Navitas and the rock star lecturer

(Additional commentary by Roger Montgomery.)

Navitas (NVT: ASX) has announced that its largest University Pathways partner – Macquarie University – will not extend its partnership after 12 February 2016.

Macquarie University has decided to reposition their brand as a research-intensive university, which involves internalising the sourcing of students. This is the first partnership agreement that Navitas has lost, and it raises serious implications about the sustainability of the company’s business model.

By way of background, Navitas sources full fee-paying international students who wish to study at Australian universities, who are without the prerequisite knowledge for their preferred degrees. The universities would then provide their facilities and course material to Navitas in order to prepare the students.

The market has historically afforded Navitas a high premium due to a perception that the partnerships were symbiotic: universities require a steady stream of capable full-fee paying international students, which Navitas has been able to provide since 1994. While Macquarie University acknowledged that the quality of Navitas’ service was not a reason for the termination, it suggests that the value provided by Navitas may not be as compelling as once thought.

Navitas has two years to source another university partner to replace Macquarie. This development shouldn’t impact the number of international students coming through the system in the short-term – if most were not looking to study at Macquarie. However, Navitas’ long-term growth potential may be impacted if more universities decide to become competitors, rather than partners.

The market certainly considers that the loss of Macquarie University has serious implications for Navitas’ prospects, with the share price falling by over 30 per cent since the news was announced.

For an indication of how the changing dynamics in tertiary learning might play out, it pays to look overseas. The headwinds for international universities are evident as massive online open courses (MOOCs) from the likes of Khan University (backed by Google and the Bill and Melinda Gates Foundation) democratise and commoditise higher learning. Much like the unbundling of record albums allowed consumers to buy individual songs and decimate music industry revenues, students can (and do) buy individual subjects and topics, rather than entire university courses.

Here are some of the observable and expected dynamics as reported by Martin Smith:

- “The price of content will free-fall over the next seven years. We heard the first rumblings last year when the Supreme Court ruled that U.S. copyright owners may not stop imports and re-selling of copyrighted content legally sold abroad, paving the way for a global market for textbooks.

- “The supply of learning content will swell. This might sound counterintuitive, but as we move toward a global market for content, creators will be price takers, unable to command much negotiating power given the sheer scale of distribution platforms (think iTunes). While it may make less sense for a professor in New York City to write a book, it makes a whole lot of sense for one in Mumbai.

- “Education will be personalized. With learning content available on demand, students will increasingly be able to build degree programs from a wide variety of institutions offering particular courses.

- “Universities will be masters of curation, working as talent agencies. They’ll draw royalties and license fees from the content professors create and curate. In many ways, the role of the best universities will become even more focused on identifying, investing in, and harvesting the returns from great talent.”

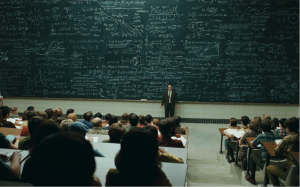

MOOCs are rapidly changing the competitive environment, cost base and revenue opportunities for bricks and mortar universities. Universities can provide courses online at lower costs. As an aside, and similar to the music industry, rock star lecturers will earn more of the fee pie, with their ‘albums and concerts’ promoted heavily, while the mediocre lecturers (like their musician counterparts) must fight for the remainder and many will be let go. Universities compete for a large number of students, but receive less revenue per student. Locally, despite the deregulation of university fees proposed by Tony Abbott, universities will also earn less from student fees.

In this environment, it’s no surprise to see a divergence emerge among the cohort of tertiary providers, and universities like Macquarie move towards research.

In addition to Martin’s comments, you can listen to more on the disruptive dynamics affecting universities, here.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Great article, Ben. Do you believe a company like Academies Australasia (AKG) might also succumb to this migration to online content?