A review of the Polen Capital Global Growth Strategy for the March 2021 Quarter

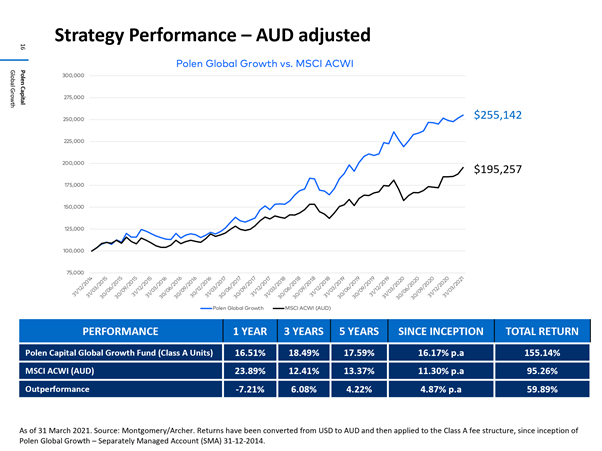

Since inception on 1 January 2015, the Polen Capital Global Growth portfolio has delivered an annualised return of 16.2 per cent, in Australian Dollars, in the 6.25 years to 31 March 2021. Relative to the MSCI All Country World Index, in Australian Dollars, this is 4.9 per cent average annual out-performance, on an after expenses basis.

The ebullient recovery speculation that began in the December 2020 Quarter continued into the March 2021 Quarter and after more than a decade of under-performing “growth” stocks, there was a solid rotation toward “value” investments.

In the March 2021 Quarter, the market favoured more cyclical and earnings depressed businesses and businesses with higher levels of debt and lower levels of profitability. This rotation was partly attributable to the sell-off of US ten-year Treasury Bonds. After bottoming at 0.51 per cent in August 2020, the yield moved up from 0.91 per cent to 1.74 per cent over the March 2021 Quarter.

In our experience, cyclical businesses and earnings-depressed companies can often rebound following a recessionary period. However, if this rebound is driven more by a recovery cycle rather than underlying business strength, Polen Capital would not expect this value rotation to last. Growth from these companies may look strong relative to a very challenging 2020. However, as the earnings and valuations of these businesses normalise, Polen Capital believe their long-term growth prospects will likely remain uninspiring, and this is particularly true for companies that face structural headwinds.

Turnover in the portfolio was modest during the quarter, with the purchase of Amazon (market capitalisation of US$1.68 trillion), whilst Automatic Data Processing (market capitalisation of US$83 billion), PayPal (market capitalisation of US$312 billion) and Align Technology (market capitalisation trimming of US$49b) were trimmed.

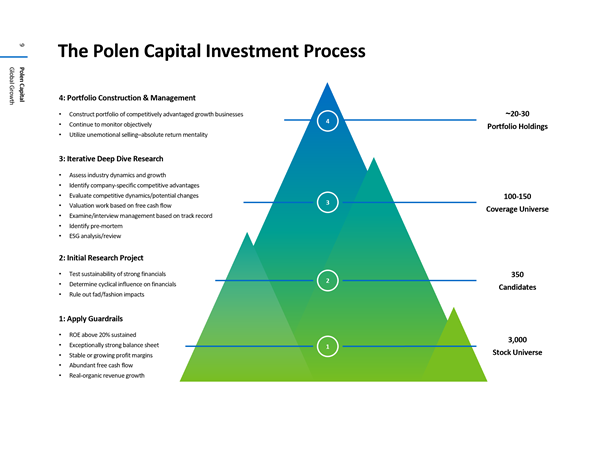

Polen Capital applies five guardrails to their investment process – a sustainable Return on Equity exceeding 20 per cent; exceptionally strong balance sheet; stable or growing profit margins; abundant free cash flow; and real organic revenue growth. While Amazon did not meet those guardrails for much of the past decade, that has recently changed. Amazon is well positioned to continue to compound revenue at high rates while expanding margins. Ongoing heavy investment in areas such as delivery infrastructure, data centre infrastructure, and shipping, which serve to strengthen the company’s competitive advantages, are now being offset by profits from Amazon Web Services (AWS), Amazon Prime and Advertising. In aggregate, these account for around 20 per cent of revenue today; and are expected to drive annual earnings growth of roughly 30 per cent over the next five years.

While Amazon did not meet those guardrails for much of the past decade, that has recently changed. Amazon is well positioned to continue to compound revenue at high rates while expanding margins. Ongoing heavy investment in areas such as delivery infrastructure, data centre infrastructure, and shipping, which serve to strengthen the company’s competitive advantages, are now being offset by profits from Amazon Web Services (AWS), Amazon Prime and Advertising. In aggregate, these account for around 20 per cent of revenue today; and are expected to drive annual earnings growth of roughly 30 per cent over the next five years.

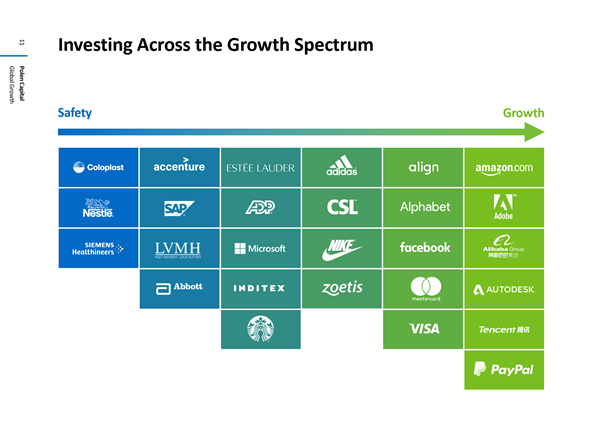

The Polen Capital Global Growth Fund invests across the growth spectrum, and the 27-stock portfolio at the end of March 2021 is illustrated below.

Investing in only companies with exceptional earnings growth, driven by a sustainable competitive advantage, hear directly from Damon Ficklin and Jeff Mueller from the Polen Capital Global Growth team as they share the investing principles for successfully investing in high quality growth companies. Watch the webinar here.

Investing in only companies with exceptional earnings growth, driven by a sustainable competitive advantage, hear directly from Damon Ficklin and Jeff Mueller from the Polen Capital Global Growth team as they share the investing principles for successfully investing in high quality growth companies. Watch the webinar here.

The Polen Capital Global Growth Fund owns shares in Amazon. This article was prepared 27 April with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Amazon you should seek financial advice.