should be going higher) then the big 4 banks collectively increased profits by something that bees have sex with.

Who really are they kidding ……….not this Qld bushie anyway.

Just my view

Hi Ash, you are quite right. I was being diplomatic with my “partly” comment.

A tale of property woes in America:

Since the housing bubble burst in 2006 the wealth of American home owners has fallen by $9 trillion or nearly 40%. This sharp fall in wealth means less consumer spending. Nearly 15 million home owners owe more than their homes are worth.

Before the housing bubble burst in 2006 the level of house prices had risen nearly 60% above the long term price path.

The fall in house prices is not just a decline in wealth but a decline that depresses consumer spending, making the economy weaker.

Lets hope this does not happen in Australia.

Your return on assets and costs to income ratios are wrong. (They don’t match what is in the annual reports).

David

Really? RBA and KPMG reported those numbers. I need to update the reference to include their data. Skaffolds data refers to the valuations etc…

Priceless info., Thx Roger ….Anthony

Roger,

Good to see you speaking about the Wells Fargo franchise – I believe the big four in Australia possess the same franchise strengths for similar reasons

The request to the SEC for non-disclosure was related to Buffett’s $10bn purchase of Big Blue I believe – as the latest 13F report disclosed the WFC purchases.

As a suggestion some of you may like to chart the price of the big four versus their book value, 1.5 times their book value & 2.0 times their book value as far back as the late 90’s at least.

It may give you an idea as to when it maybe safest to buy a bank depending on its return on equity and the return that you are chasing of course.

You may in fact need to buy lower than book value…

Happy Hunting

Hi Roger,

I do think the biggest risk to our banks is the property market. Compared to US , US property market has already made the correction. Maybe they will go lower but the magnitude of that would be small. UK property market has made correction as well. However, in Australia, our property just started correcting. I do fear that the correction of the Australian property market still has a long way to go. The simple fact that we avoid the previous recession was due to China’s stimulus program by loosening lending during GFC. Clearly, China now is trying to rein the lending to avoid the collapse of credit bubble they currently have. Now back to the AUS property prices, I’m based in Brisbane so I will simply take an example from Brisbane (Sydney and Melbourne prices will much higher). Typically, an average house would cost around $450,000. Assuming you have saved up 20% of the initial deposit, which is $90,000. The mortgage you need to take is about $360,000. An average mortgage rate is about 7%, so for interest only you have to pay about $25,000. That’s about half of an average person’s after tax income. So the housing affordability, in my view, is pretty bad. Even if people can afford it, then you would imagine how much spare cash left for them to spend on other items. This is the scenario we are currently in, not discounting the fact of a slow down of China, a slow down of Europe etc. So i do think the outlook is not quite good for the banking sector in terms of futher growth. Also, the slow down of our property market started about mid of this year, I don’t think the current reports from banks have fully reflect that anyway.

Thanks Roger,

Household formation versus housing supply are the key drivers for medium term house prices. Longer term they tend to generate ‘average’ rates of growth in line with income.

re house prices falling…I thought the banks protect themselves with mortgage insurance??

Peter Hartcher (political ed SM Herald) has released a new book “The Sweet Spot: How Australia Made Its Own Luck-And Could Now Throw it All Away” published by Black Inc. I’m reading an extract in Spectator Australia edition 12 November. Hartcher says we are now the most successful country on earth.

Look at some of these:

We sailed through the Asian economic crisis of 1997-98.

And we sailed through the US market bust and recession of 2001.

We continued to grow through the GFC of 2008-09.

In 2008 our per capita income exceeded the USA’s for the first time since WW2, and by 2010 it exceeded the Yanks’ by $15,000 per annum or 30%! USA, benchmark of prosperity, and here we are not even celebrating.

The UN Human Development Index now rates Australia as having the world’s highest living standard-bar none! The OECD confirms this after an exhaustive study.

One could go on and on.

Are we too dependent on mining? Does it provide too much of our GDP? Well guess what. It doesn’t. It’s only 8.4% according to Hartcher. Smaller than our finance industry (10.6%) and wait for this-MANUFACTURING at 9.3%! Mining employs only 1.5% of working Australians! We will NOT go bust if China falters for a time. Our charitable giving has doubled in the last 10 years. It’s now the world’s second highest. So much for millions suffering “mortgage stress.” Violent crime is down, and so on and on.

Real estate is safe. I spent 40 years in the property industry, and saw the ups and downs. Currently we are NOT in a big “up” the last one having ended in December 2003. Bank mortgages by average Loan to Valuation look perfectly safe (for the banks.) Steve Keen should take another long walk to calm his nerves, and stop moaning on about the coming property crash. It’s a fantasy.

I regret not having bought more bank shares during the GFC. I can’t imagine a better place for a goodly slice of my dollars than in the big four banks of this amazingly fortunate country but the recent past suggests to me that as Europe wobbles about like a half-set jelly, there will be better margins to be had within the next 6-12 months, and I suggest-have cash poised and ready. Can you imagine CBA at $35,($24 in Jan 09) NAB at $18 , WBC ($14.60 Jan 09) and ANZ ($12. Jan 09) at $15? I can. Saw it before and I believe we’ll all see similar again. Soon. Not buying yet because I don’t want to see my next few dividends absorbed in capital losses.Patience. Fear is looming again. Let’s wait a little longer.

