Reflecting on Australia’s Future

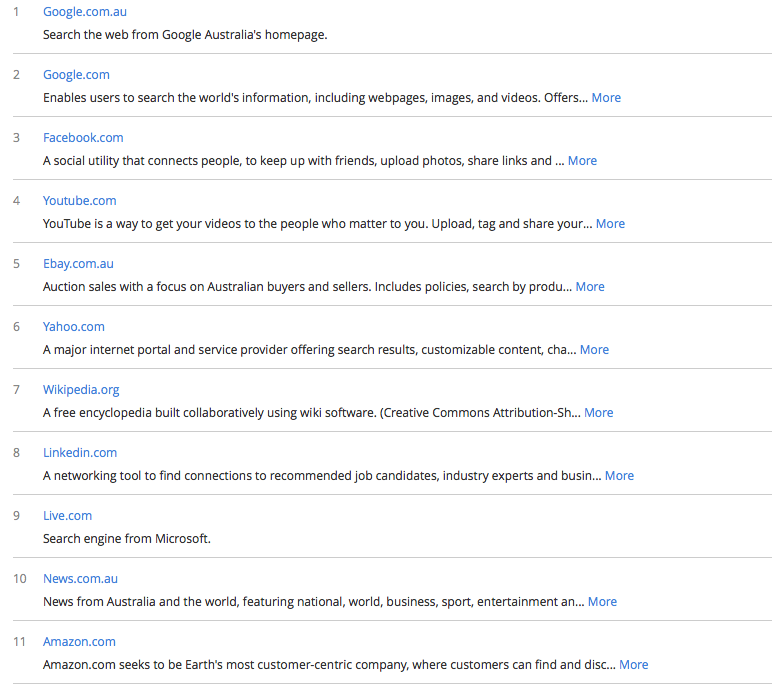

It’s hard not to be impressed by US dominance of the online world. If you look at a list of the top internet sites in Australia, the leaders are almost all of US origin: sites like Google, Facebook, YouTube, eBay and Wikipedia.

It’s only when you get down to number ten that you find a genuine ‘.au’ – in the form of news.com.au. While this is a good result for News, it is very much a domestic beast, and a follower rather than an innovator. The sites mentioned above dominate not only in Australia but globally, and in many cases pioneered new business models.

It is tempting to ask why Australia hasn’t made more of a contribution to innovation in the internet era, given we are ostensibly a “clever country”. However, perhaps that’s not the right question. Australia is pretty much on par with much of the globe, and the real question, is: why has the US been so dominant? Certainly there are Chinese sites like Alibaba that attract large global audiences, but a disproportionate share of business model innovation seems to have come out of the US, with the Chinese and others tending to adopt models that had already been proven elsewhere.

One suspects the answer must have network effects at its core. A critical mass of innovative businesses attracts a cohort of appropriately qualified and motivated people, and those people go on to drive new start-ups and further innovation. The same critical mass attracts capital formation and investment expertise to fund the growth of the start-ups, and success becomes self-perpetuating.

In an increasingly complex and interconnected world, it seems reasonable to think that these sorts of network effects will be pervasive, and technology will promote more of a winner-takes-all dynamic. It may not be as black and white as the internet world, but as the flow of information becomes more important than the flow of material, it seems the gap between leaders and followers will widen. Being the best in a local market is no longer a winning strategy when what you do can be outsourced, crowdsourced, or stored in the cloud.

The implications of this for Australia don’t seem especially cheerful. As a nation, we are good at digging stuff out of the ground and putting it on boats, and while other countries take genuine actions to improve education in the disciplines of science, technology, engineering and maths (STEM) to try to secure a place in the leaders group of the future, Australia seems to be content to sit this one out.

For interest, here are the top Australian internet sites, as provided by Alexa (down to number 11, since Google appears twice):

One might also happen to suspect that it may have something to do with the masses of money which poured into the US tech sector during the dot-com bubble.

Sure the collective insanity (and subsequent losses) weren’t particularly good for investors, but it allowed experimentation with business models that would not have otherwise got the oxygen, and created the ecosystem of Silicon Valley from which those dominant companies then emerged (the network effect you refer to).

If we had a bubble in biotech, renewables or IT in Australia rather than in mining, real estate and banks, there wouldn’t be the need to try and convince anyone that STEM education mattered…

Given the lack of demand for people with postgraduate degrees in this country (see the article below), pushing more into higher education in STEM is just like pushing on a rope, and will only make things worse:

http://www.afr.com/p/national/education/unemployment_rises_among_postgraduates_oeZYjMBNwJ9CYWxG2AWeWN

What we really need comes after the education: Better ties between research and business communities, a venture capital industry that isn’t stillborn, a willingness in the boardroom to invest in R&D, and a financial community that cares more about innovation than it does about oligopolies.

Like your thinking Robert.

Completley agree with yor last paragraph Robert and nice post overall. I think the boardroom willingness to invest in R&D is a tricky one when dividends is such a big deal in Australia though. I agree though, if some businesses reinvested more than taking the route to quicker maturity by paying dividends than we would have a greater number of quality companies in Australia.

As someone who is about to finish a post grad degree in the first half of 2015 i hope this lack of demand you speak of changes though.

No twitter? That is a surprise.

Nice observation Peter, it is interesting. I have been analysing Twitter and have just completed 2 valuations on the company assuming different growth trajectories. I will need to have al ook where Twitter falls in the rankings for App stores as this might be something i can use to refine it even further.

For those interested at home, probably not surprisngly, i think Twitter is overvalued.

Australia does seem to be content to sit on the sidelines whilst other countries improve in relation to education, science and technology etc. I think it shows these days as well when you look at the quality of public debates going around whether it be in regards to environmental, economic and various other topics.

I have increasingly come to the conclusion that Australia is risk averse. This aversion to risk however is also allowing decisions to be made that actually increase the risk to Australian competitiveness. This is why we are still content it seems to hitch our wagon to mining and resources (arguably an industry in decline) rather than trying to help implement an evironment that helps facilitate more value adding activities.

It will take a concerted effort by Australians to prevent us from sliding further. We need to hold the nations leaders a bit more accountable and let them know that we expect better than what we are currently getting. A “dumb” (for lack of a better term) nation, may help the politicians in the short term but it won’t help Australia in the long term.

It is too easy at the moment to scare Australian’s when it comes to innovation and change and this has arguably been used by biased debate participants to prevent such changes from occuring that may risk a certain outcome that doesn’t serve their self interest. Classic principal/agent problem.

Always terrific to hear your views Andrew.