A look at CCL’s pricing power

At Montgomery Investment Management, we are enamoured with companies that can exert pricing power. Yet with great power, comes great responsibility.

While pricing power can allow a company to grow revenues without increasing the customer base, it should never be the primary focus for earnings growth. A company’s pricing power can only be as strong as its underlying competitive advantage – once this advantage is lost, so too is its power. As such, the company must always focus on sustaining its competitive advantage or ensuring that the cost structure is flexible to accommodate deterioration.

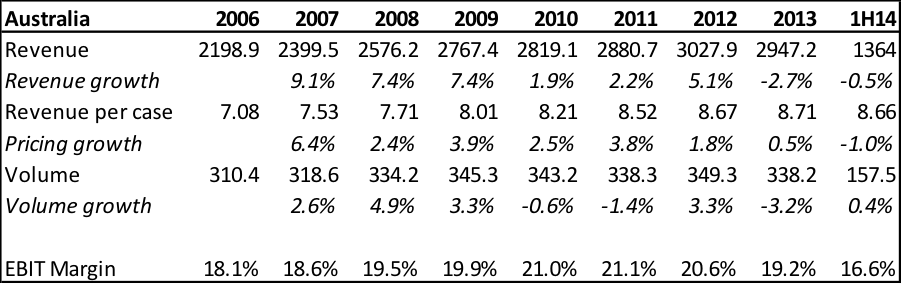

Coca-Cola Amatil (ASX: CCL) enjoyed pricing power for many years. Between 2006 and 2013, revenue grew at a compound annual growth rate (CAGR) of 4.3 per cent, of which 3 per cent was derived from pricing increases. This helped to increase EBIT margins from 18.1 per cent in 2006 to a peak of 21.1 per cent in 2011.

Yet during this period, volumes only grew by 1.2 per cent each year. When volumes declined in 2013 as a result of pressure from supermarkets and increasing competition, Coca-Cola Amatil was forced to lower prices in response. Margins subsequently fell to 16.6 per cent, which suggests that efficiency may not have been a top priority. Management is currently engaged in a strategic review to understand the deterioration in the company’s competitive position and hopefully regain the power that has been lost.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Ben,

Is there any information out there about how coca cola and the supermarkets arrange discounting? It may seem unlikely but with supermarkets now having their own ‘private label’ soft drink, they may prefer to sell coca cola and its brands at closer to full price to increase the price difference between coca cola and ‘private label’, in the hope of increasing sales of their own product which presumably is of a higher margin for themselves. Would you agree at this aim to direct revenue to higher margin products by the supermarkets?

Cheers,

Sam