David,

It is important to understand that a portion of what is classified as “manufacturing” is the processing of mining output. Most of what we “manufacture” is really only assembly anyway. I agree wholeheartedly with your comments on real estate and banks.

David

I’m sure a political newspaper editor writing a book on macroeconomics lauding how Australia will just be fine and dandy is an enjoyable read. Lindy thinks a different ending though needs to be written.

Regarding the argument that Mining is only 8.4% of GDP and hence there is no cause for alarm from a China slow down; The author may want to take some basic economics and understand 2nd order impacts. From the RBA –

“….for the mining sector, which, at around 9 per cent of GDP, is the second-largest single sector after finance and insurance (Graph B1). However, this estimate does not include the value of output in sectors closely linked to mining production: for example, when Queensland coal production fell around the start of this year, so too did output of rail transportation and port services partly because coal exports had fallen. Furthermore, this measure does not include most investment in mining, which is typically attributed to the value added of the construction (and other) sectors.”

And to housing –

Private-debt-to GDP was ~35% 40 years ago when you started your Real-estate adventure and now when its come to an end the private-debt to GDP ratio is ~135%; leveraging up against a growing asset class worked well for these 40 years – some may say it was the golden period of real estate. Will it be so for the next 40 years?

Until there is a recession Australian sheeple will happily remain debt-slaves handing over 65% of disposable income to debt service. Generally home prices are sticky until unemployment causes forced selling or credit is constrained.

But Australia is the Lucky-Country – We don’t have recessions! We’re the miracle economy!

Kisses, LL

Take delight in the freedom we have here to be able to express such disparate views. It’s what makes a market possible.

Lindy, my real estate adventure also included experiences with double digit unemployment accompanied by double digit interest rates. The sky dId not fall, and to the amazement of many, we discovered just how resilient and determined Aussies are when it comes to home ownership.

Far too much credit today is used to finance items that begin at once to depreciate (like cars) or are used up even before paid for.(fashion.holidays..)

Glass half-full or glass half-empty, it’s all the same to me. I just report what I observe and experience. Lindy, I enjoy reading your contributions, and suspect you are a most intelligent young lady. And I can understand and respect your views.

Just want to make one comment on this.

David, you say that “Far too much credit today is used to finance items that begin at once to depreciate (like cars) or are used up even before paid for.(fashion.holidays..)”

Surely people who purchased houses in 2009 are in the same boat.

Just my view but it is a total myth that housing prices keep rising in perpetuity

.

I’ve enjoyed reading these posts and can’t help but relate back to value-investing and various analogies. House price being a short-term popularity contest and house-value the long-term weighing machine.

Excellent point Matt.

David, I totally agree with you. The way the media and Mr Abbott (I hate to be political but really that’s how it is) portray it we are currently in a depression. The fact is unemployment is low and there are no problems with the economy (compared to other countries). Measuring the economy by how much people are spending at the shops is no way to tell how an economy is travelling. I think its a good thing people are saving more!

What a sad way to measure whether the population are happy – consumption. In the absence of an alternative however, thats what economists came up with.

Our obsession with spending is driven by the Keynesian dominated economics profession. According to them, prosperity is the function of people spending money.

In reality savings drive the economy. Savings are the capital we need to grow our businesses. We need savings to build productive capacity to grow the economy. Instead we have economist and governments encouraging us to borrow and spend more and more. See how well that worked out in the US.

As of today – If you were not prepared to buy CBA or any other Aust. Banks or even Telstra – What would you buy that would give you a margin of safety where you could still sleep at night – nothing or maybe a health care stock. Because Govt. figures are usually 3 to 4 months behind Business figures Comm. and Resi. investments are now high risk – I can inform all that Business is hurting bad and my contacts tell me wait until the 1st Qtr. figures are released in 2012

It wont be good news. We might get a large margin of safety if the All

Ords. fall below 4000pts. But would that be good ?

Hi Roger, can you tell me what ANZ’s debt is ?

Hi Anthony, that depends on how you would like to define the debt of a bank. For example do you mean the money they have borrowed in the wholesale funding market or the deposits (money they have borrowed from you) or both?

Hi Roger, money they have borrowed from wholesale funding

Its a challenge to get exact figures because there is ‘on balance sheet’ and ‘off balance sheet’ and NAB did not disclose details of their short term wholesale funding for Fy10 or FY11. Westpac did not disclose a breakdown of their wholesale maturity profile either. Over the last three years all the banks (and to the least extent WBC) have increased the proportion of funding provided by deposits and all banks have reduced their short term wholesale funding dependency. ANZ has grown deposits the most representing 55% of funding in 2009 but circa 61% in 2011. This has been good because while the wholesale funding environment had been pretty benign prior to June 30, things haven’t tightened up now. Here’s where you should find the aggregate numbers: http://www.bankers.asn.au/Bank-Funding/default.aspx