The liquidity tide turns: A reckoning for Private Equity

For years, the financial markets operated under a “lower for longer” mantra that pushed investors further and further out on the risk curve. Starting with bonds, then equities, as a tidal wave of money pushed prices higher, investors were forced to consider alternatives such as private equity, cryptocurrencies, non-fungible-tokens (NFTs), and collectables. But as the tide of cheap liquidity slows, we are witnessing a classic sequence of correction. It begins at the most speculative fringes – the “canaries in the coal mine.” We’ve seen Bitcoin tumble from its speculative heights and the tech-heavy NASDAQ ease as investors quietly take money off the table, often driven by broader, unarticulated fears of a structural shift in liquidity and the global economy.

And, we’re witnessing the chill reach the deeper, less liquid waters of Private Equity (PE). For a long time, PE was viewed as a sanctuary of stable returns and “smoothed” volatility. Today, however, that veneer is cracking. The industry is facing a fundamental reckoning: the gap between what managers say their companies are worth and what the market is actually willing to pay.

The myth of conservatism

A central critique of Private Equity since 2022 has been the lack of realism in carrying valuations. Critics argue that while public markets adjusted rapidly to higher interest rates, private market valuations remained stubbornly high to project an image of success and protect investors in prior fundraising rounds.

Of course, the simple truth in markets is this: if you can’t sell an asset, the price is wrong.

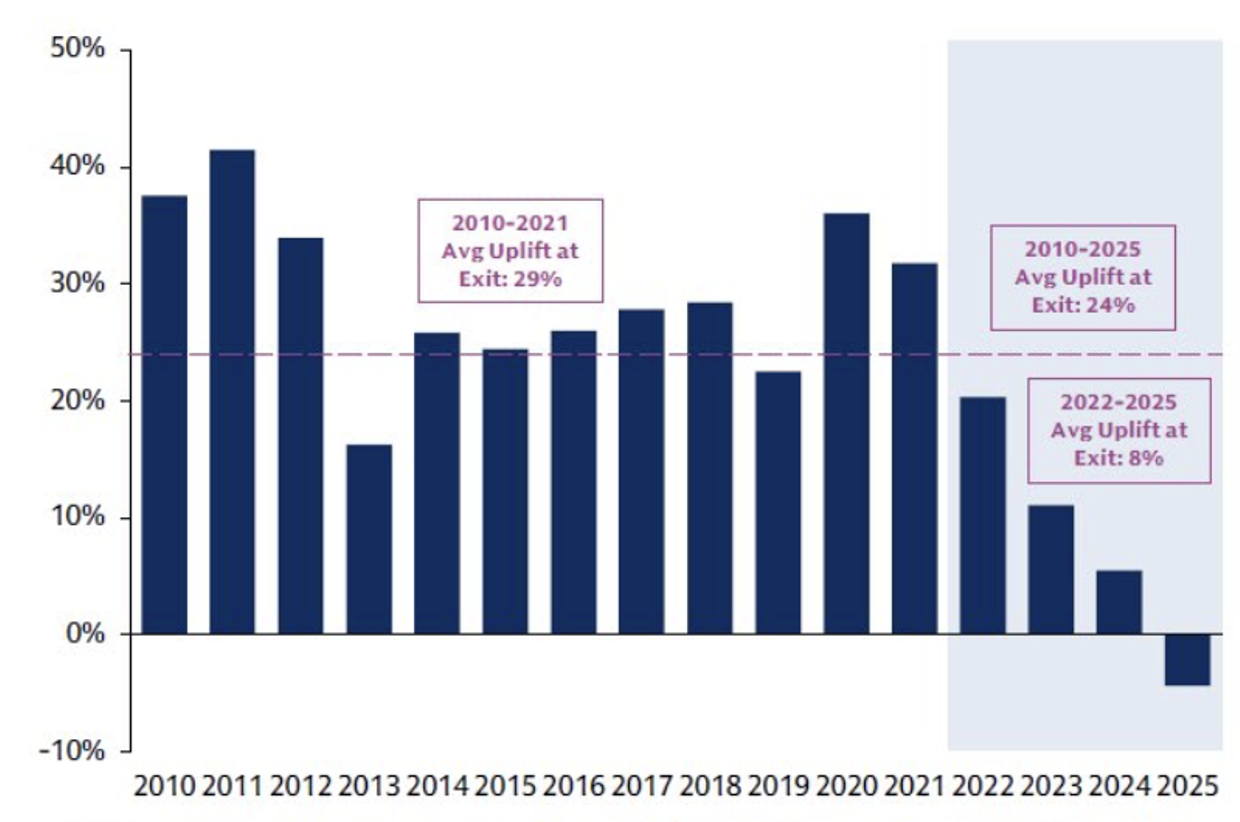

Historically, PE managers could deflect this criticism by pointing to the “exit uplift.” As shown in recent data from XIG and Preqin, there was a prolonged era (2010–2021) where private equity owners realised a meaningful “bump” in value at the point of sale. During this period, the average uplift at exit was an impressive 29 per cent.

Figure 1. Exit valuation uplift (%)

Source: XIG Private Equity Platform Data (excluding Petershill investments, access vehicles, and OCIO mandates) and data from Prequin as of December 2025

If a company’s value was recorded at $100, it was sold for $129 on average. This was the ultimate defensive shield, allowing General Partners (GPs) to claim their valuations were “conservative.” After all, if the exit price consistently exceeded the carrying value by nearly 30 per cent, how could anyone argue the book values were inflated?

This historical uplift served three critical functions that kept the PE machine humming:

- The Liquidity Safety Net: If a manager needed to generate quick liquidity to satisfy nervous Limited Partners (LPs), they had a massive margin of safety. They could discount a deal slightly to move it fast and still exit at a level above the prevailing book or carrying value.

- Psychological Barriers: There is a massive behavioural hurdle to selling an asset below its carrying value. Doing so forces the “realisation” of a loss on a client statement. The 29 per cent cushion meant managers almost never had to face that embarrassment.

- The IRR Mirage: Investors were often willing to accept modest Internal Rates of Return (IRRs) in the early years of a fund’s life, comforted by the knowledge that the “exit bump” would provide a performance surge as assets were sold and the fund wound down.

Bubble burst 2025

The data for 2025 suggests this era has come to an abrupt and possibly an ultimately painful end. As Figure 1 illustrates, the average realised uplift collapsed to just 8% per cent between 2022 and 2025.

The most alarming data point, however, is the projection for 2025. For the first time in recent history, the uplift has turned negative, implying that investments are being sold at roughly a 4 per cent discount to their carrying values. The old “conservative” valuation has rapidly become an “aspirational” one.

Questions.

Is this a permanent decline, or just a “hangover” from the exuberant deals of 2021 and 2022? Data on Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization (EV/EBITDA) multiples (the price paid relative to earnings) suggests a deep-seated valuation mismatch across almost every sector.

Currently, deals purchased in the “frothy” years of 2021 and 2022 are being held at multiples that simply aren’t clearing in today’s market. In Information Technology, for example, 2021/22 vintages are being held at nearly 20x EBITDA, while the market clearing price for deals in 2024/25 has dropped closer to 17x. Gaps of 5 per cent to 10 per cent are also being reported in Financials, Health Care, and Consumer Staples.

These 2021/22 deals were struck in a vacuum of rock-bottom interest rates and heroic growth assumptions. Now, as these vintages reach the age when they should be sold, managers are finding demand at desirable prices illusory.

Is it over?

It’s never ‘over’. Markets are cyclical because human behaviour is. But cycles have ups and then they experience downs. Some hope that once these “bad vintages” work their way through the system, the old 25 per cent exit bump will return. But that might also be assuming a return to zero-percent interest rates and endless multiple expansion.

The reality might be more sobering. The disappearance of the exit uplift is a sign that the “risk-off” sentiment seen in Bitcoin and elsewhere has finally reached the private markets.

More importantly, if the hundreds of billions of dollars investors have committed to venture capital and private equity don’t generate decent returns, or if the businesses purchased can’t be on-sold, investors will seek liquidity elsewhere. What will they sell next? Stocks? Possibly, and if so, hold on to your hats!

The message for investors is becoming clear. Others are retreating from risk, and if the slide down the risk curve continues beyond private equity, it will eventually extend to public markets, including equities. As investors move steadily and perhaps, interminably, toward a “realisation/liquidation” phase, the gap between perception and reality is narrowing for all to see.